Going long on Avalanche [AVAX]? Mark these levels to take profit

- AVAX rallied as BTC continued to soar following announcements from U.S. CPI.

- The target for a long entry could be $14.82 and the 38.2% Fib level ($14.96) if the uptrend continues.

Avalanche [AVAX] has rallied since mid-November, making higher lows. However, it reached a lower low around 12 December, settling at the $12.99 support level. A bullish BTC is driving it higher.

Bulls used the $12.99 support to initiate a rally that could take AVAX towards the 38.2% Fib level ($14.96). At press time, AVAX traded at $13.78, up about 6%, with a trading volume of over 120% in the last 24 hours.

AVAX could break through some resistance levels, including $14.96, the immediate target if the uptrend continues.

A confirmed breakout above $13.61: will the uptrend continue?

After the announcement from U.S. CPI showing that inflation eased in November, the stock market went up, and the crypto sector moved with it. A bullish BTC turned the altcoin market green, and AVAX was one of the altcoins that rallied.

AVAX could break through the 38.2% Fib level resistance ($14.96) and continue its uptrend if BTC remains bullish. Consequently, technical indicators suggest that the uptrend could continue.

After retreating from the lower range, the Relative Strength Index (RSI) has broken above the neutral 50 level. This shows that buying pressure is building up quickly.

Accordingly, the On-Balance-Volume (OBV) also rose steeply, indicating that trading volume has increased. Thus, buying pressure could increase and drive the price of AVAX upwards.

AVAX could, therefore, break through resistance at the 38.2% Fib level ($14.96) and head for the 50% Fib level ($16.05). This would mean a potential gain of 15% if the rally reaches the 50% Fib level or 8% if the bulls cool off at the 38.2% Fib level.

However, a drop below the 23.6% Fib level ($13.61) would negate the above bullish forecast. Such a downside move could force AVAX to retest the support level at $12.99.

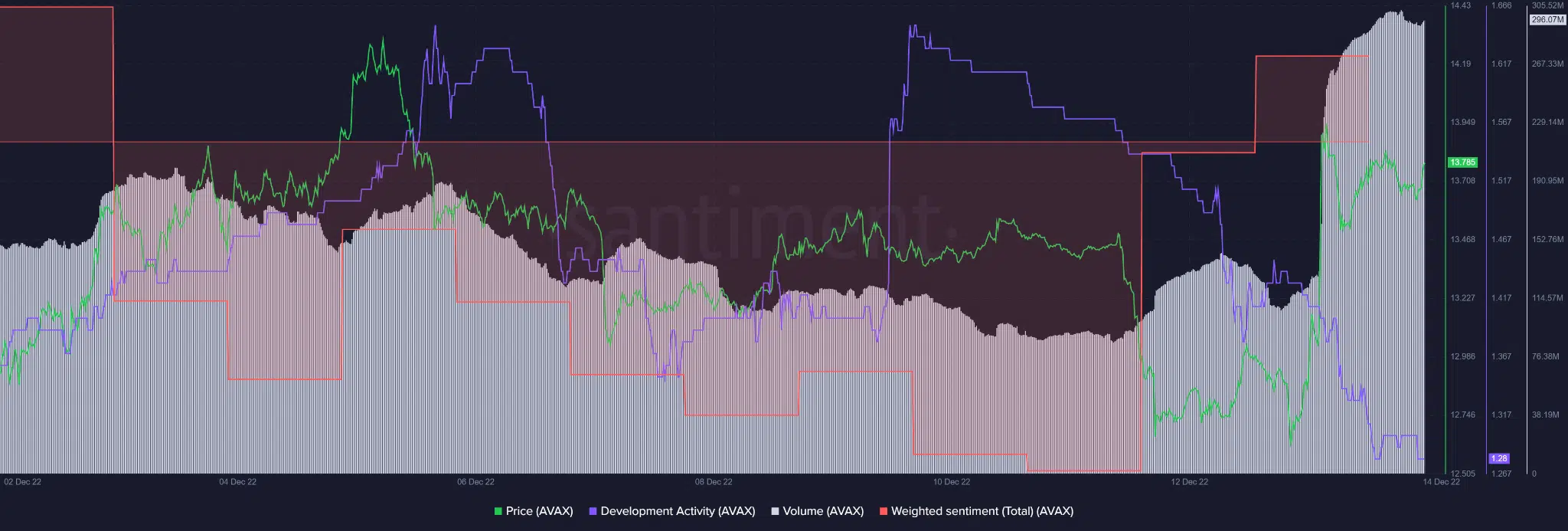

AVAX saw improved weighted sentiment in the spot markets

According to Santiment, sentiment for AVAX has improved since 12 December. At press time, weighted sentiment had moved into positive territory, indicating a bullish outlook for AVAX in the spot market

In addition, increased trading volume indicates increased buying pressure, suggesting that the AVAX rally could continue.

However, bearish sentiment in BTC could reverse the trend and negate the bullish outlook.

![Kusama [KSM] explodes 119% in one day - How DOT helped](https://ambcrypto.com/wp-content/uploads/2024/11/Michael-KSM-400x240.webp)