Trader Joe takes steps to boost its ecosystem, will JOE reap the benefits

- The annual inflation rate of JOE dropped to 0.26%.

- The rewards paid to users in JOE tokens rose by 47% in the last seven days.

Decentralized exchange (DEX) Trader Joe [JOE] saw a considerable increase in trading activity over the past week, moving up to fourth place on DeFiLlama’s ranking of the top DEXs by volume.

Read Trader Joe’s [JOE] Price Prediction 2023-2024

Trades worth nearly $590 million were settled on the platform in the last seven days. This marked an increase of almost 50% from the previous weekly period.

The steady rise in volume further enhanced the appeal of the native token of the ecosystem as it accumulated monthly gains of over 48% at press time, data from CoinMarketCap revealed.

Moreover, Trader Joe also shared a crucial update which could further boost JOE’s price soon.

JOE to become scarce?

Trader Joe announced that the daily JOE emissions, or the rewards sent to liquidity providers (LPs), dropped from 4,289 to 2,486 as of this writing. This marked a reduction of 42% in the number of JOE tokens entering the daily circulating supply.

Trader Joe further added that the current annual inflation rate of JOE has dropped to 0.26%. This was a significant step towards making the token deflationary.

As part of the current setup, LPs earn additional incentives apart from the portion of the trading fees. The LPs who contribute to liquidity pools receive LP tokens, which in turn, are deposited to earn rewards in the form of JOE tokens.

It is to be noted that the maximum supply of JOE is capped at 500 million, out of which 336.43 million tokens were in circulation at press time, according to CoinMarketCap.

Driven by the concept of scarcity economics, crypto projects have been making all efforts to make their native tokens deflationary in order to achieve higher prices in the future.

Emissions Update

Daily $JOE emissions sent to Liquidity Providers reduced by 42%. From 4,289 to 2,486 (Approx $1.5k per day).

Trader Joe is building an ultrasound, long-term focused sustainable ecosystem ?

Current annual inflation of $JOE: +0.26%

Note: This does not include… pic.twitter.com/6XMflZsOKl— Trader Joe??? | ?? (@traderjoe_xyz) April 20, 2023

Token rewards surge

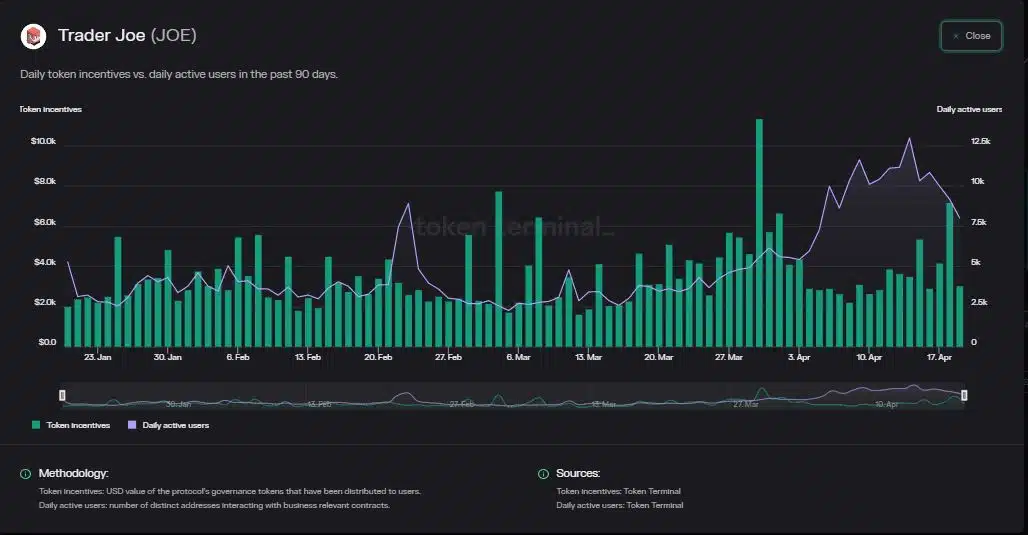

The value of JOE tokens awarded to users on Trader Joe surged since the start of April. Data from Token Terminal revealed that token incentives increased by 47% in the last seven days.

However, after a sharp upward trajectory which saw daily active users on the DEX reach their all-time high on 14 April, the momentum reversed.

How much are 1,10,100 JOEs worth today?

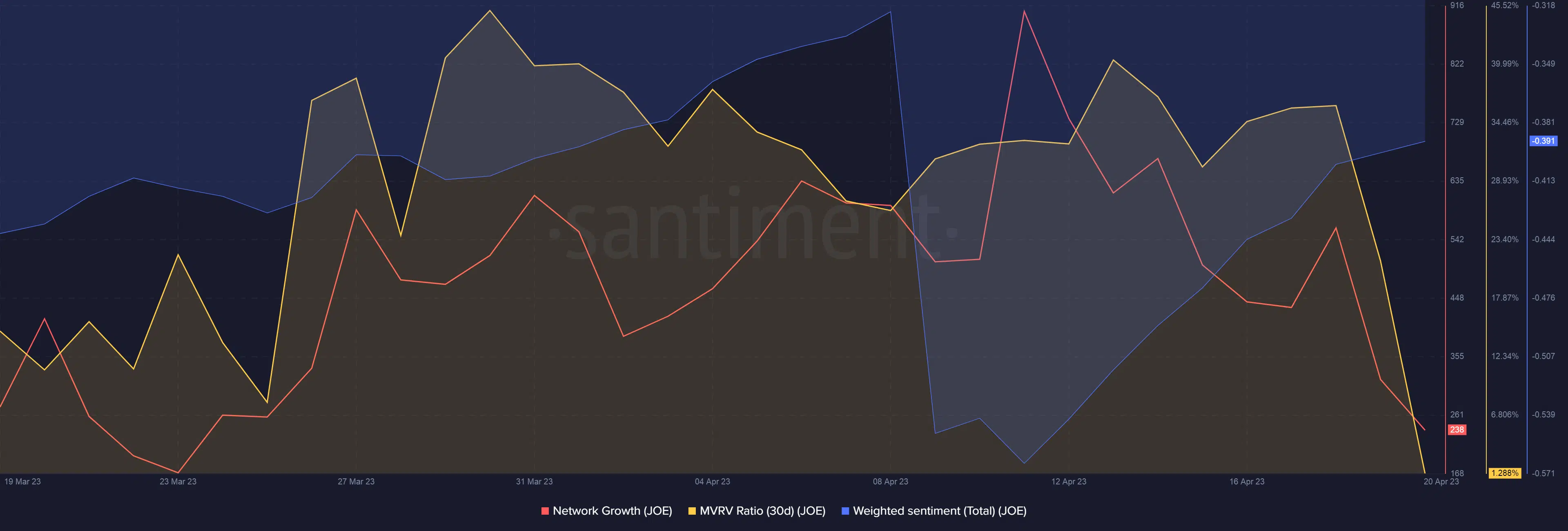

The value of JOE has receded over the last week, shedding over 13% to trade at $0.5763 at press time. Network growth went downhill since mid-April, highlighting the lack of interest among new addresses.

A reason for this could be the sharp drop in MVRV Ratio, indicating a decline in network profitability. The weighted sentiment also trended in the negative territory, lending credence to declining investors’ optimism in JOE.