Ethereum: Shanghai Upgrade approaches, here’s what node operators should know

- Earnings from transaction fees on the network declined by 3.66% over the previous week.

- The Open Interest (OI) for ETH rose, complementing the increase in price.

In preparation for the much-anticipated Shanghai hard fork which is scheduled to go live on 12 April, Ethereum [ETH] developers asked all network validators to upgrade their nodes.

During the All Core Developers Consensus Call, Ethereum client teams gave updates about the status of their final releases after which Alex Stokes, who chaired the call, asked all stakeholders to follow relevant distribution channels to take the next step.

Another developer Paritosh added that mainnet nodes were getting synced and once final client releases were out, developers will execute one final mainnet shadow fork, a week before the eventual launch.

Ethereum conducted successful launches of the Shanghai Upgrade, also known as Shapella, on various test networks. However, the last one on Goerli, the largest public Ethereum testnet, saw a dip in participation rates because validator nodes didn’t upgrade.

Read Ethereum’s [ETH] Price Prediction 2023-2024

All’s not well with staking!

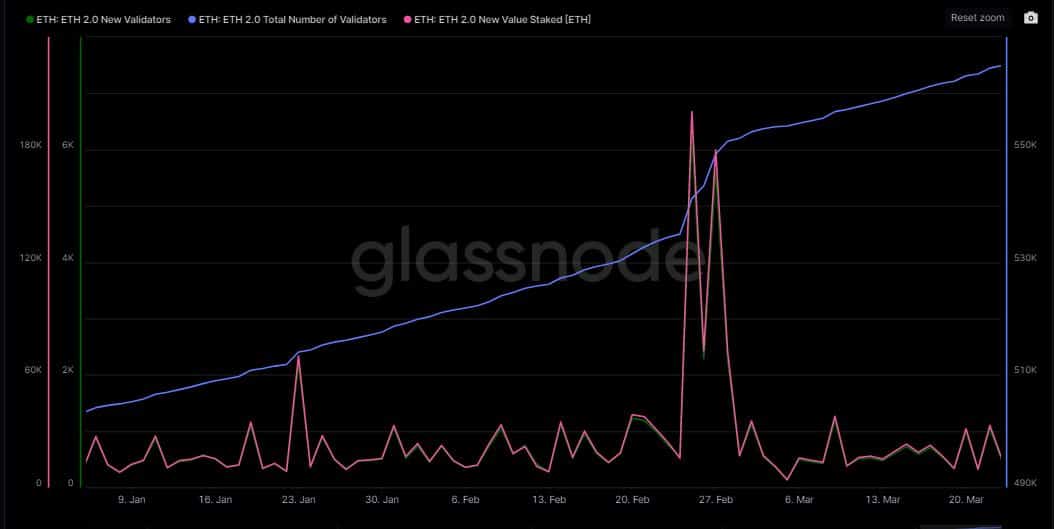

Staking activity on the Ethereum network saw steady growth as per data revealed by Glassnode. The total number of validators on the network reached 564,951, an increase of 5% over the previous month.

But while the overall number of validators grew, the pace at which new players were entering the ecosystem declined. From a one-year high of 6,302 on 25 February, the number of new validators plummeted to 483 as of 23 March.

A similar trajectory was observed for the growth in new value staked.

One possible reason could be due to the decline in revenue collected by the validators. As per data by Staking Rewards, earnings from transaction fees declined by 3.66% over the previous week.

Positive signals for ETH

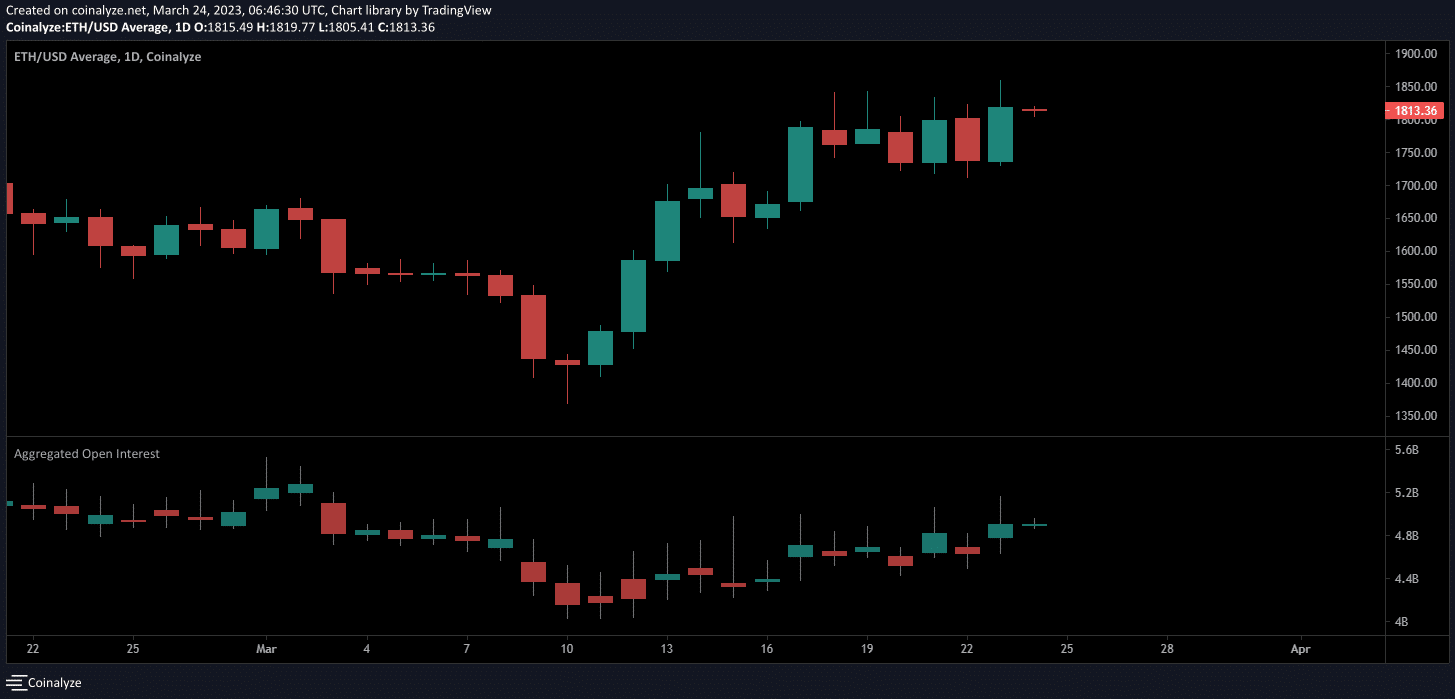

At the time of writing, ETH increased by 3.36% to $1813.97 in the 24-hour period, as per CoinMarketCap. The king of altcoins registered gains of 11% on a month-to-date (MTD) basis, fueled by a broader crypto market recovery.

With the rise in prices, investors’ holdings became profitable. The number of addresses in profit on ETH reached its second consecutive 11-month high as per a Glassnode tweet.

? #Ethereum $ETH Number of Addresses in Profit (7d MA) just reached a 11-month high of 63,933,355.435

Previous 11-month high of 63,912,252.762 was observed on 23 March 2023

View metric:https://t.co/9t2b8JZFT0 pic.twitter.com/CunNLHBJpZ

— glassnode alerts (@glassnodealerts) March 24, 2023

How many are 1,10,100 ETHs worth today?

Additionally, the Open Interest (OI) for ETH rose, complimenting the increase in price, as per Coinalyze. This was a bullish signal as there was a surge in buying activity and money was coming into the market.