Will VeChain succumb to crypto winter despite increased testnet activity

- VeChain registered an increase in activity on its testnet

- Development activity was up, but market indicators were bearish

VeChain [VET] revealed an interesting development that reflected the increased adoption and popularity of the network. As per VeChain Community Hun’s tweet on 12 December, the network witnessed a spike of unusual activity on its Testnet, as its number of transactions went up sharply.

Big spike of unusual activity on Testnet today, continuing to ramp up since the past week or so.

Always cool to see! $VEThttps://t.co/h2fgvIaBXM pic.twitter.com/kK0Mvi7Wr5

— VeChain Community Hub (@VechainThorCom) December 12, 2022

Read VeChain’s [VET] Price Prediction 2023-2024

The network went through a few more integrations and partnerships, thus, carrying the potential to drive a new bull run for VET. For instance, Shanghai Tanlian developed a digital carbon emission reduction platform for public building lighting based on the VeChain, in collaboration with Suzhou Fenghe Wulian.

VeCarbon x Suzhou Fenghe Wulian ?

"Shanghai Tanlian, together with Suzhou Fenghe Wulian, built a digital carbon emission reduction platform for lighting in public buildings based on the VeChain #blockchain." ?#VeChain $VET #VeFam #Sustainability #Technology #Business #Tech pic.twitter.com/oo87MnAKsP

— eisenreich (@eisenreich) December 12, 2022

However, at the time of writing, nothing reflected on VeChain’s chart, as it was mostly painted red. According to CoinMarketCap, at the time of writing, VET registered over 3% negative weekly gains and was trading at $0.01859 with a market capitalization of more than $1.3 billion.

Can the metrics help?

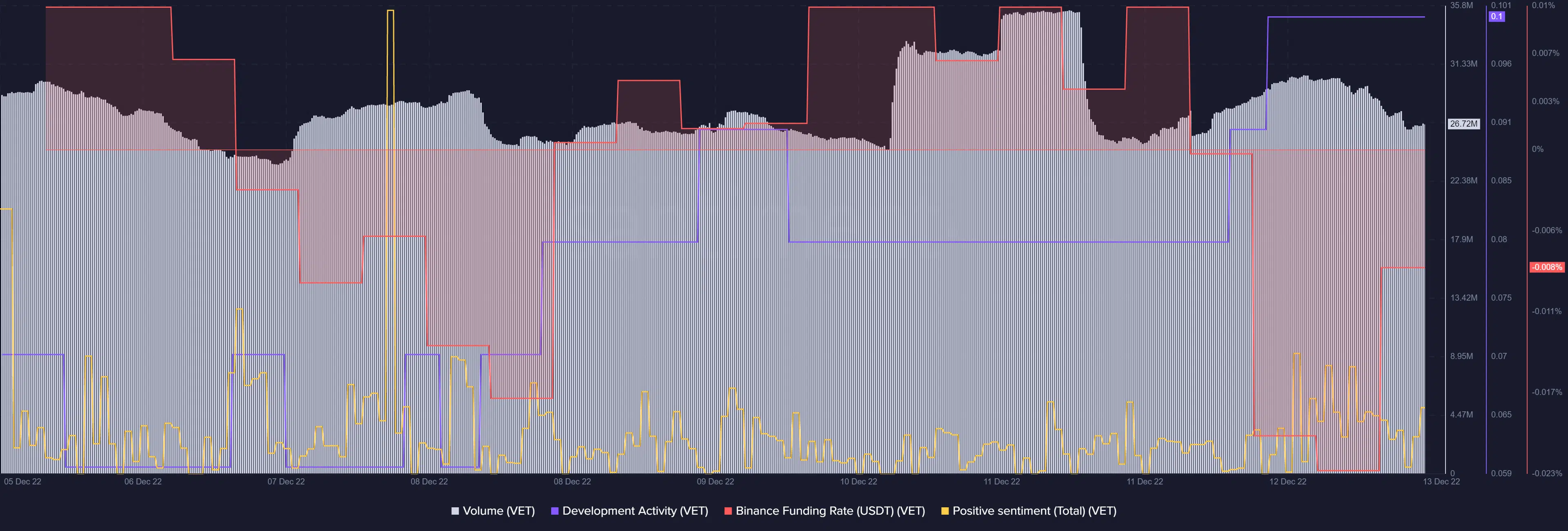

Over the last week, VeChain’s development activity went up, thanks to the new collaborations. This was a positive uptick as it reflected more effort from the developers to improve the capabilities and offerings of the blockchain. Not only that, but VeChain also maintained consistency in terms of volume in the past week. This was also a green flag.

However, after registering a spike, the network’s positive sentiments went down. This indicated that the crypto community had little faith in VeChain. The blockchain also did not receive much interest from the derivatives market as its Binance funding rate decreased.

The VeChain winter will get colder

A look at VET’s daily chart revealed that the investors might have to wait longer to enjoy the results of the aforementioned developments. This was because most market indicators did not support a price surge. The Exponential Moving Average (EMA) Ribbon revealed a bearish advantage in the market as the 20-day EMA was resting below the 55-day EMA.

The Chaikin Money Flow (CMF) and On Balance Volume (OBV) also registered downticks, suggesting a further downtrend in the days to follow.