MakerDAO suffers a fall in annualized fee income, thanks to SVB

- MakerDAO’s annualized fee income has been decreasing since SVIB’s collapse.

- Waning buying pressure puts MKR’s price at risk of further decline.

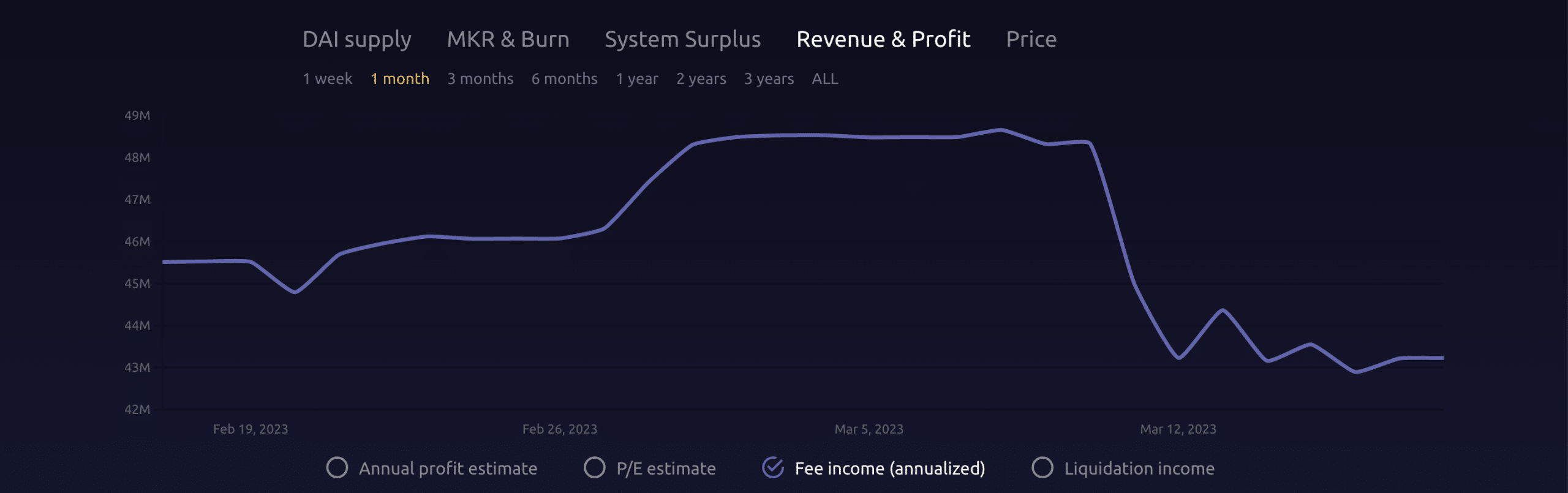

The annualized fee income of leading decentralized finance protocol MakerDAO [MKR] has declined since the collapse of Silicon Valley Bank (SVIB) on 10 March, data from MakerBurn revealed.

At 43.23 million DAI tokens at press time, Maker’s fee income has decreased by 11% in the last week.

The exact amount of fee income that MakerDAO generates varies depending on a number of factors, including the demand for DAI, the amount of collateral locked up in the Maker protocol, and the stability fee and liquidation penalty fee rates set by MKR holders.

The steep drop in fee income on the protocol in the last week was attributable to the DAI stablecoin losing its $1 peg after USDC’s issuer confirmed that it held deposits at SVB.

As USDC was a significant collateral backing for DAI, its de-pegging event resulted in a temporary loss of dollar parity for DAI.

Is your portfolio green? Check out the Maker Profit Calculator

This also culminated in a significant drop in MKR’s value forcing the protocol to implement a number of emergency proposals to prevent another black swan event. All of these led to a drop in the protocol’s fee income in the last week.

Up and down goes MKR’s price

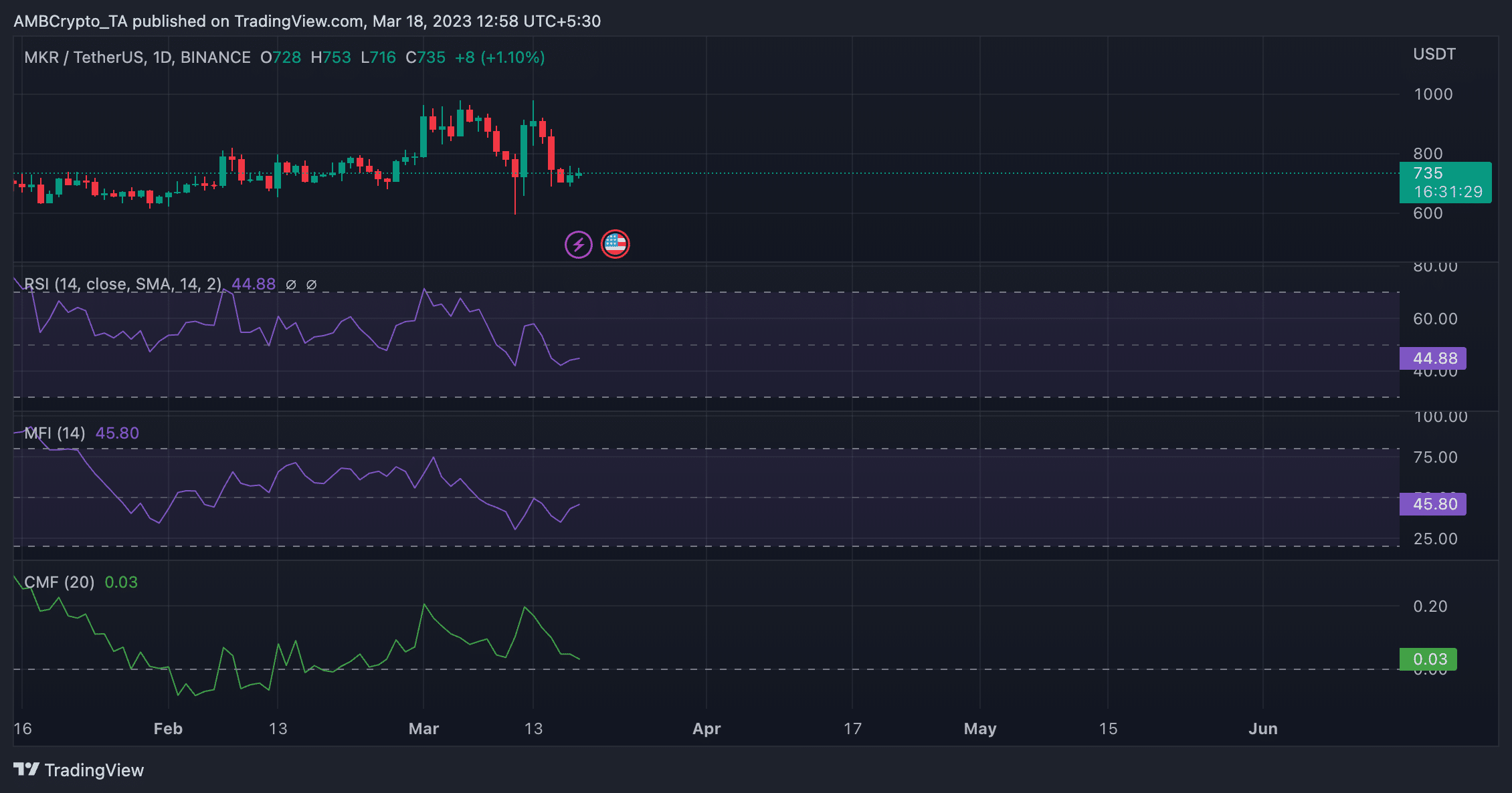

Following the announcements on 12 March by Federal Regulators to make SVB’s depositors whole, MKR’s price rallied by double digits. According to CoinMarketCap, the DeFi token exchanged hands for as high as $956 in the early trading hours of 13 March.

However, as the week progressed, buying momentum dropped gradually, causing MKR’s price to initiate a downtrend. At press time, the token traded at $739.95, having shed 23% of its value since Monday.

With waning buying pressure, MKR has traded within a tight range in the past two days. An assessment of its price on a daily chart revealed that it has oscillated within the $745 and $740 price range since 16 March.

Read Maker [MKR] Price Prediction 2023-24

At press time, key momentum indicators rested below their respective neutral lines. For example, MKR’s Relative Strength Index (RSI) and its Money Flow Index (MFI) were both positioned at 44.88 and 45.80, respectively.

With the market trading sideways in the past few days, MKR traders have become increasingly skeptical of sudden price swings, and have, as a result, refused to intensify accumulation.

Although the dynamic line (green) of MKR’s Chaikin Money Flow (CMF) was still in the positive territory at press time, in a downtrend position already, a further decline in positive sentiment will push the CMF below the center line. If this happens, it would mark the exit of liquidity needed to initiate any rally in MKR’s price.