Algorand: Are sellers subdued as ALGO retests support level $0.1805?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- ALGO was bearish on the six-hour chart

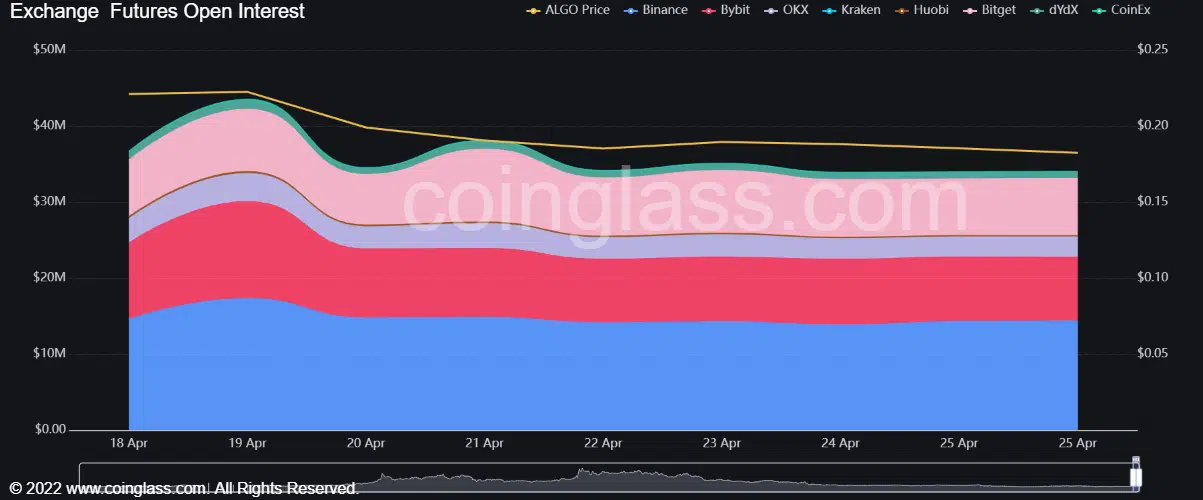

- Open interest rate flattened; funding rates were positive

Algorand [ALGO] dropped to an attractive level for trend and swing players. The asset retested its range’s lower boundary of $0.1805, and bulls were on-site at press time, as demonstrated by the long candlestick wicks.

However, the selling wave still looms, and coupled with next week’s FOMC announcement; any hawkish stance could undermine bulls.

Read Algorand’s [ALGO] Price Prediction 2023-24

Which way for ALGO – a rebound or a bearish breakout?

Since mid-March, ALGO oscillated between $0.1805 – $0.2347, chalking a parallel channel pattern. At press time, price action retested the lower boundary of $0.1805. The level also lined up with March swing lows.

The downsloping 50-EMA and 200-MA indicated that sellers had the upper hand at the time of writing. In addition, the Relative Strength Index (RSI) was in the oversold zone, reiterating the seller’s leverage.

Ergo, the $0.1805 support could crack, setting the ALGO/USDT pair into an extended downtrend which could ease at December swing lows of $0.1604. If that happens, shorting ALGO if it closes below $0.1805 could offer a good risk ratio.

However, the clearance of the $0.1900 hurdle could show buyers gaining traction and will invalidate the above thesis. The move could see the pair rally towards the channel’s mid-range of $0.2076 and 50-EMA ($0.2003). A move past 200-MA could set the pair to zoom and retest the upper range boundary of $0.2347 before facing strong resistance.

Open interest rate flattened; funding rates were positive

How much is 1,10,100 ALGOs worth today?

ALGO’s funding rates in the past few days remained relatively positive – stable demand indicating a bullish sentiment in the derivatives market.

However, the open interest (OI) rates fluctuated in the same period. At press time, OI was flat, suggesting a likely pivot to the upside or downside. If OI rises as ALGO hits $0.20, it will signal a bullish sentiment and a possible recovery.

However, a dip in OI and the price will signal a likely bearish breakout; thus, investors can track this front alongside Bitcoin’s [BTC] price action.