Reasons BNB Chain’s latest development could be BNB’s saving grace

- GMX to launch on Binance Chain to benefit both parties

- Dapp activity declines, along with TVL and revenue that is being generated

GMX, a decentralized exchange initially deployed on the layer 2 solution Arbitrum, recently proposed its launch on the Binance Smart Chain (BNB). According to GMX, this collaboration will be mutually beneficial for both GMX and Binance.

Are your BNB holdings flashing green? Check the profit calculator

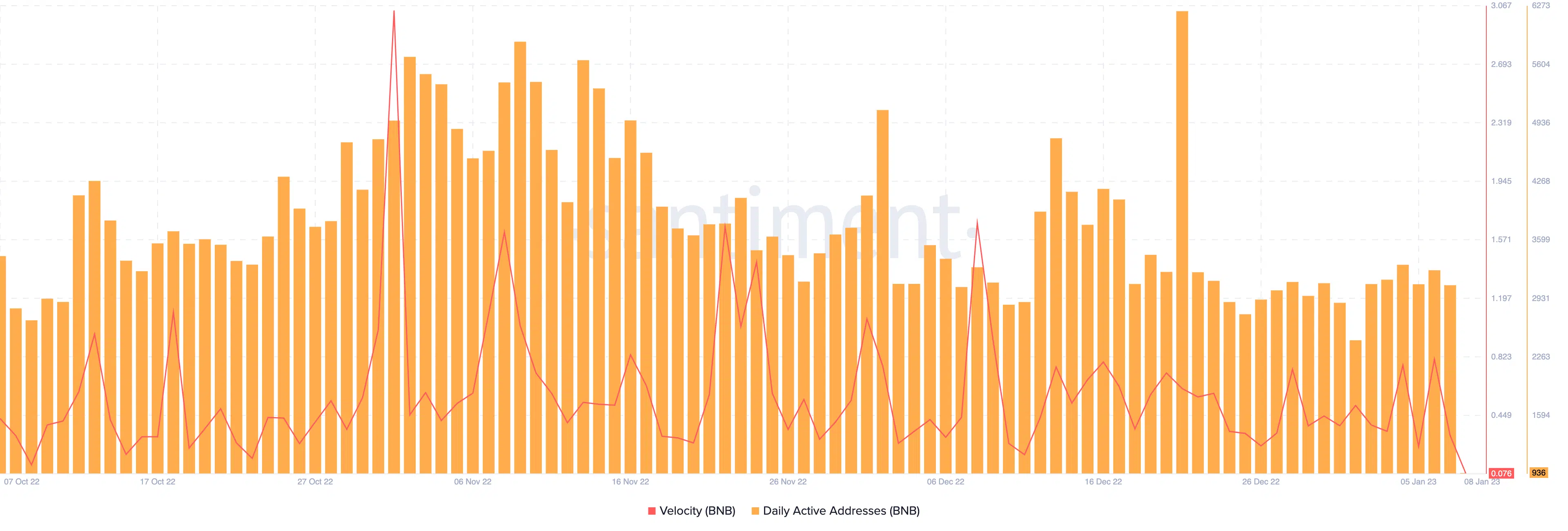

The launch of GMX on the BNB chain could help address Binance’s declining transaction count and velocity, as reported by Santiment.

A decline in velocity indicated a reduction in the frequency of BNB transfers between addresses. This could be a potential indication of a decline in the overall activity on the chain.

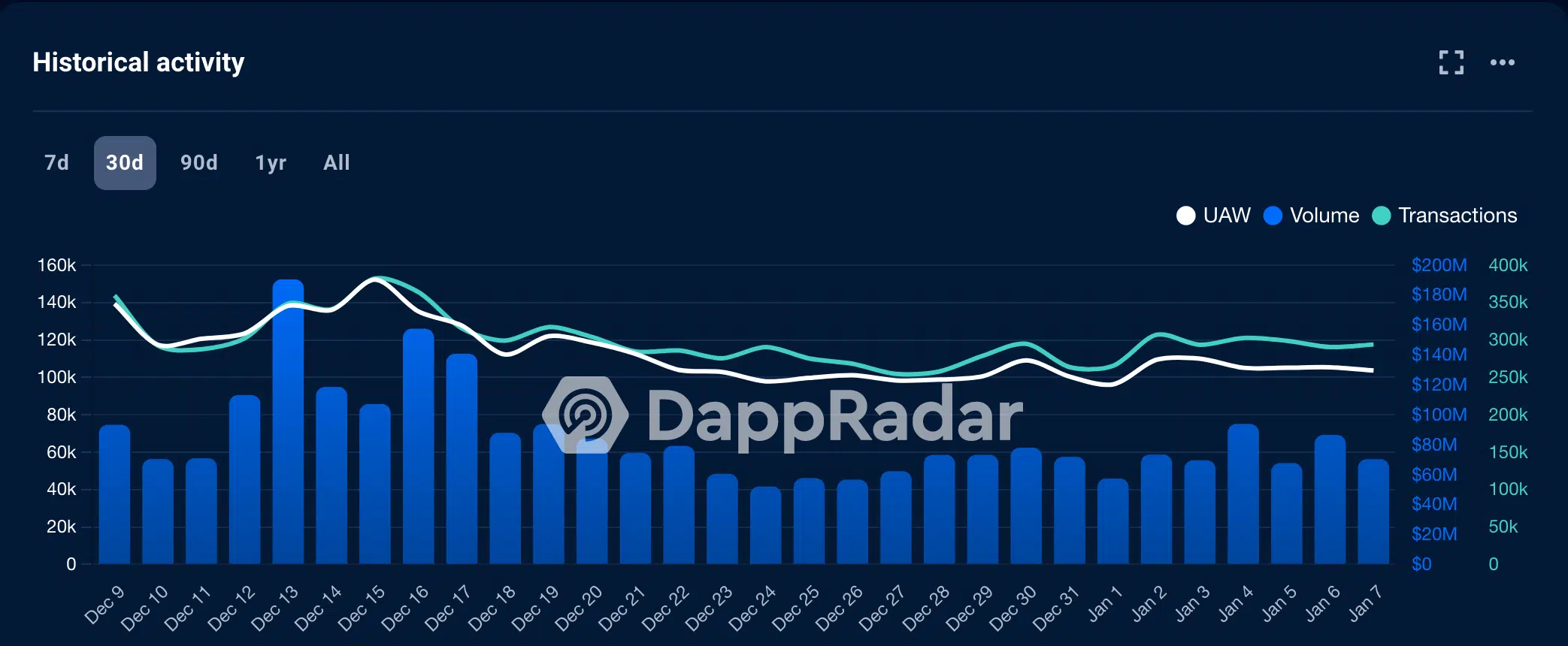

This decline in activity may be due to a drop in dApp usage. Based on data data from Dapp Radar, it was observed that popular DEXs, such as PancakeSwap and Hooked experienced a decrease in the number of unique active wallets on their network. The number of unique active wallets for Hooked declined by 47.26% in the last seven days.

The number of unique active wallets on PancakeSwap, on the other hand, fell by 25.26%. Furthermore, the volume on the dApp also decreased by 56.04% during the same period.

Even though dApp activity on the BNB chain continued to decline, BNB still managed to grow in terms of TVL.

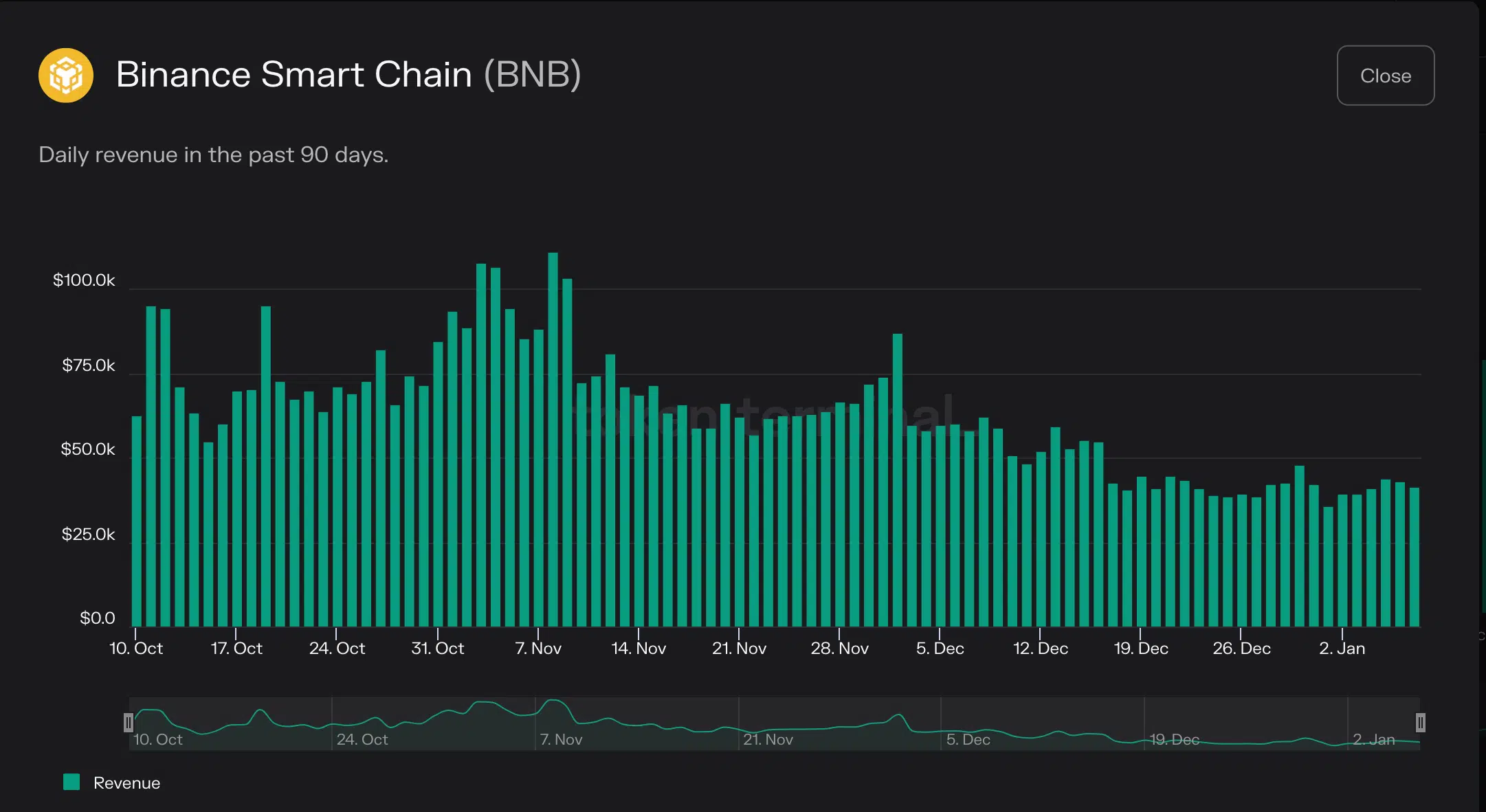

According to data provided by DeFiLlama, BNB’s TVL went from $4.13 billion to $4.23 billion in the last week. However, despite the growing TVL observed by BNB, its revenue continued by BNB to decline.

BNB’s revenue decreased by 33% in the past week, which made the TVL stand at $5.7 million at the time of writing according to token terminal.

Activity on chain

Although the revenue generated by BNB continued to decline, the BNB token witnessed some positive developments.

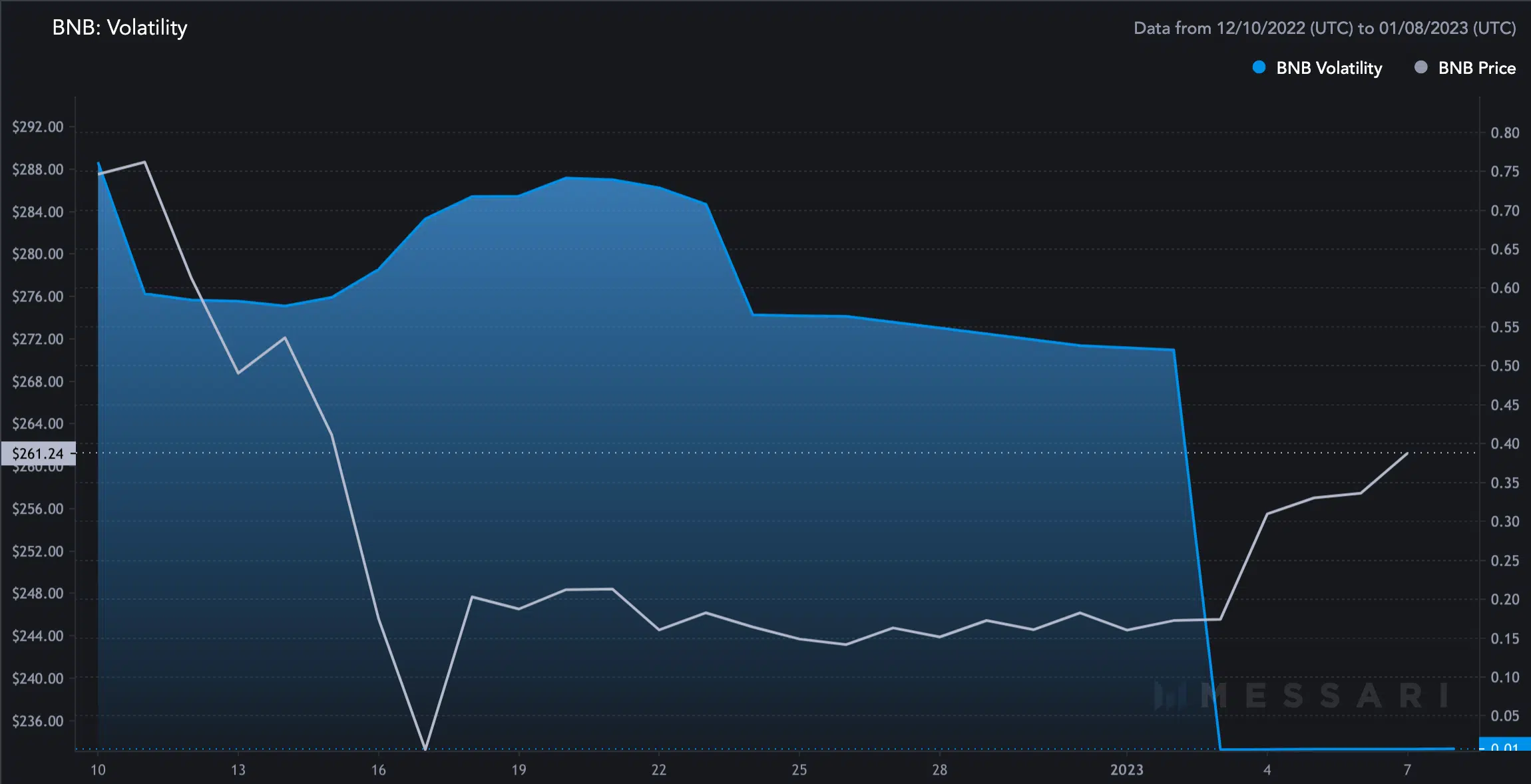

For instance, the volatility of the BNB token declined. The decreased volatility of BNB in the market could be attractive to investors who are looking for a more stable asset to invest in.

In times of low volatility, investors may feel more comfortable holding onto their assets for longer periods of time. This is because there stands a less likelihood of sudden price fluctuations.

How many BNBs can you get for $1?

However, there was a decrease in market cap dominance which was observed according to Messari. This may also be a concern for some investors, as it suggested that BNB could be losing market share to other cryptocurrencies.

At the time of writing, BNB was trading at $261.52 and its current market cap dominance was at 4.88%.