How Aave’s treasury will help it rise above MakerDAO and Uniswap

- Aave’s treasury funds saw significant growth.

- Other competitors also witnessed a surge in their treasury funds.

Decentralized lending protocol Aave [AAVE] has seen a growth in its treasury funds, according to a 1 February tweet from Delphi Digital. The growth in treasury funds is an indicator of consistent revenue generation for the protocol, which can be used for various initiatives, such as development, marketing, and strategic planning.

.@AaveAave has ~$143M in its treasury:

– $120M $AAVE

– $7M $USDC

– $5M $DAI

– $5M $USDT

– $2M $BAL

– $2M $WETH

– $2M misc.

– $739K $SHIB

– $631K $CRV pic.twitter.com/YNtSzJdcmw— Delphi Digital (@Delphi_Digital) February 1, 2023

Read Aave’s [AAVE] Price Prediction 2023-2024

A strong and growing treasury can also provide stability and assurance to investors and stakeholders, which can increase confidence in the protocol and lead to increased demand for its tokens.

Aave starts to give tough competition

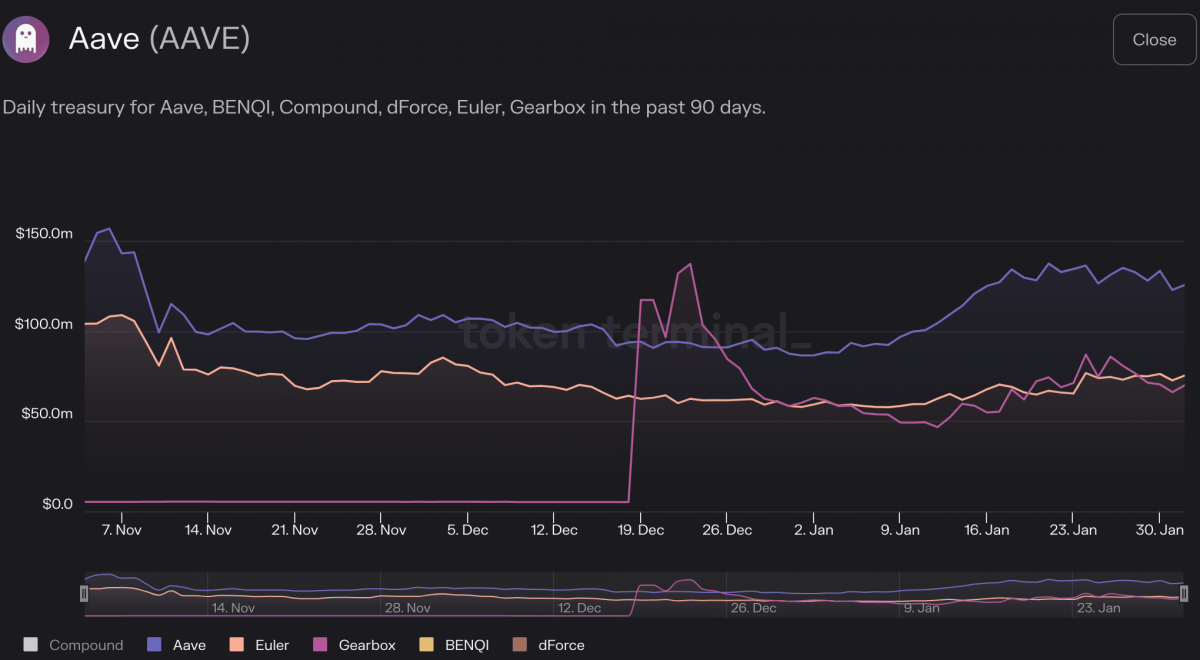

Compared to its competitors such as BenQI and Compound, Aave‘s treasury funds grew materially in the last three months.

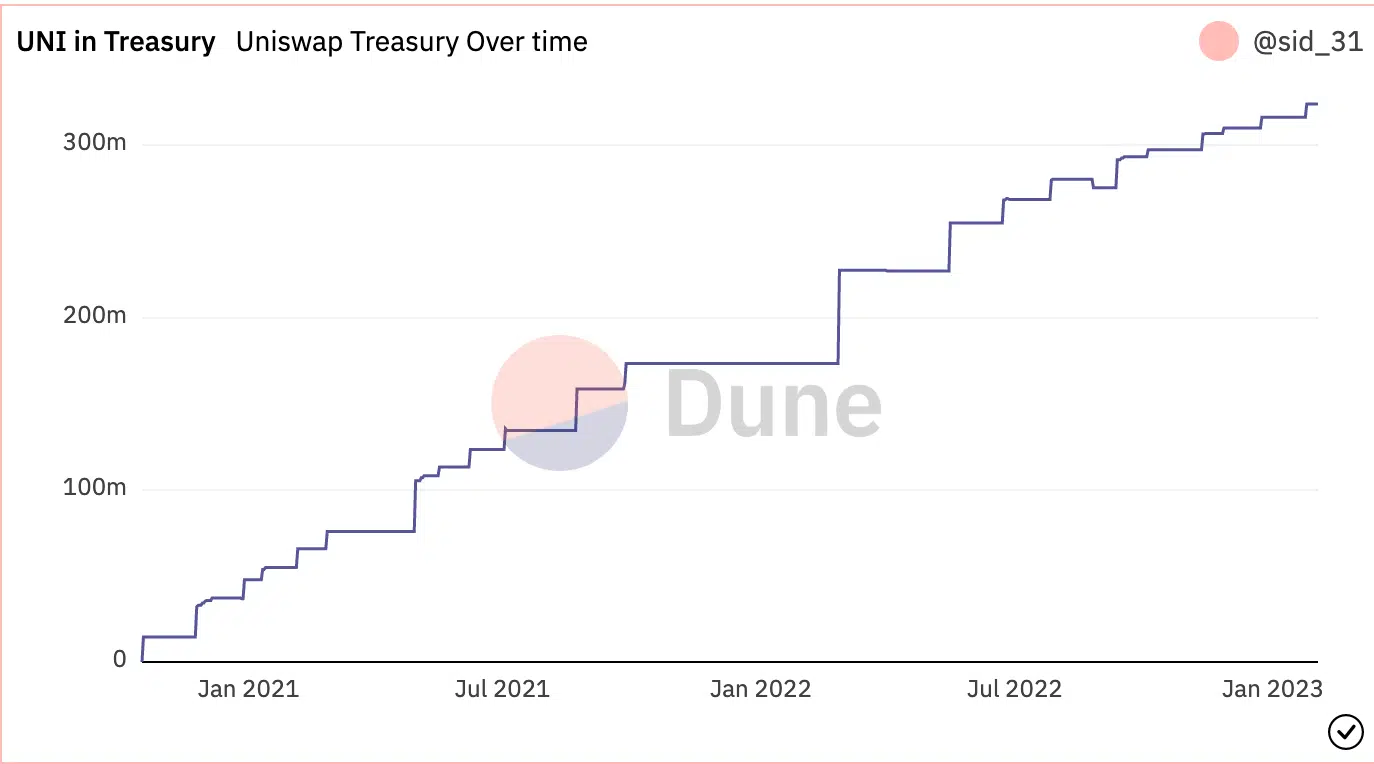

However, other DEXes such as Uniswap [UNI] and MakerDAO [MKR] also witnessed growth in this area.

According to Dune Analytics, Uniswap’s treasury funds increased over the last few months despite the volatility observed in the crypto market. Similarly, MakerDAO weathered the storm and saw growth in terms of the assets being held by the protocol.

MakerDAO’s treasury consisted mostly of stablecoins, which accounted for 59% of its overall assets. Despite this, it was MakerDAO’s Real World Assets (RWA) that generated the most revenue for the protocol.

It remains to be seen whether MakerDAO will continue to increase its revenue and add value to its treasury.

Looking at the tokens

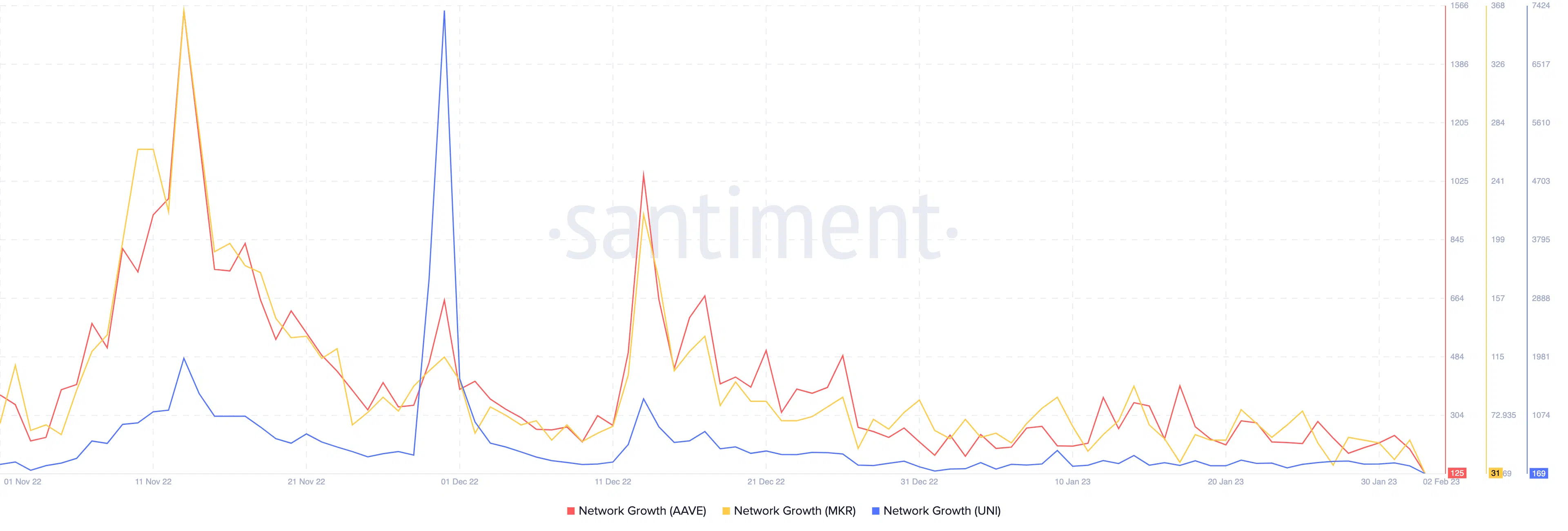

Despite the growing funds of these protocols, the tokens could not generate interest from new addresses.

According to data from Santiment, the network growth for UNI, MKR, and AAVE declined. UNI took a significant hit in this space. However, AAVE outperformed the other protocols in this area despite the declining network growth.

Is your portfolio green? Check out the Aave Profit Calculator

In conclusion, Aave’s growing treasury fund is a positive sign for the protocol, as it showcases consistent revenue generation and provides stability and assurance to investors. Its growth, compared to competitors like Uniswap and MakerDAO, highlighted its financial strength.

However, the decline in network growth for all three protocols showed a lack of interest from new addresses. This could be a potential roadblock in the future growth and adoption of these protocols and their tokens. Nevertheless, the large treasury funds of these protocols could drive growth for their respective ecosystems.