Is Aptos’ [APT] bull run coming to an end? Here’s why investors should be cautious

![Is Aptos' [APT] bull run coming to an end? Here's why investors should be cautious](https://ambcrypto.com/wp-content/uploads/2023/01/APT-1.png.webp)

- Aptos’ Total Value Locked (TVL) reached a new ATH of over $62.5 million.

- However, the market indicators showed reasons why investors should be worried.

Aptos [APT] remained in the headlines for the entire week because of its massive price pump, which outperformed the rest. The gains also helped Aptos reach another milestone.

10/ Last but not least, we hit a new peak ATH TVL (all time high total value locked) of ~$62M!

At just 12 weeks out from Mainnet launch, these milestones continue to set an incredible pace for the entire ecosystem! ??? pic.twitter.com/2fP896WHKE

— Aptos (@Aptos_Network) January 30, 2023

Read Aptos’ [APT] Price Prediction 2023-24

APT’s total value locked (TVL) reached a new all-time high of more than $62.5 million. This was great news, as APT achieved this in just a matter of 12 weeks since the mainnet launch.

In addition to the increased TVL, Aptos also recently updated its wallet, which added more features and provided a better experience to the users. The Aptos Wallet Adapter Standard made it easier for users to deploy, integrate, and transact across the network.

dApp builders don’t need to deal with maintaining and implementing different wallets in the Aptos ecosystem, as the adapter takes care of everything. The adapter offers a standard to wallet builders, making integration simple while also increasing their wallet’s visibility and exposure.

1/ The Aptos wallet experience has been revamped! With Aptos’ new Wallet Adapter Standard, it’s easier than ever to deploy, integrate, and transact across the network.

Aptos users can enjoy this improved experience instantly.

Devs, try it out! ?https://t.co/M2NAgrHIGx pic.twitter.com/n3jcy9rufj

— Aptos (@Aptos_Network) January 30, 2023

Trouble is around the corner

While these developments gave hope for better days ahead, the opposite was revealed by the crypto’s price action. CoinMarketCap’s data pointed out that after a commendable week, APT’s price declined, as it was down by 14% in the last 24 hours. At the time of writing, it was trading at $16.46 with a market capitalization of over $2.6 billion.

Aptos’ four-day chart revealed yet more reasons for the investors to worry as the market indicators aligned with the bears’ interest. For example, the MACD displayed a bearish crossover. APT’s Exponential Moving Average also painted a bearish picture as the distance between the 20-day EMA and 55-day EMA was reducing.

The Relative Strength Index (RSI) also registered a downtick and was headed further below the neutral mark, increasing the chances of a continued downtick. Nonetheless, the Chaikin Money Flow (CMF) slightly supported the bulls as it went up.

Realistic or not, here’s APT market cap in BTC’s terms

The downtick is justifiable

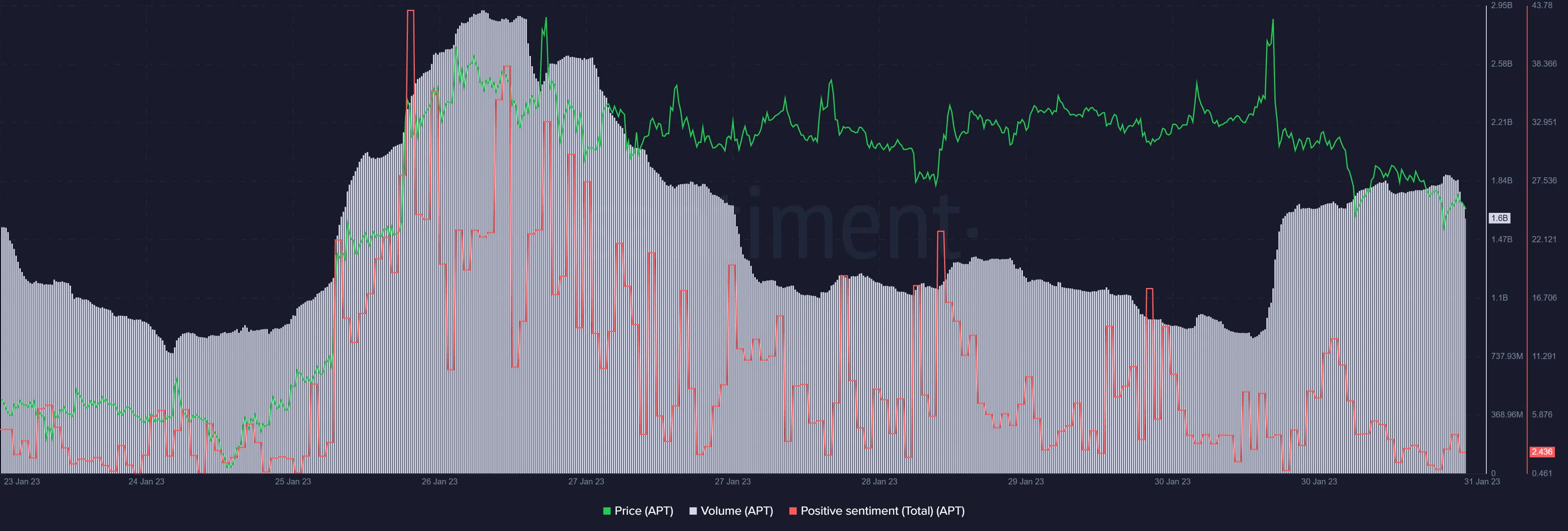

The recent downtrend in APT’s price was accompanied by an increase in its volume, which legitimized the plummet and decreased the chances of a sudden uptrend.

Positive sentiments toward APT have also declined in recent days, indicating that the crypto community has less faith in the token. Interestingly, despite decreased trust, APT was on the list of the top 15 coins by trending search of Binance.