Assessing the state of centralized exchanges as they record sharp dip in trading volumes

- The drop in overall CEX trading volume was driven by behemoths like Binance and Coinbase.

- Opposed to the conventional idea, users didn’t shift to DEXs.

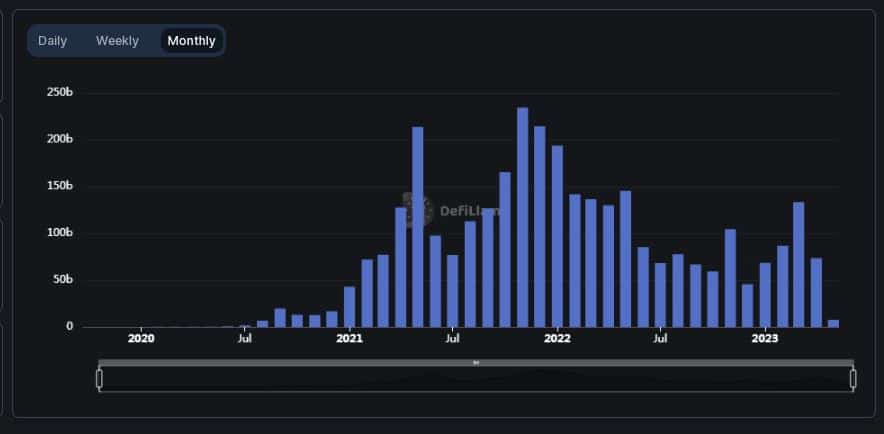

After three consecutive months of growth, trading volumes on centralized crypto exchanges (CEX) fell sharply in April, according to market data provider Kaiko. Infact, April witnessed the lowest monthly volume so far in 2023. The volumes nearly halved from March, which were the highest in 2023.

Kaiko added that April’s decline reversed the gains made in March during which pre-FTX levels were attained. However, it added that the overall volume remained considerably higher than the pre-2020 bull run era.

Trade volumes on #CEXs declined in April after rising for three consecutive months and surpassing pre-FTX levels in March.

Overall, however, the crypto market remains significantly larger than it was before the 2020 bull run.#crypto #TradeVolume #liquidity #CEX pic.twitter.com/cmftFD3Qya

— Kaiko (@KaikoData) May 3, 2023

Behemoths falter

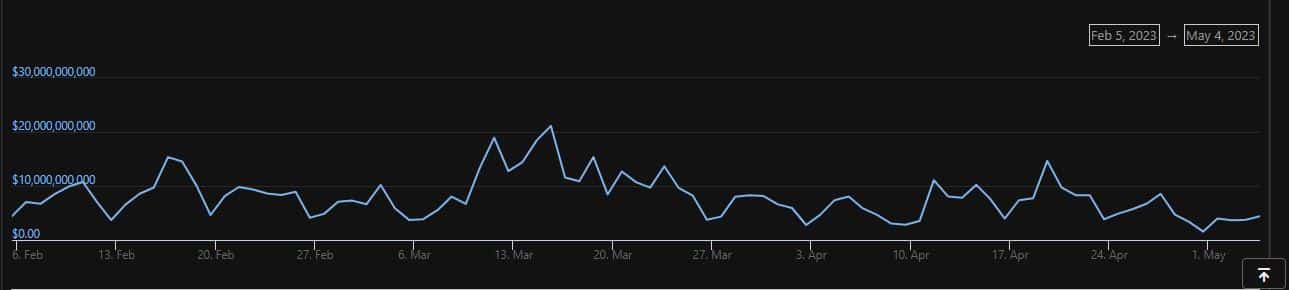

The drop in overall CEX trading volume was led by behemoths like Binance and Coinbase. Data from CoinGecko revealed that daily volume on Binance, the world’s largest crypto exchange, dipped significantly in April after the highs in mid-March.

This decrease was primarily due to Binance halting its no-fee trading program on 22 March. As per an earlier report by Kaiko, zero-fee trade volume made up the bulk of the total volume on Binance, nearly 66%, until mid-March 2023.

Moreover, U.S. based exchanges also witnessed steady drop in trading volumes. The largest exchange in the U.S., Coinbase, registered volumes worth $1.1 billion over the last 24 hours, climbing down from the peak of over $3 billion in mid-March.

At this stage, it is pertinent to recall that Bitcoin’s [BTC] reserves at U.S.-based exchanges fell sharply since the beginning of 2023. Increasing scrutiny by U.S. regulators prompted investors to explore offshore trading platforms. This could explain the dwindling activity on CEXs.

Are DEXs benefiting?

As per conventional belief in the crypto space, declining activity on CEXs is seen as a result of investors’ preference for self-custody and switch to decentralized exchanges (DEXs), something which was evident following FTX collapse.

However, the current trend failed to support this narrative. This was because monthly trading volume on DEXs plunged 44% in April, as per data from DeFiLlama.

Negative sentiment pervades

The overall market cap of the crypto market plummeted from $1.28 trillion in mid-April to $1.19 trillion at the time of writing, per data from CoinMarketCap.

Additionally, a recent report revealed that digital asset investment products recorded second straight week of net outflows. This indicated that the drop in CEX volume was more closely tied to the ongoing market correction than other factors.