SNX fails to push past $3 wall despite Synthetix V3 mainnet milestone

- SNX hits a brick wall in its attempts to push to a new 2023 high.

- Short sellers should exercise caution as SNX’s relative strength leans in favor of a limited retracement.

Synthetix’s native token SNX is among the few cryptocurrencies that managed to maintain a bullish bias in the last two weeks. This, at a time when most of the top cryptos have been struggling to hold on to January gains.

But can SNX keep up the trend or is there room for shorts to benefit?

Is your portfolio green? Check out the Synthetix Profit Calculator

Synthetix just announced a new milestone that has the potential to boost its liquidity operations. The network has officially rolled out its Synthetix V3 on the mainnet.

This milestone is important for the network because it will facilitate a transition to a distributed pool model. The network previously used a debt pool of liquidity approach.

Yes, you heard right. @synthetix_io v3 is officially on mainnet.

This is a good time to go over how I personally view this milestone for Synthetix and why it’s so exciting.

— sunnyv.lens (@sunnyvempati) March 1, 2023

The main advantage of the transition is that liquidity providers can now contribute to liquidity in different pools across multiple markets.

Synthetix plans to make the pools permissionless in the future. These measures might be encouraging to LPs leading to higher TVLs.

There was some excitement in the market around the announcement. Synthetix joined the list of the most used smart contracts among the top 100 ETH whales in the last 24 hours at press time.

JUST IN: $SNX @synthetix_io one of the MOST USED smart contracts among top 100 #ETH whales in the last 24hrs?

We've also got $GRT, $SHIB, $LPT, $CVX & $LINK on the list ?

Whale leaderboard: https://t.co/N5qqsCAH8j#SNX #whalestats #babywhale #BBW pic.twitter.com/AIfXH1SHxb

— WhaleStats (tracking crypto whales) (@WhaleStats) March 2, 2023

SNX bulls tire after retesting previous YTD highs

The market’s reaction was completely different despite expectations of a significant investors’ confidence boost courtesy of the milestone. SNX tanked by 7.88% in the last 24 hours to its $2.79 press time price.

This bearish mid-week outcome occurred after the price hit a resistance wall at SNX’s previous 2023 high. The subsequent sell pressure as a result of this resistance retest may have suppressed any potential bullish volumes associated with the recent announcement.

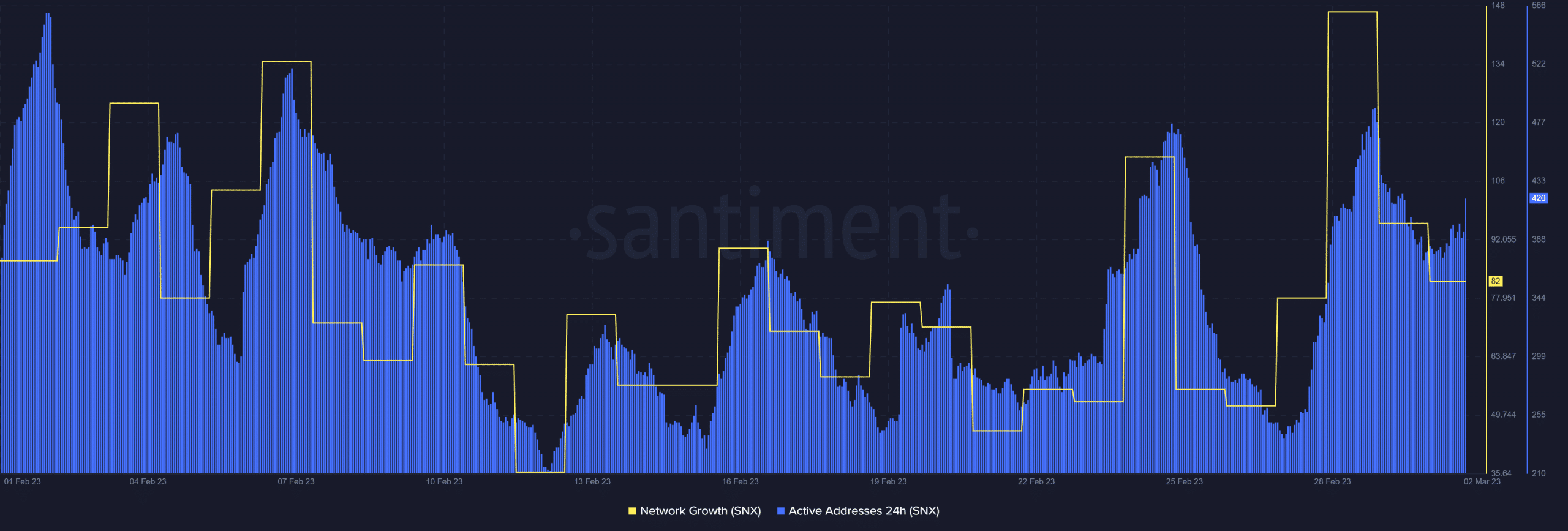

The recent peak and retracement reflect a surge in 24-hour active addresses. This is because of the increase in demand for SNX at the end of February.

Thus, triggering a surge in network growth. However, active addresses dropped off since the start of March, confirming that demand was slowing down.

How many are 1,10,100 SNXs worth today?

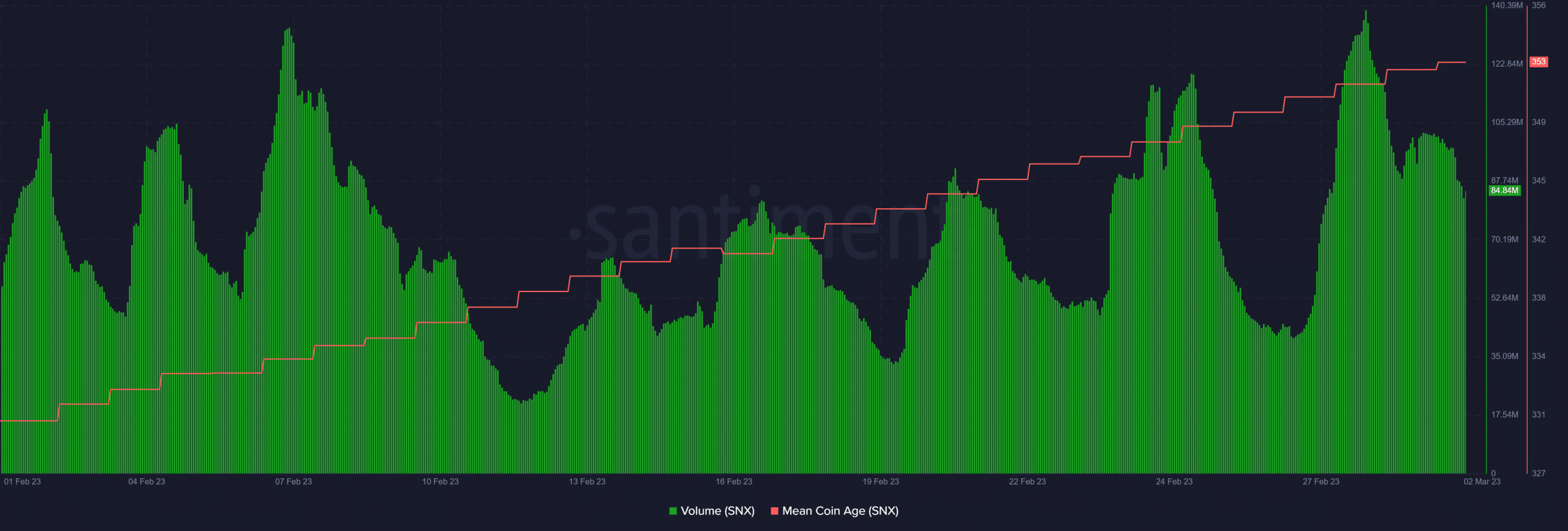

SNX’s mean coin age is currently at its 4-week high, which means it was not affected by the retracement. In other words, most of the buyers that accumulated SNX in February are still holding onto their coins.

Lastly, SNX’s on-chain volume indicator reached its highest 4-week levels at the end of August. This confirms that the coin was still able to command robust demand from the market. These characteristics warrant caution for short-sellers as prospects of more downside are low.