Bitcoin [BTC]: This report predicts massive rally – is the king coin primed for $100k

![Bitcoin [BTC]: This report predicts massive rally - is the king coin primed for $100k](https://ambcrypto.com/wp-content/uploads/2023/04/po-2023-04-25T072649.423.png.webp)

- The research lead of a reputable financial institution said BTC would hit the milestone by 2024.

- On-chain data suggests an undervalued state as another analyst expects the coin to thrive by the next halving.

Bitcoin [BTC] has been on a wild ride over the past few months, hitting yearly highs and then plummeting again. However, a recent prediction by Standard Chartered has suggested that the cryptocurrency could be poised for a massive rally by the end of the coming year, with some analysts predicting that BTC could reach $100,000.

Is your portfolio green? Check the Bitcoin Profit Calculator

BTC: Already started the journey to new highs

While this may seem like a lofty goal, the digital asset arm of the firm outlined several factors at play that could drive Bitcoin’s price to new heights.

According to the report shared by Reuters, the multinational financial institution noted that the banking sector turbulence could have a positive effect on Bitcoin mining activities.

Additionally, Geoff Kendrick, head of digital assets research at the firm, pointed out that the U.S. Federal Reserves ending its rate hike may have confirmed the end of the crypto winter. Kendrick, in backing his position, mentioned:

“While sources of uncertainty remain, we think the pathway to the USD 100,000 level is becoming clearer”

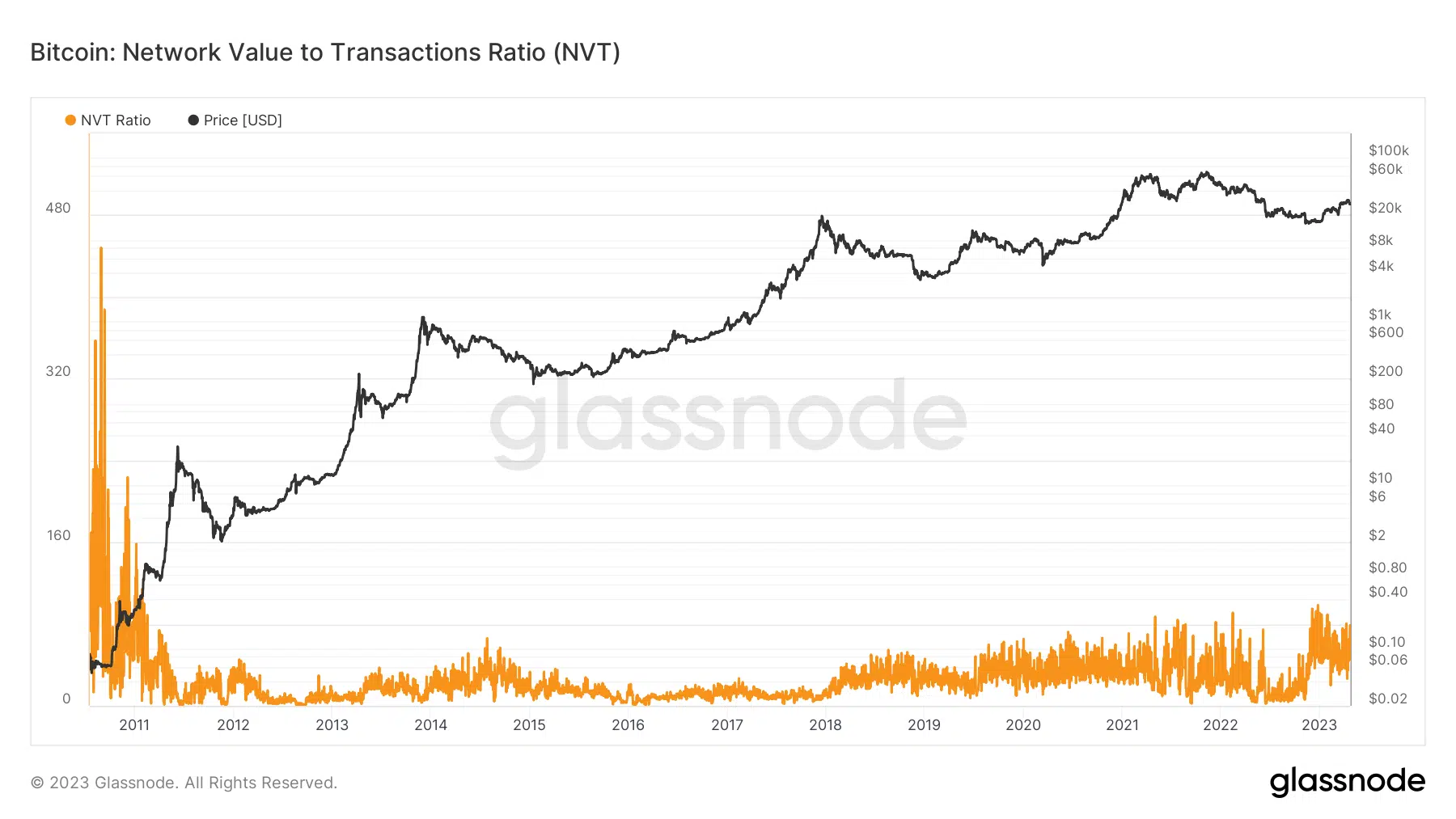

On looking at the Network Value to Transactions (NVT) ratio, Glassnode showed that it had exited the bottom to a relatively high level. The NVT ratio is the ratio of the market cap to the transferred on-chain volume, which indicates sentiment and fair value.

When this metric is high, it means network value had outpaced network activity, indicating a bearish sentiment. But when it is low, it means that investor sentiment is bullish. At the press time state of the metric, BTC could be considered undervalued.

Is halving the game changer?

On 23 April, a Bloomberg report mentioned that the Bitcoin halving was paramount to the recovery of the asset. When Bitcoin undergoes a halving, it means that miners’ rewards have been cut in half. And historically, this sets the precedent for a bull market.

Jamie Douglas Coutts, an Intelligence analyst at Bloomberg, opined that BTC could be valued at $50,000 around April 2024 after the event.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

Noting that Bitcoin was already in preparation mode and agreeing with some of Kendrick’s reasons, Coutts said,

“Bitcoin cycles bottom around 12-18 months prior to the halving and this cycle structure looks similar to the past ones, albeit many things have changed — while the network is vastly stronger, Bitcoin has never endured a prolonged severe economic contraction.”

Meanwhile, Bitcoin’s liveliness had decreased to 0.60 at press time. This metric increases when long-term holders decide to liquidate their positions. But since it was falling from its peak, it implied that these devoted sets were willing to HODL.

For the time being, several analysts expect BTC to continue in its correction stage.