Why DOGE’s 11% pullback can be a result of selling pressure from these holders

- A strong bearish outcome underpinned by higher shorts led to a push below support.

- Dogecoin demonstrates mixed whale activity amid extended sell pressure.

Traders watching Dogecoin’s price action in the last few days may have expected a breakout or breakdown sometime this week. That outcome is finally here and it turns out to be a bearish outcome.

Is your portfolio green? Check out the Dogecoin Profit Calculator

The breakout/breakdown expectation was because the price has been pushing into the tight squeeze zone of its wedge pattern. DOGE maintained an overall bullish bias since the second week of March, eventually forming an ascending support line. However, strong sell pressure in the last two days has eventually broken through the support.

An 11% pullback from its current weekly high of $0.095 ensured that the price pierced through the support line. It traded at $0.083 at press time with prospects of the next support level near the $0.080 level where it demonstrated short-term support.

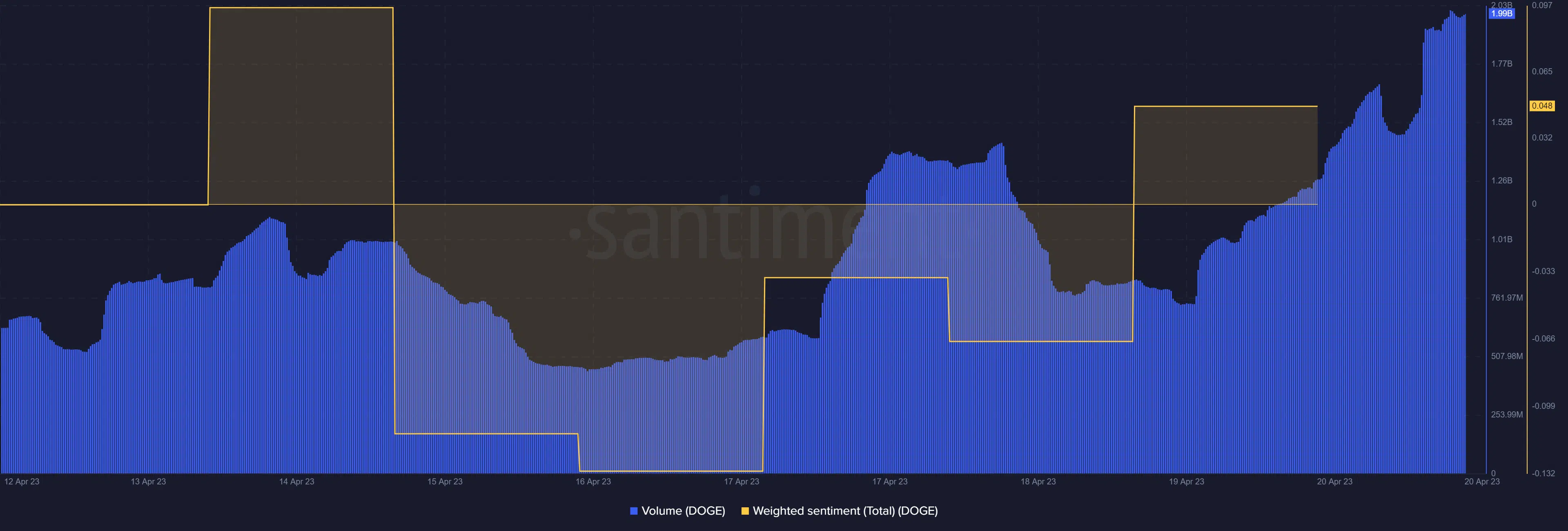

Dogecoin’s MFI confirmed that liquidity had been flowing out of the cryptocurrency so far this week. As such, the liquidity crunch made it hard to sustain the bullish trajectory.

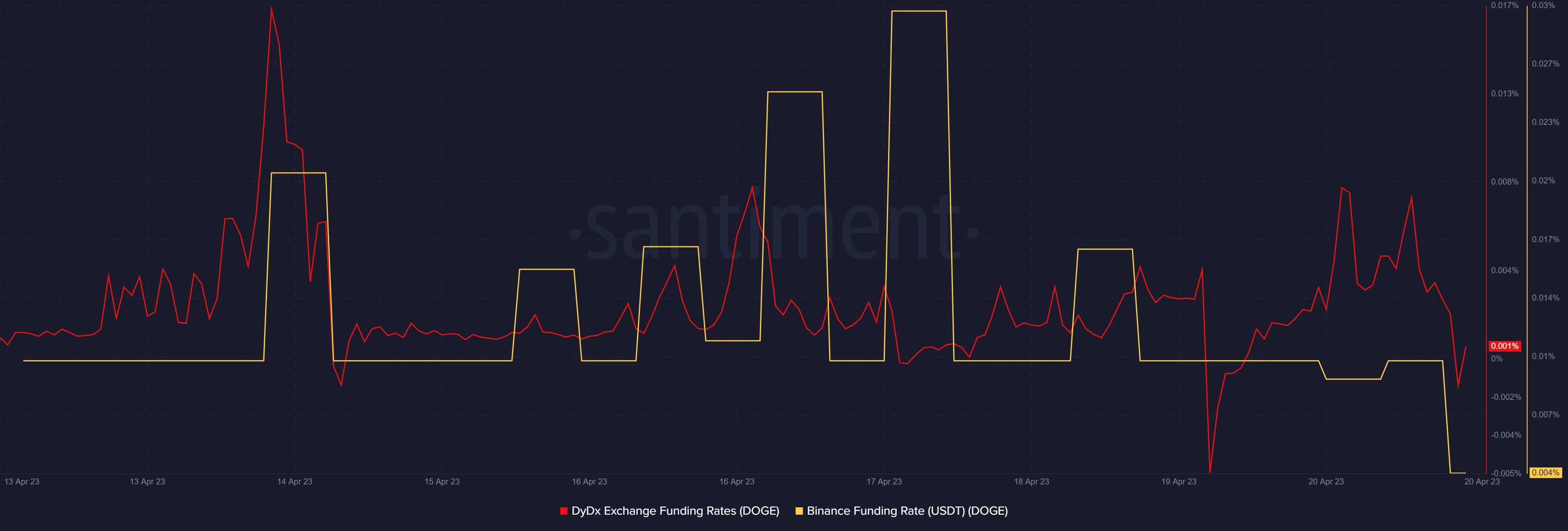

Both the Binance and DYDX funding rates fell sharply in the last 24 hours, suggesting that the derivatives market also favored the bears as the weekend approaches closer.

An assessment of the short versus long ratio reveals that shorts were higher at roughly $1.35 billion. This represented 51% compared to $ 1.26 billion (48.3%) in long positions.

Are the shorts in danger of liquidation?

An assessment of the prevailing demand conditions at press time revealed that the investor consensus was still leaning towards the bullish side. In addition, DOGE’s on-chain volume witnessed some growth, hence the higher volatility.

So is there a chance that these observations may lead to a healthy bounce back? Well, if a bounceback were to happen, there would likely be a sizable liquidation that might force more investors to buy.

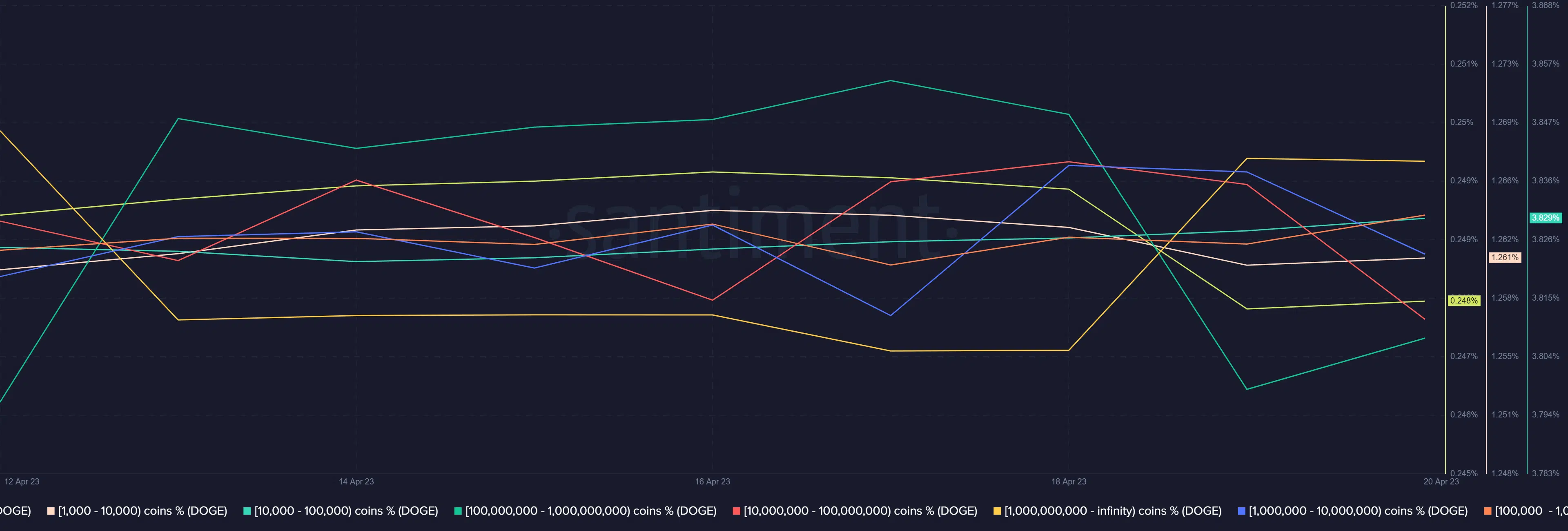

Such an outcome would require significant demand from whales. So, here’s a look at what whales have been doing according to the supply distribution metric.

Realistic or not, here’s Dogecoin’s market cap in BTC’s terms

It turns out that whale activity was a bit of a mixed bag in the last two days. Most of the selling pressure in the last 24 hours came from addresses in the 1 million to 100 million DOGE range. This category of whales controlled roughly 18% of Dogecoin’s current circulating supply.

Addresses holding over 100 million DOGE have been buying during the same period and this category controls over 19% of the circulating supply. The supply distribution data means it is too close to call. Nevertheless, a pivot in the weekend might be on the cards if whale accumulation intensifies.