Bitcoin: Exploring the curious case of dormant BTC as ancient supply worth billions awaits

- Glassnode’s data showed that 91.7% of Bitcoin’s ancient supply was dormant or lost.

- Bitcoin’s current NetFlow trend revealed a higher inflow of BTC into exchanges, indicating more sales than withdrawals.

The rollercoaster of Bitcoin’s [BTC] value has been nothing short of exhilarating and nerve-wracking for investors. But here’s a surprising fact: despite all the ups and downs, some portions of the BTC supply have remained inactive, unfazed by the market’s turbulence. Recent data has shed light on this curious phenomenon.

– Read Bitcoin (BTC) Price Prediction 2023-24

Ancient Bitcoin

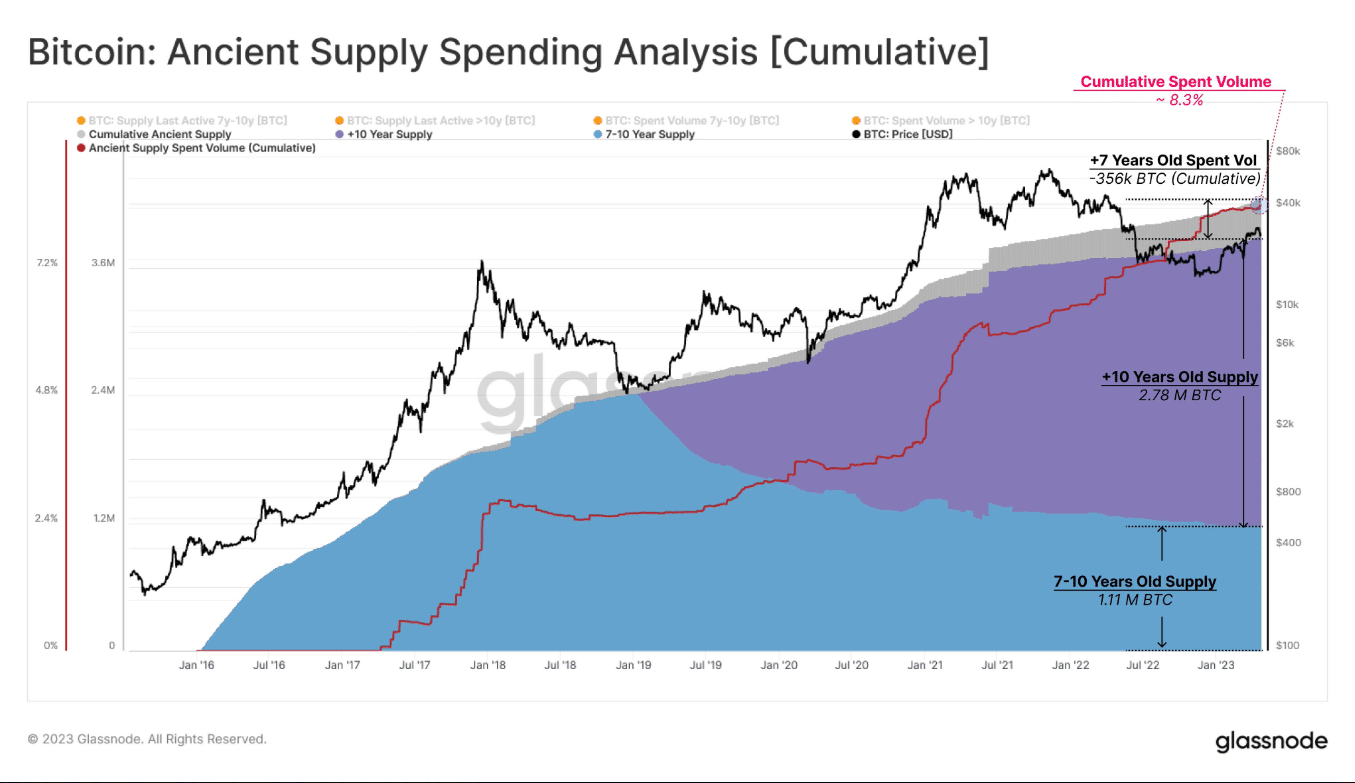

Glassnode’s data from 27 April uncovered a fascinating fact about Bitcoin’s circulation – some portions of the cryptocurrency remained untouched for a staggering seven years or more.

The Ancient Supply metric from Glassnode has revealed that out of the 19.3 million coins currently in circulation, only 4.25 million have achieved the coveted status of Ancient Supply.

Even more intriguing was that only 8.3% of the ancient coins (equivalent to 356K) were spent since their inception, leaving a whopping 91.7% (roughly 3.9 million) dormant or lost.

At the current price range of Bitcoin, the value of these dormant or lost coins amounts to a whopping $113.1 billion.

CoinMarketCap’s data showed that the current market cap of BTC was around $566 billion. This means that if the current ancient supply were to be activated, it could substantially impact both volume and price, potentially altering Bitcoin’s netflow.

Current Bitcoin Netflow status

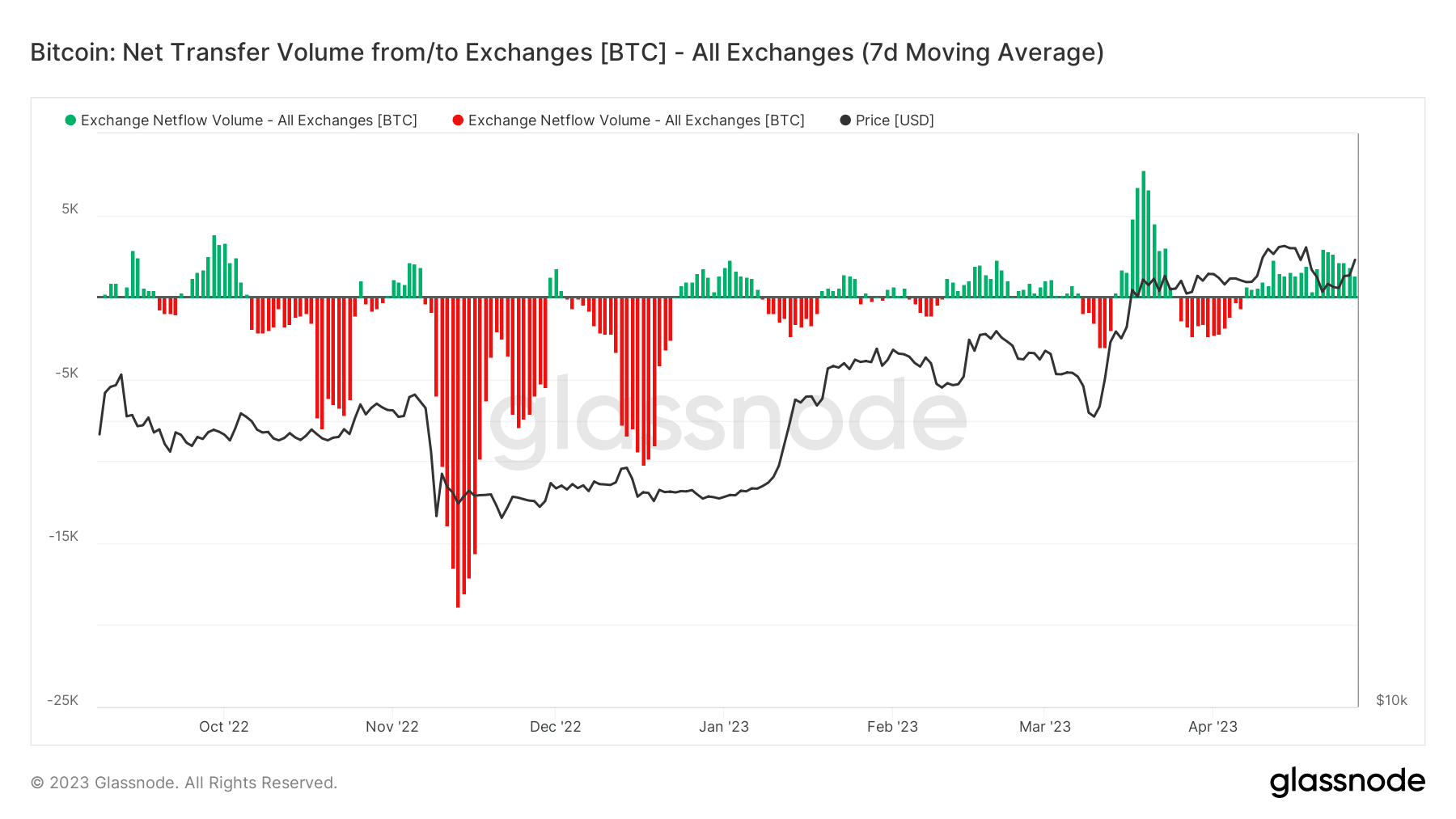

Glassnode’s netflow data revealed an interesting trend in the movement of Bitcoin. The chart showed that there was currently a higher number of BTCs entering exchanges than leaving them.

In other words, the inflow of BTC into exchanges was currently dominant, suggesting more sales than withdrawals.

As of the time of writing, the netflow data showed a substantial inflow of over 1,300 BTCs, indicating that there was still significant selling pressure in the market.

Current price trend

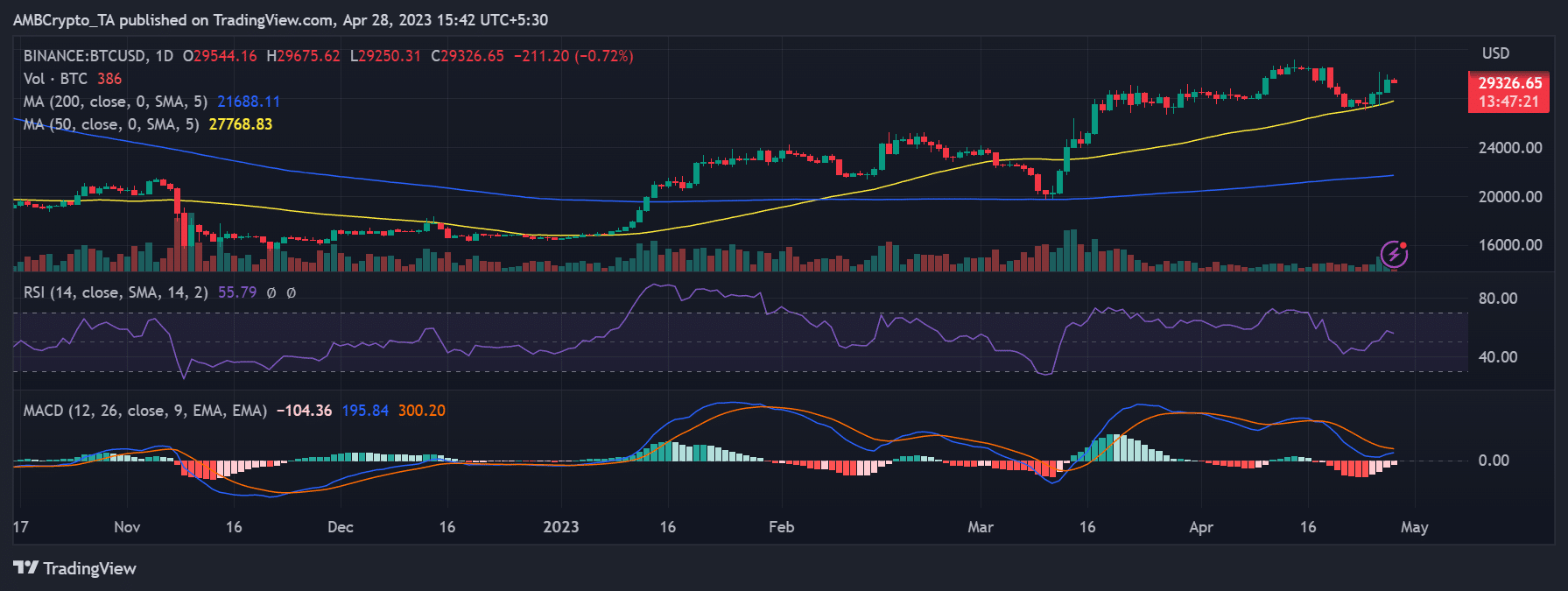

Bitcoin made a small but significant recovery on April 27. It climbed back to the $29,000 price range, closing the day’s trading at approximately $29,500. The closing price represented a 3.62% gain in value.

While it has since experienced a slight pullback, BTC still hovered in the $29,000 price range.

Interestingly, despite the decline, Bitcoin’s short Moving Average (yellow line) continued to provide strong support around the $27,000 price region.

However, it was still struggling to break through the psychological barrier of the $30,000 price range. This range has proven to be a significant resistance level in recent months.

– Is your portfolio green? Check out the Bitcoin Profit Calculator

The Ancient Supply of Bitcoin may be dormant, but it is unclear if this will change the cryptocurrency’s price breaks through the predicted $100,000 mark.

If the prices were to reach this level, holders of Ancient Supply coins could be incentivized to sell their holdings and realize significant gains, which would have a notable impact on the market.