NEAR faces selling pressure, but here’s why $2.255 support is crucial

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- NEAR could break below the $2.255 support.

- The Funding Rate dropped significantly by press time.

Near Protocol’s [NEAR] shrinking trading volumes could impact investors and traders. At press time, the token’s value had dropped to a crucial support level of $2.255. It had plummeted by 10% in the past 24 hours, according to Coinmarketcap.

Is your portfolio green? Check out the NEAR Profit Calculator

Will the $2.255 support hold?

Read NEAR Price Prediction 2023-24

On the 12-hour timeframe chart, NEAR was bearish, as indicated by the Relative Strength Index (RSI) value of 41. In addition, the OBV (On Balance Volume) fell below a crucial level seen during the recent price consolidation phase. The dropping trading volumes could give sellers more leverage.

NEAR could drop below the $2.255 level and break a few supports. In such an event, short traders could benefit from short-selling opportunities at $2.067 and $1.968.

Alternatively, bulls could launch a recovery from the $2.255 if demand rises for NEAR at its discounted prices. Such development would invalidate the bearish bias described above. Nevertheless, the upswing could aim at the bearish order block level of $2.688.

Notably, the ADX (Average Directional Movement Index) dipped, showing NEAR’s market structure weakened significantly. It shows that bears had more leverage in the market at press time and could attempt to devalue the token further.

NEAR’s demand fell with the increasing bearish sentiment

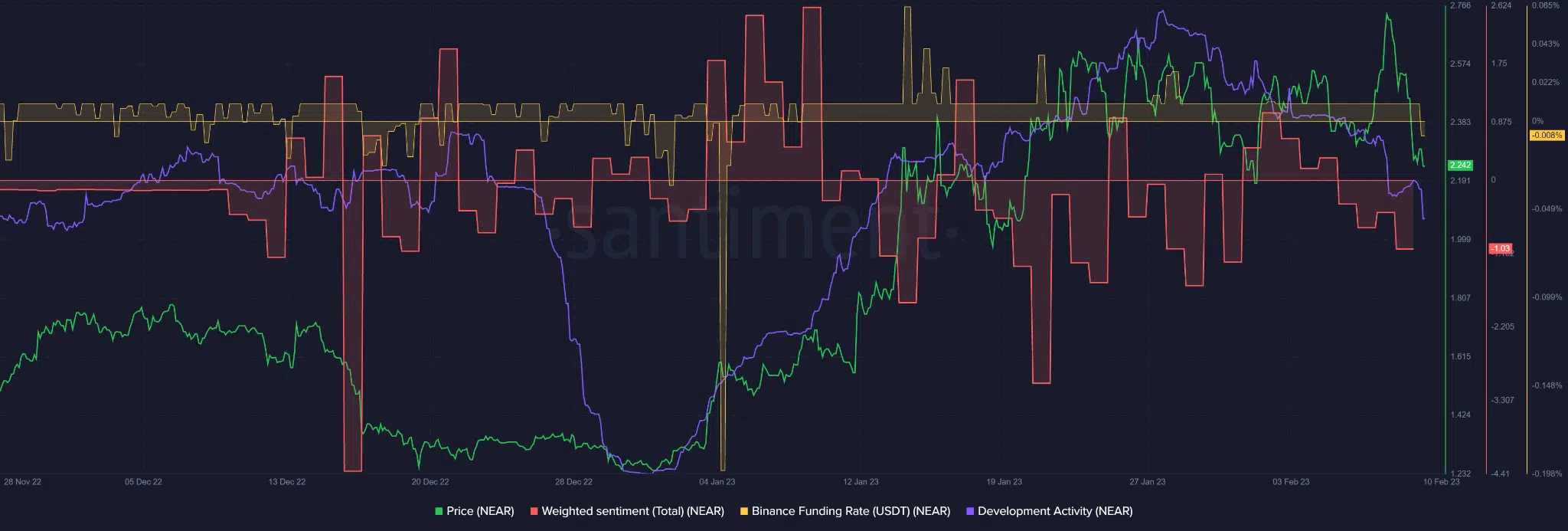

NEAR’s demand in the derivatives market tanked as the funding rate for the NEAR/USDT pair fell and turned negative by the time of writing.

In the same period, the weighted sentiment also declined and flipped into negative, underlying the bearish sentiment in the market at press time.

In addition, NEAR’s development activity has declined since the end of January, indicating that NEAR protocol has experienced limited developer action and building for the past two weeks.

The trend could negatively impact investors’ outlook and assurance on the protocol and its native token. It could weigh on NEAR’s recovery attempts.

However, a bullish BTC could tip bulls for a strong recovery, invalidating the above bearish bias.