BTC unable to stay afloat above $30k: How low can the dip go

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- The market structure flipped to bearish and buyers weren’t safe in the near-term.

- The next level to watch out for was the $27,750 support that was respected in early April.

Bitcoin [BTC] climbed past $30k and the bulls kept the prices there for close to a week, but the selling pressure was too high toward the end. The buyers succumbed, and several short-term significant support levels were breached.

Read Bitcoin’s [BTC] Price Prediction 2023-24

The flip in structure to bearish meant more losses can follow. The USDT [Tether] Dominance rose, showing that investors were fleeing to the safety of stablecoins. If the selling pressure continued, it was likely that BTC would fall to the next higher timeframe support at $25.2k.

Key support levels saw little reaction from buyers, signaling bullish exhaustion

The H4 bullish market structure was broken on Monday 17 April when BTC fell beneath the previous higher low at $29,660. The drop to $29,104 was followed by the formation of a lower high at $30.4k. During the past few days, the RSI also showed bearish momentum. It was at 25 at the time of writing to denote extreme bearishness.

The $29.6k and $28.7k were two of levels of former support that can be expected to serve as resistance in the near-term. The $27.7k and $26.8k are support levels to watch out for. It was possible the prices could bounce from there, but the trend was downward and short-term traders can look for opportunities to sell BTC.

A retest of $27.7k as resistance could offer such an opportunity. The CMF has been below -0.05 over the past couple of days to show a large capital flow out of the market and highlighted strong selling pressure.

Speculators continued to bid defiantly but have faced losses

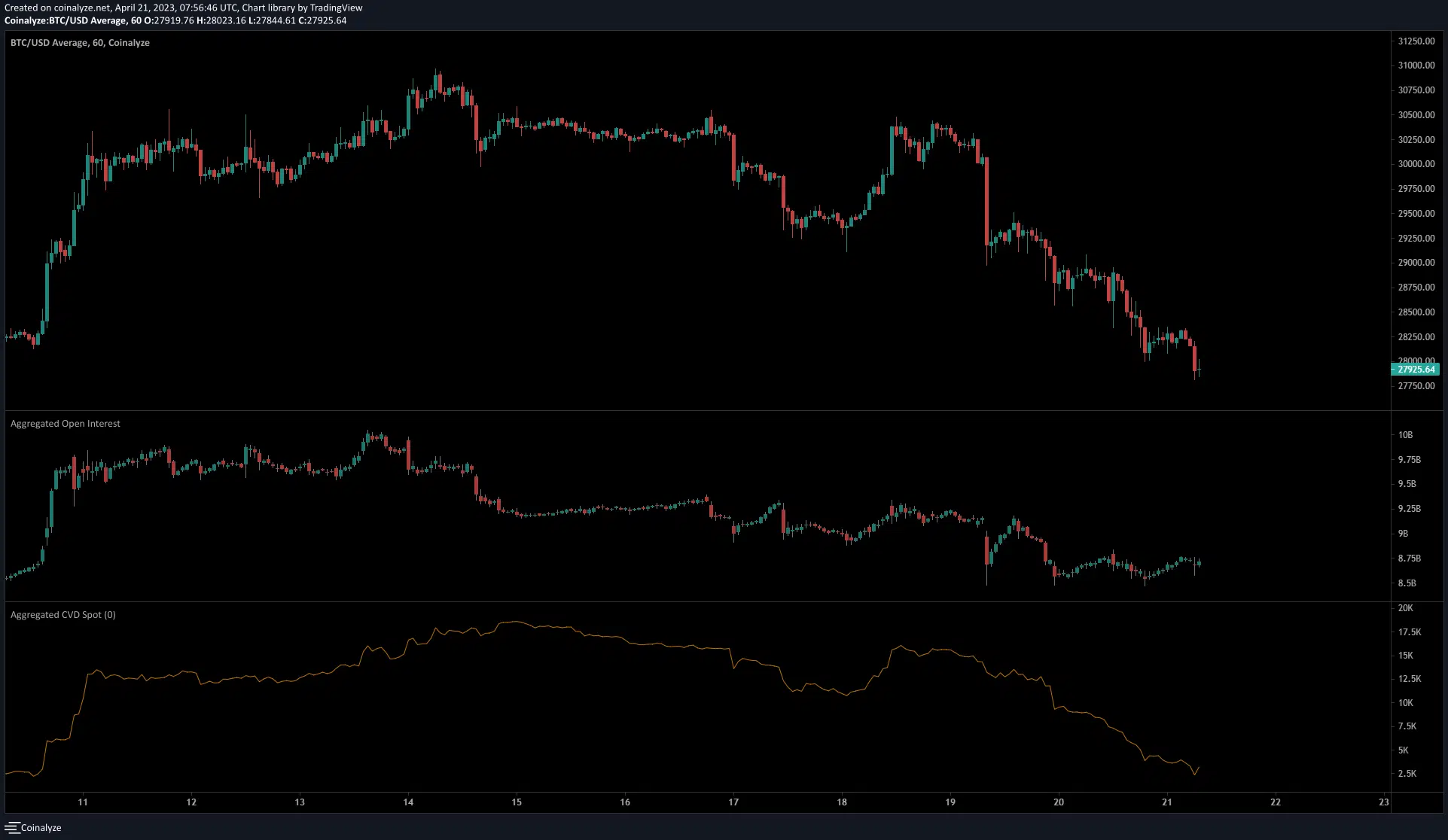

Source: Coinalyze

Coinglass’ data showed that $45.6 million worth of long positions were liquidated on 20 April. But only $9.9 million worth of short positions met the same fate, which showed bulls took a greater hit.

Is your portfolio green? Check the Bitcoin Profit Calculator

The Open Interest data from Coinalyze on the one-hour chart is presented above. It showed speculators tried to enter the market when BTC showed signs of a bounce.

They were quickly and repeatedly shot down as the market proceeded lower over the past 24 hours. The spot CVD also remained in a downtrend to underline the intense selling pressure behind BTC.