BTC accumulation rises as USDC holdings decrease: What’s the connection?

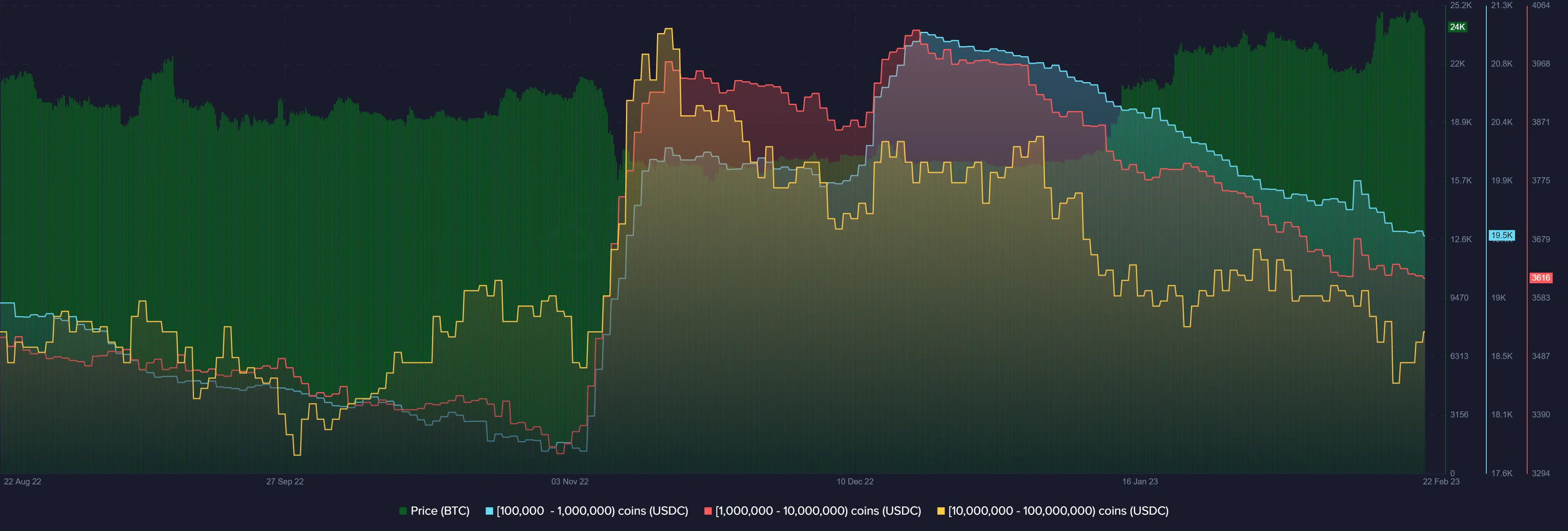

- Addresses holding 100,000 – 1 million USDC decreased by around 7.8%.

- USDC flow into Bitcoin has increased in the last couple of days.

More and more US Dollar Coin [USDC] appeared to be being exchanged for Bitcoin [BTC] as of late. As a result of this influx, several addresses have seen a decrease in their holdings. What may be driving this influx, and how much is happening right now?

Read Bitcoin’s [BTC] Price Prediction 2023-24

BTC accumulation increases

Most traders sold their Bitcoin holdings after the FTX collapse in 2022 and the ensuing market turmoil. Most traders liquidated their BTC positions into stablecoins like USDC to preserve liquidity. According to recent Santiment research, USDC holdings increased while BTC holdings decreased. Yet, the tide has turned for both assets.

Santiment reported that in a recent turn of events, there has been a rise in the amount of USDC invested in Bitcoin. Based on the observed figure, the number of addresses holding between 100,000 – 1 million USDC had decreased by roughly 7.8% during the past two months. The graph also revealed that the USDC withdrawals were being reinvested in Bitcoin.

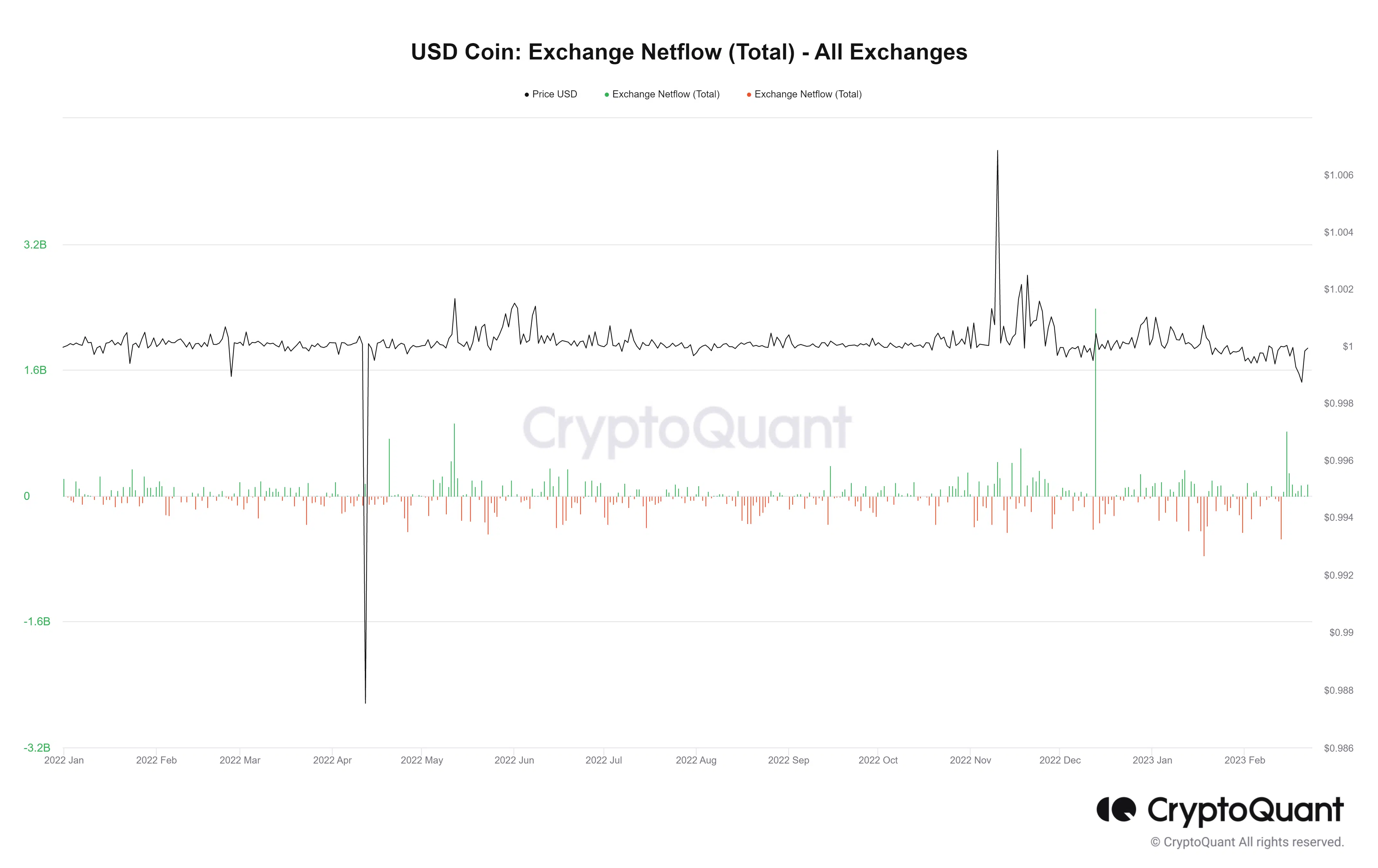

More USDC hits exchanges

The Netflow measure on CryptoQuant was examined to ascertain the size of USDC‘s outflow. The Netflow indicator indicated that there had been a considerable amount of USDC traded. Most of the influx points to traders unloading their holdings for Bitcoin and other cryptocurrencies. As of this writing, the NetFlow was positive, with about $150 million entering the exchanges.

Why stables move

Stablecoins are preferred by crypto market participants who wish to hedge against price fluctuations in Bitcoin and similar cryptocurrencies by virtue of their pegged value to fiat. When they decide that the time is right, these investors will trade in their safe assets for volatile cryptocurrencies, which will positively impact the price.

So, investor demand for Bitcoin and other cryptocurrencies may be shown by a pattern of stablecoin deposits in spot markets. Traders may feel more confident about entering BTC, now that its volatility had decreased.

How much are 1,10,100 BTCs worth today?

At the time of writing, the price of Bitcoin was about $24,000, with the $23,000–21,000 range serving as its support level. The Bollinger Bands also indicated that some volatility was still present, albeit not to a high degree.

The recent Bitcoin price movement may cause the USDC Bitcoin influx to rise even more. The stablecoin will, however, gain more at the first indication of a decline, as was the case during the FTX catastrophe, and the USDC – Bitcoin connection will reverse.