Maker [MKR] could witness a 10% hike, traders can set a stop loss below…

![Maker [MKR] could witness a 10% hike, traders can set a stop loss below...](https://ambcrypto.com/wp-content/uploads/2023/02/1674220735850-f4991710-e482-47c6-9036-f72e87182493-3072-e1675486062676.png)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- MKR chalked a bullish flag pattern on the daily chart.

- The token’s Funding Rate remained flat but positive.

Maker [MKR] offered over 30% gains to investors in January. At press time, MKR’s value was $683 after losing substantial value in its recent price consolidation range. However, a potential patterned breakout could offer investors and traders an extra 10% gain.

Read Maker [MKR] Price Prediction 2023-24

MKR chalked a bullish flag pattern – Are more gains likely?

On the daily chart, MKR’s price action in 2023 chalked out a bullish flag pattern. Therefore, a bullish breakout was likely, with $800 as the target. That would offer investors about 10% more gains.

The Relative Strength Index (RSI) and On Balance Volume (OBV) showed an uptick, indicating that MKR was bullish, thanks to the increasing demand.

So, bulls could inflict a bullish breakout. But the bulls must deal with the sell pressure zone of $716 – $746 and September’s overhead peak resistance of $781.

How much are 1,10,100 MKRs worth today?

However, a bearish breakout would invalidate the above bullish bias. The downtrend would settle at the $553 support level. So, investors and traders going long on the asset can set a stop loss below the range of $615 – $635 (green zone).

MKR saw short-term sell pressure, but the Funding Rate was unchanged

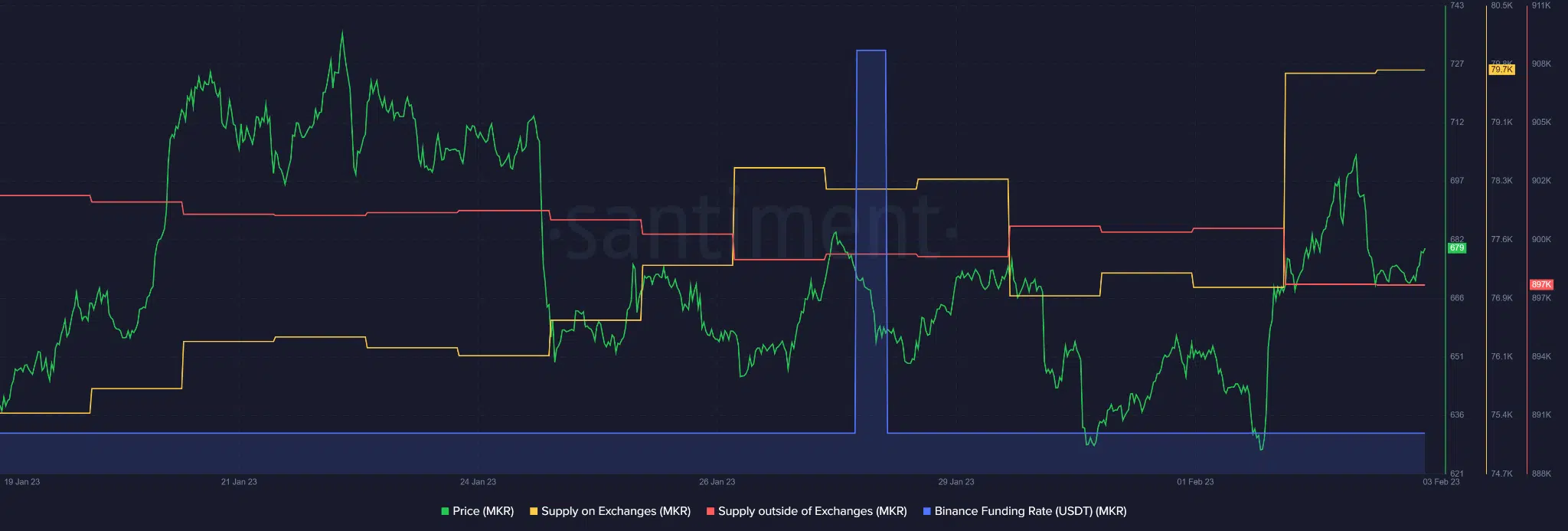

MKR’s supply on exchange was flat, while the supply outside of the exchange registered a spike, as per Santiment data. The spike indicates a rise in short-term sell pressure, especially from short-term holders wishing to lock in short-term gains.

This could delay a convincing breakout if the supply outside of the exchange increases. Therefore, traders and investors should be cautious with the sell pressure zone of $716 – $745.

On the other hand, the Funding Rate for MKR/USDT pair remained unchanged for the past few days. This shows that demand for MKR hasn’t increased or declined. This could support a sideways structure scenario.

However, the rising open interest (OI) rate could help boost MKR’s price surge in the next few days. According to Coinglass, MKR’s OI dropped sharply between January 10 – 19, indicating more money flowed out of its futures market, painting a bearish sentiment.

But the OI has been rising since January 20, meaning more money has been pumped into MKR’s futures contracts. The trend could boost MKR’s bullish momentum to inflict a patterned breakout.