ApeCoin [APE] shrinks below $4.2 – Buyers can bid at these levels

![ApeCoin [APE] shrinks below $4.2 - Buyers can bid at these levels](https://ambcrypto.com/wp-content/uploads/2023/04/image-1200x800-5.png.webp)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- APE was bearish on the 12-hour chart.

- Daily active addresses declined.

ApeCoin [APE] depreciated from $4.6 and breached a key mid-point level of $4.2, flipping the structure to bearish on the 12-hour chart. Since mid-March, the asset has been oscillating between $3.8 and $4.6.

Notably, the price action has been firmly within the upper range in the past few days, reinforcing the overall bullish sentiment in the same period.

Read Apecoin [APE] Price Prediction 2023-24

However, the crypto market has recently experienced increased market choppiness amidst increasing interest rates fears. Notably, Bitcoin [BTC] dropped sharply from $30k, reclaimed it, then retreated to $29k before sliding lower to $28k, at the time of writing.

If macro headwinds persist, APE could drop to lower supports and offer new buying opportunities.

Will the drop extend?

On the 12-hour chart, the RSI was in the lower range, while the stochastic RSI slid into the oversold zone – evidence of increased selling pressure. Although the oversold condition could suggest a likely reversal, a strong recovery can happen if BTC reclaims the $29k and $30k price ranges.

In addition, the OBV (On Balance Volume) dipped – confirming the demand for APE faltered in the past few days.

As such, APE could drop further, especially if BTC fails to reclaim higher price ranges. A close below the channel’s mid-level of $4.2 could set APE to slide to a lower boundary of $4.0 or $3.8.

Buying at the above levels ($4.0 or $3.8) could offer a good risk ratio if APE rebounds and retests the upper boundary of $4.6 or inflicts a bullish breakout.

Buyers could track for a pullback retest or local double-bottom formation on the lower supports to confirm the recovery.

However, a close above the channel’s mid-point of $4.2 will invalidate the above thesis. Such a move could push APE to retest $4.6 without necessarily dropping to the lower supports.

Daily active addresses declined

Is your portfolio green? Check out APE Profit Calculator

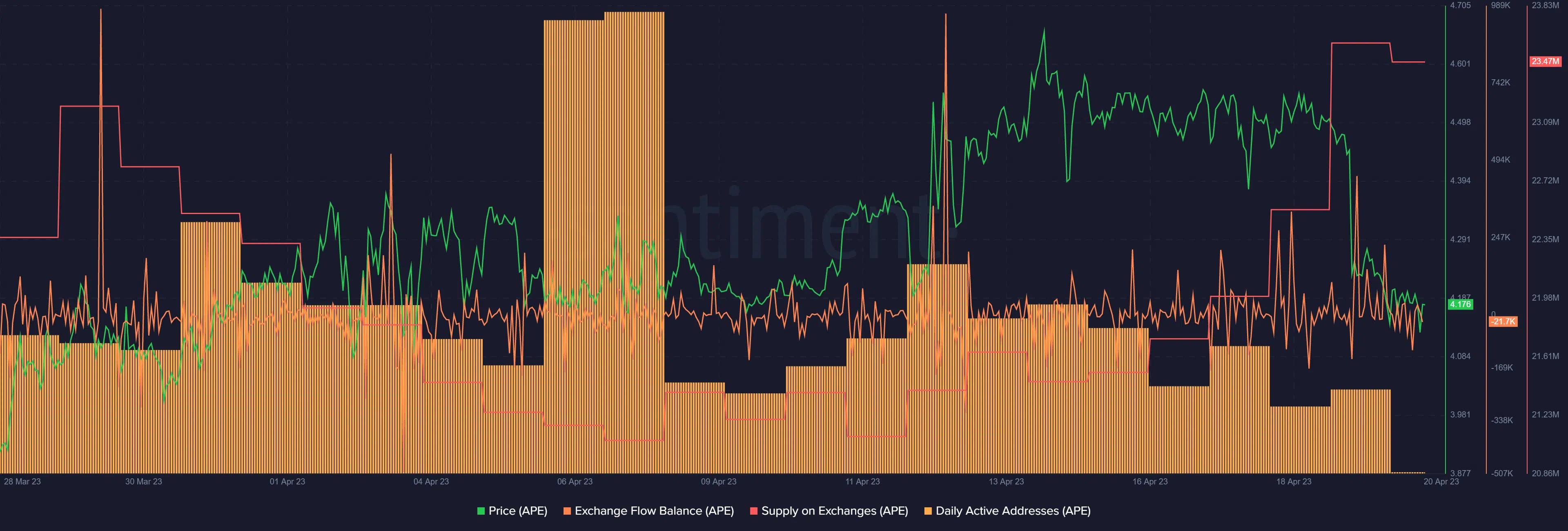

After peaking at 4.8k on 6 April, APE’s daily active addresses declined. At press time, daily active addresses were below 2k. This could favor sellers as limited trading volumes undermines a strong recovery.

However, supply on exchanges dipped at press time, indicating short-term selling pressure eased. Similarly, the exchange flow balance was negative – evidence of short-term accumulation of APE at current discounted prices.

If the accumulation trend continues, APE could recover without dropping to the lower boundary of $3.8, invalidating the above thesis. Investors should track BTC price action for better-optimized trades.