After an exciting Q1, here’s why AAVE’s Q2 could leave investors feeling sour

- A major highlight for Aave in Q1 2023 was the launch of its v3 on Ethereum

- AAVE was down by 16% over the last week and selling pressure was dominant

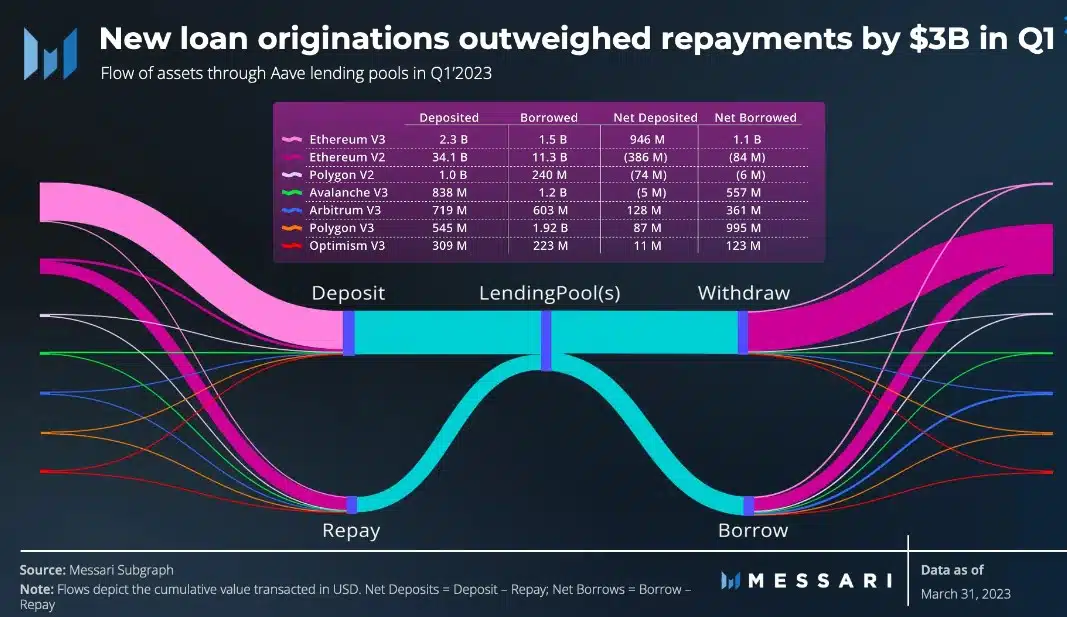

On 25 April, market intelligence platform Messari published a report regarding Aave’s overall performance in Q1 2023. Talking about the protocol’s state, the most notable update in Q1 was the launch of Aave v3 on Ethereum [ETH].

After the launch, the new market exceeded $1 billion in value deposited and closed the quarter with $350 million in outstanding loans.

.@PortKey256's State of @aaveaave Q1 23' report ⬇️

+Value supplied on Aave increased 40% QoQ

+Launched V3 market on @Ethereum & @arbitrum — Arbitrum deployment saw 305% growth in outstanding loans

+V3 Governance & GHO Initial Parameters releasedFREE report ? in next tweet? pic.twitter.com/2ZRqvTgslp

— Messari (@MessariCrypto) April 24, 2023

Realistic or not, here’s AAVE’s market cap in BTC terms

AAVE’s Q1 performance in a nutshell

In addition to the aforementioned information, the asset flows for the Arbitrum deployment significantly increased. This led to a 305% increase in outstanding loans from $21 million to $83 million.

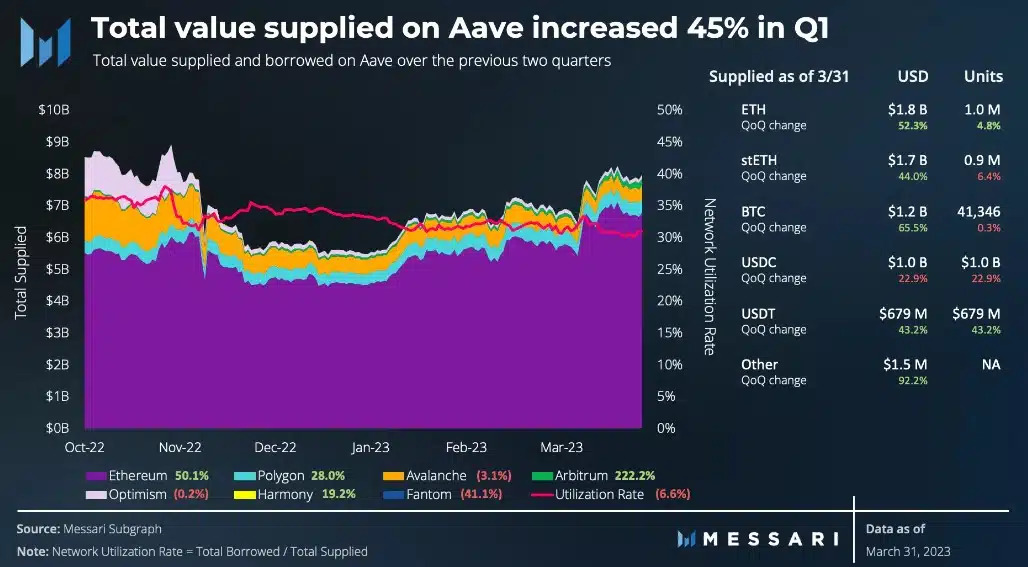

The report also mentioned the protocol’s performance in terms of network value. The value supplied on Aave increased by 45% in Q1.

This development happened while regulatory pressures increased. Furthermore, with their market share of deposits rising from 42% to 50%, ETH and its staking derivatives continued to be the main source of collateral on Aave.

Speaking of revenue, Aave’s interest revenues in Q1 were on track to be within 1% of Q4 earnings. However, the scenario changed after the USDC depegging episode. Following three days of increased activity, the DAO earned $305,000 in interest income.

Not everything was in Aave’s favor

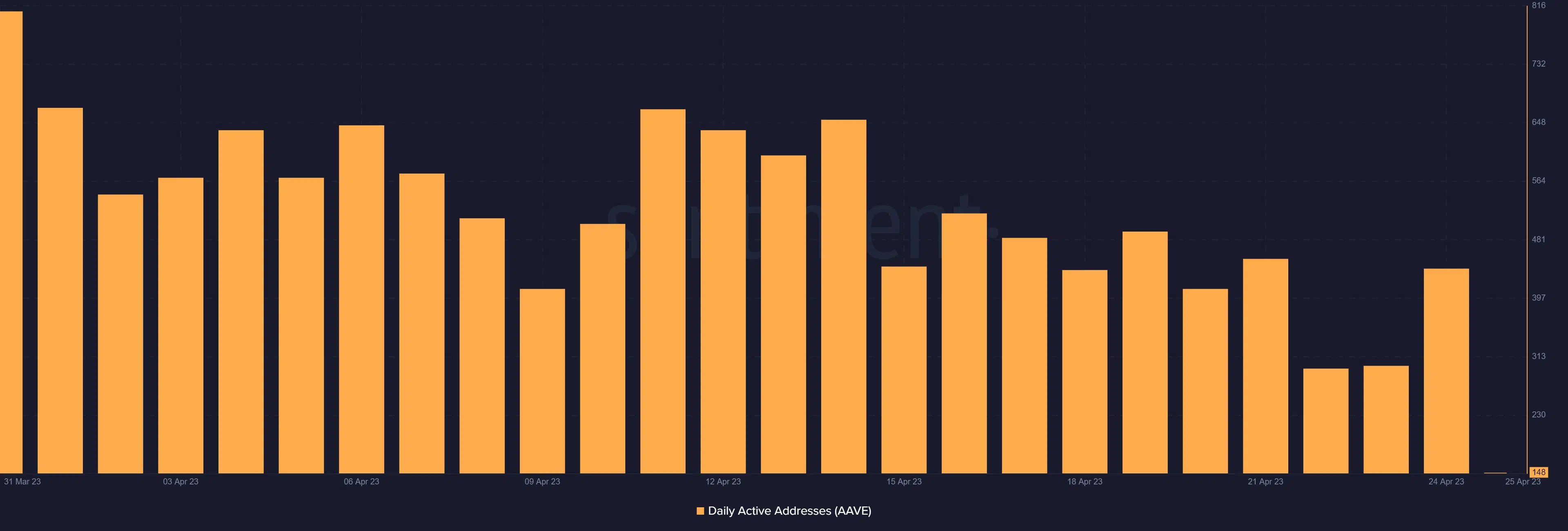

At the time of writing, Aave couldn’t be considered at its best. This was because the network’s usage registered a decline in the last quarter. For instance, the protocol’s daily active users declined by 34% in Q1, which looked concerning.

The most significant reductions occurred on Optimism V3 (59%) and Polygon V3 (50%). It was also interesting to note that a similar trend also remained true in Q2. Data from Santiment revealed that Aave’s daily active addresses have been declining since the beginning of April 2023.

AAVE’s state in Q2 2023

Upon shifting the focus from Q1 to Q2, it could be seen that the initial weeks of the new quarter haven’t been kind to the protocol. This was suggested by several on-chain metrics.

AAVE’s weighted sentiment remained pretty low, suggesting that negative sentiment was dominant in the market. Furthermore, its Market Value to Realized Value (MVRV) Ratio also declined sharply, thanks to its price action.

Read AAVE’s Price Prediction 2023-24

Is investor interest diminishing?

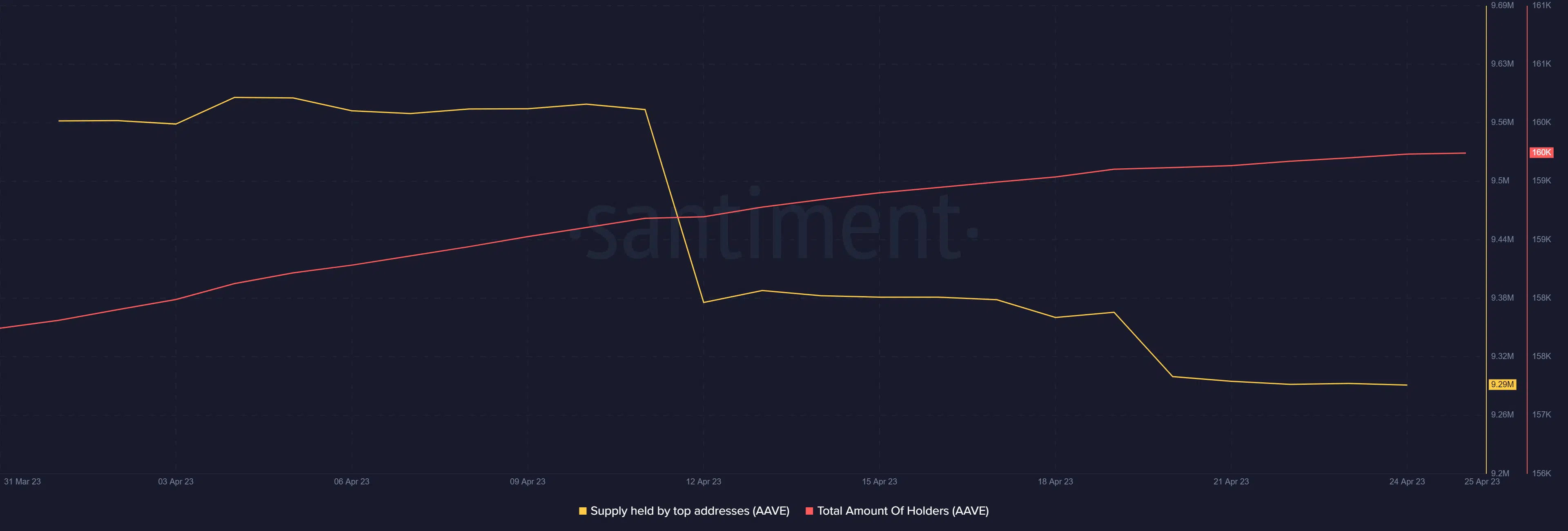

The supply held by top addresses declined considerably over the last few days. This looked concerning as it indicated that the whales lowered their trust in AAVE. Additionally, net deposits on exchanges were high compared to the seven-day average. This suggested a rise in the overall selling pressure.

On the other hand, the total amount of token holders increased. At press time, the token’s price had declined by over 16% over the last week and was trading at $69.04 with a market capitalization of over $991 million.