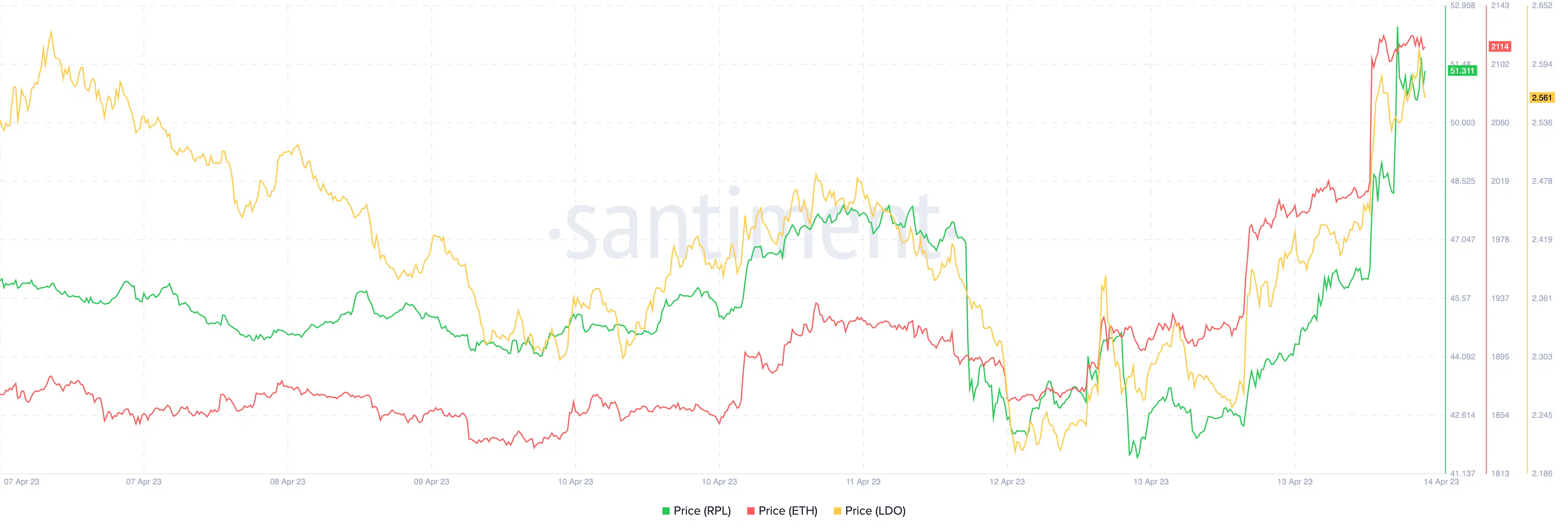

As ETH surged following the Shapella upgrade, here’s how LSD tokens fared

– Ethereum’s Shapella upgrade impacted LSD tokens positively as prices surged.

-Activity on the protocols rises as well, though Lido experienced some minor setbacks.

The highly anticipated Shapella Upgrade took place on 12 April, which generated considerable speculation about the potential impact on the prices of ETH and other tokens in the Liquid Staking Derivatives [LSD] market.

Read Lido’s [LDO] Price Prediction 2023-2024

Many were worried that the impact of this event on ETH and other tokens would be the same as when the Merge happened and prices fell drastically.

However, as time passed, the opposite happened. ETH and other LSD tokens, such as Lido [LDO] and Rocket Pool [RPL], have witnessed improvements in their price over the last few days.

The protocols get affected

There was a positive impact on the protocol’s health as well. For instance, active users on the Lido protocol increased by 11.9% in the last seven days. As a result, the earnings made by the protocol surged by a whopping 278.2% during the same period.

Rocket Pool had the same impact, as the network’s daily active users surged by 30% over the last month.

Some interesting developments for Lido

Even though the impact of the upgrade on Lido was positive, there were other developments that could impact the protocol’s ability to grow.

RockLogic, an infrastructure provider, ran into issues with the Lido protocol on 13 April. It led to the slashing of 11 active validators on the Lido network.

@RockLogicGmbH ran into some issues with @LidoFinance pool's validators, this resulted in the slashing of 11 active validators. Damages will be reimbursed. https://t.co/3hkF9Gla6j

— stefa2k.eth??? (@Stefa2kEth) April 13, 2023

This resulted in a project impact of 20 ETH, which is about 3% of the average daily protocol rewards for Lido users. However, the Lido protocol was swift in resolving the issue and mitigating the impact of the problems.

It remains to be seen whether the problems faced by the Lido Protocol would impact the progress of the LDO token.

Realistic or not, here’s LDO market cap in BTC’s terms

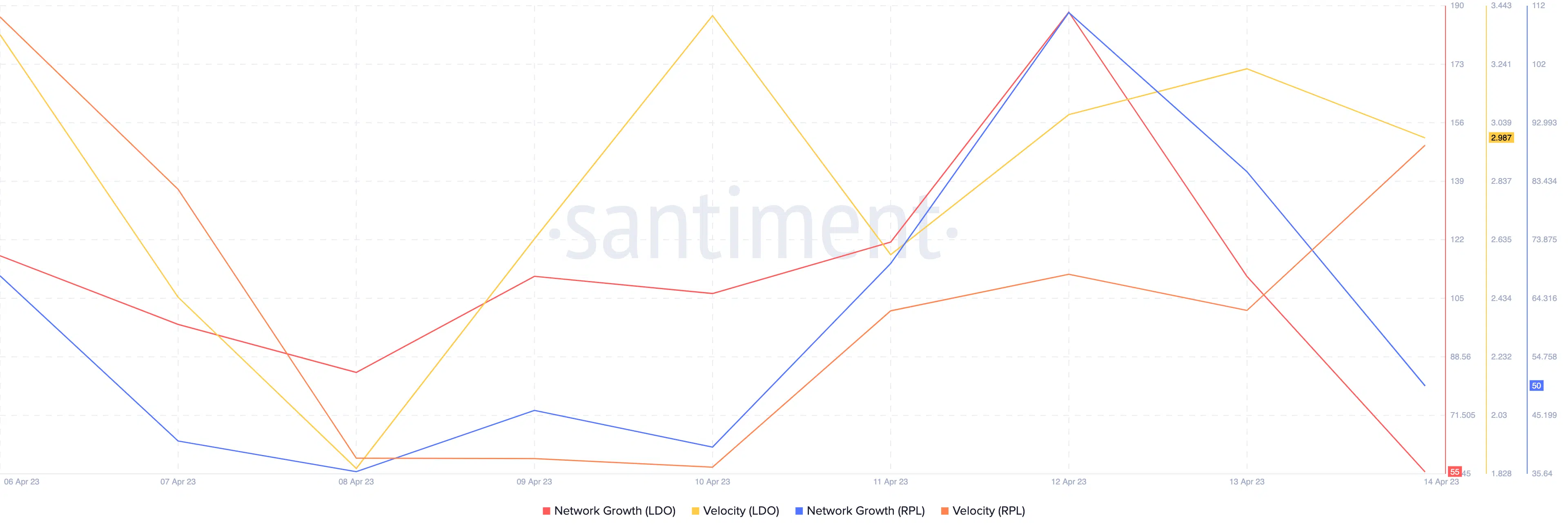

At press time, the LDO tokens’ velocity surged, along with their price. This showed that the frequency with which LDO was being traded rose. However, the network growth of the token showed decline, suggesting that new addresses were not interested in buying the token at press time.

Rocket Pool’s native token RPL saw the same trajectory in terms of network growth and velocity. It needs to be seen whether the correlation between RPL and LDO correlation will continue in the future.