Assessing whether Ethereum’s [ETH] price rally is imminent in the short term

![Assessing whether Ethereum's [ETH] price rally is imminent in the short term](https://ambcrypto.com/wp-content/uploads/2022/11/regularguy-eth-mJcQSltkdeM-unsplash-1.jpg.webp)

- Ethereum [ETH] has seen a surge in its count of daily active addresses.

- The past few days have been marked by increased ETH accumulation.

On 28 November, for the first time since 15 October, the number of unique addresses that traded Ethereum [ETH] daily clinched a high of 497,300 addresses, data from Santiment showed.

The surge in the number of daily active addresses on the network represented the highest level in over six weeks. This contributed to the 10% intraday price rally in ETH’s price between 28 and 29 November.

Read Ethereum’s [ETH] Price Prediction 2023-2024

As gleaned from data obtained from Santiment, when the number of active addresses that traded ETH rallied to a high of 513,330 addresses on 15 October, ETH’s price went up by over 30% in the three weeks that followed.

Should ETH holders expect a similar rally?

ETH on a daily chart

On its rally, ETH’s price was up by 5% in the last 24 hours. With $8 billion worth of ETH coins traded within the same period, the alt’s trading volume also increased by 18%.

On a daily chart, the position of ETH’s Moving Average Convergence/Divergence (MACD) indicator revealed that the alt commenced a new bull cycle on 26 November. This was when the MACD line intersected with the trend line in an uptrend and has since posted only green histogram bars, albeit short.

Since 26 November, ETH’s price has gone up by 6%. The bull cycle came after a significant price decline following FTX’s untimely demise at the beginning of the month.

Furthermore, buying momentum for the alt has also grown since the bull cycle began. ETH’s Relative Strength Index (RSI) grew from 42 on 26 November to lie above the 50 neutral region, at press time. The RSI was spotted at 51.21.

Also showing growth in ETH’s buying pressure in the last four days was its Chaikin Money Flow (CMF). The dynamic line (green) of ETH’s CMF grew from a negative -0.07 on 26 November to be pegged at a positive 0.08 at press time. The CMF posted a value above zero at press time which was a sign of strength in the ETH market.

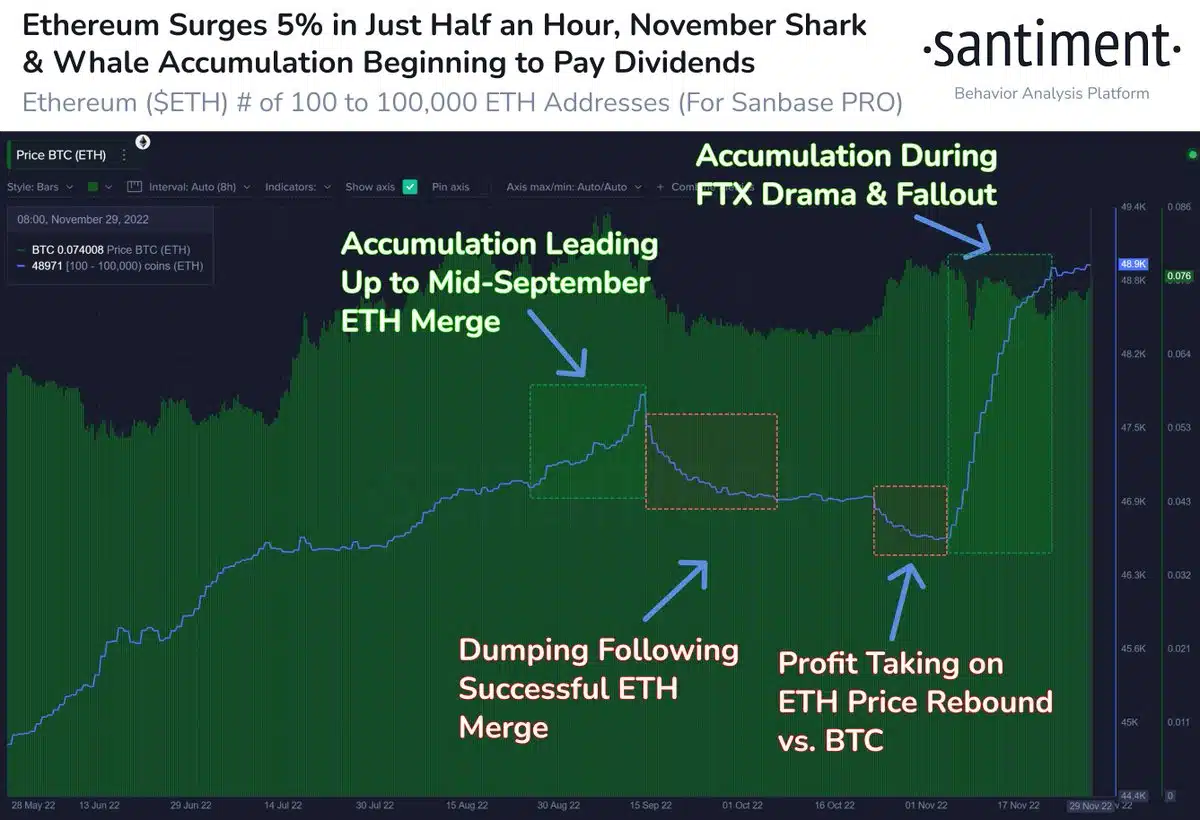

Increased accumulation comes with a caveat

Per data from Santiment, the count of large key addresses holding ETH has been growing since the FTX saga started at the beginning of the month.

At 48,900 addresses at press time, the number of addresses holding between 100 to 100,000 ETH tokens was at a 20-month high. This showed an increment in ETH whale accumulation.

It is, however, important to note that these large key addresses often dump their holdings when ETH’s price grows to a particular point; hence, caution is advised.