PancakeSwap’s progress may not sit well with investors, is CAKE the culprit

- CAKE planning to bring a new Syrup Pool/Farm on PancakeSwap

- However, days ahead might get harder as metrics and indicators were not supportive

PancakeSwap [CAKE] recently revealed that they have been working with Hashflow to bring a new syrup pool and farm to PancakeSwap. Before voting on PancakeSwap, the hashflow must receive more than 60% support for the syrup pool and farm.

Hey community members,

We have been working with Hashflow to bring you a BRAND NEW Syrup Pool/Farm on PancakeSwap. For the Syrup Pool and Farm to happen, the vote needs more than 60% positive votes on Hashflow itself, before it can be voted on PancakeSwap. pic.twitter.com/vReAlutILT

— PancakeSwap ? #BSC (@PancakeSwap) November 29, 2022

Read PancakeSwap’s [CAKE] Price Prediction 2023-2024

Furthermore, CAKE also topped the list of projects that were the most viewed and trending on CoinMarketCap, and a possible reason for this might be the aforementioned update. Apart from CAKE, QUACK and BabyDoge also made their place in the top three.

? Most Trending & Viewed Projects on @CoinMarketCap ?

? $CAKE @PancakeSwap

? $QUACK @RichQuack

? $BABYDOGE @BabyDogeCoin$DOGE @BabyDogeCoinThe Top trending cryptocurrencies that people are searching for on #CoinMarketCap?#BNB #BSC #WEB3 ? pic.twitter.com/vBoHEbQ3Ou

— BSCDaily (@bsc_daily) November 29, 2022

With all these developments on the chain, CAKE’s price action decided to take the opposite route. As of 30 November, CAKE registered negative daily gains. CoinMarketCap’s data revealed that at the time of writing, CAKE was down by nearly 1% in the last 24 hours.

Furthermore, CAKE was trading at $3.96 with a market capitalization of more than $622 million. Let’s have a look at CAKE’s on-chain metrics to understand what the last weeks of this year might have in store for it.

Is CAKE’s goodwill dwindling?

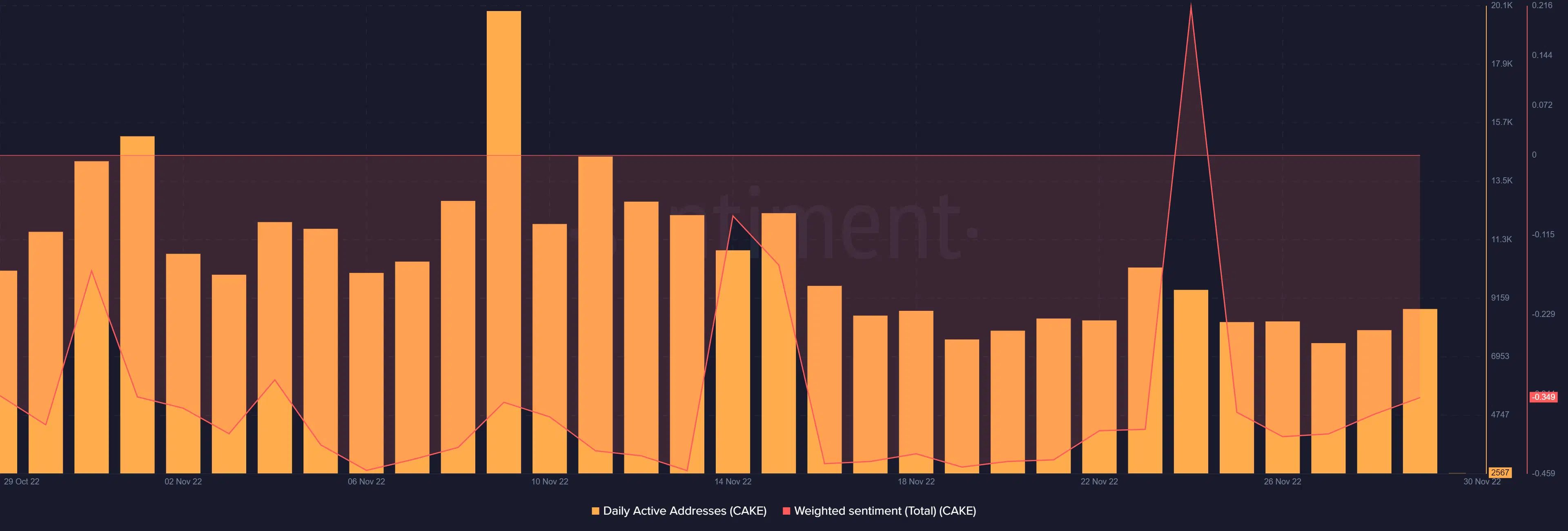

Santiment’s data revealed that CAKE’s daily active addresses kept declining over the last month. This indicated a lower number of users present on the network. Moreover, CAKE’s weighted sentiment was also considerably lower, suggesting less popularity for the token in the crypto community.

However, the Market Value to Realized Value (MVRV) ratio gave slight hope as it registered upticks. This indicated a price hike in the coming days. Furthermore, CAKE’s burn rate was optimistic, with over 6 million CAKE tokens worth $27 million burned.

Can the market indicators give relief?

Most of the market indicators also painted a bearish picture for CAKE, which suggested that investors might have a hard time ahead. For instance, the Chaikin Money Flow (CMF) registered a steep downtick, which was bearish.

Moreover, the Exponential Moving Average (EMA) Ribbon revealed that the bears had the upper hand in the market as the 55-day EMA was resting above the 20-day EMA. Nonetheless, CAKE’s Relative Strength Index (RSI) provided some much-needed relief by going up during the last few days. This could be a sign of a price surge in the coming days.