Shiba Inu gets attention from whales, but what does it mean for its price

- Whales show interest in Shiba Inu despite its sluggish performance.

- MVRV Ratio suggested that SHIB’s price might surge soon.

Shiba Inu [SHIB], one of the most popular meme coins in the world, failed to put a smile on investors’ faces with its sluggish performance. Over the past week, SHIB only managed to increase its price by over 2%, which was not up to the mark when compared to other cryptos.

For instance, Dogecoin [DOGE], the largest memecoin in terms of market capitalization, was able to register a more than 22% increase in its price over the last week. At the time of writing, SHIB was trading at $0.000009243 with a market cap of more than $5 billion.

Read Shiba Inu’s [SHIB] Price Prediction 2023-24

Though SHIB struggled to climb up the price ladder, the whales still showed immense interest in the token. SHIB managed to be the first choice of the whales that the top 500 Ethereum whales were holding. Surprisingly, a look at SHIB metrics sheds some light on what the whales are thinking.

? The top 500 #ETH whales are hodling

$76,578,704 $SHIB

$50,282,855 #UnknownToken

$45,314,877 $UNI

$36,226,257 $BIT

$35,413,060 $BEST

$33,090,827 $LINK

$32,887,986 $LOCUS

$31,112,000 $MOCWhale leaderboard ?https://t.co/tgYTpOm5ws pic.twitter.com/9ATG4ys061

— WhaleStats (tracking crypto whales) (@WhaleStats) November 30, 2022

This might be just ahead

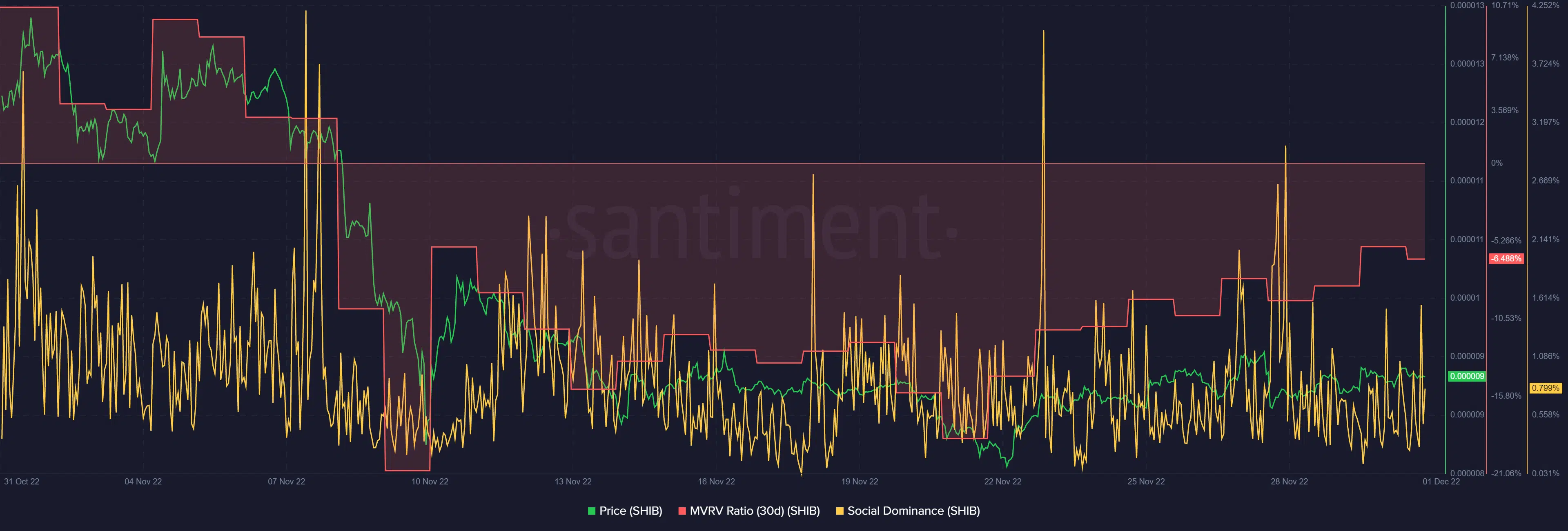

Santiment’s chart revealed that despite the slow-moving price action, SHIB’s MVRV Ratio was on a continuous rise, which is a bullish signal indicating a possible northbound breakout soon.

Shiba Inu managed to be popular in the crypto community over the past week as its social dominance spiked quite a few times. Moreover, according to BSC Daily, a popular Twitter handle that posts updates related to the BNB ecosystem, SHIB was also on the list of crypto projects that were trending on CertiK.

According to CryptoQuant’s data, SHIB’s net deposits on exchanges were low compared to the 7-day average, which too was a bullish signal as it signified less selling pressure. Additionally, the active addresses and number of transactions were also increasing, giving further hope for a price surge in the coming days.

But not everything was favorable

While the metrics looked in favor of SHIB, the market indicators told a different story as a few of them hinted at the possibility of a downtrend in the days to follow.

The Bollinger Band indicated that SHIB’s price had entered a squeeze zone, reducing the chances of a northward movement in the short term.

Shiba Inu’s Relative Strength Index (RSI) and Chaikin Money Flow (CMF) both registered slight downticks and were resting below the neutral mark.

Nonetheless, the Exponential Moving Average (EMA) Ribbon gave some hope as the 20-day EMA was still above the 55-day EMA, suggesting a bullish edge in the market.