Did BNB’s GameFi growth help it outshine Ethereum and Solana

- In April, BNB was the blockchain with the highest number of active addresses.

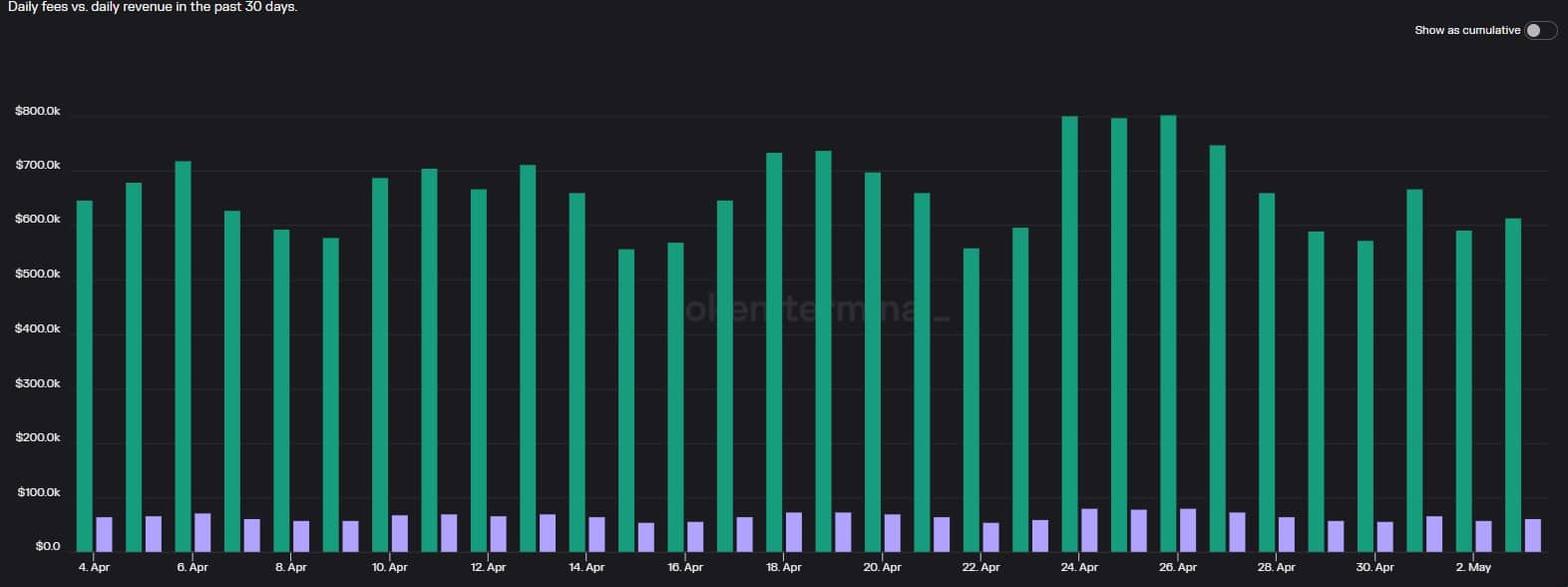

- Over the last 30 days, the blockchain’s fees and revenue remained pretty stable.

BNB Chain [BNB] outperformed other cryptos, including Ethereum [ETH] and Solana [SOL] by a huge margin last month.

Nansen’s tweet revealed that BNB was the blockchain with the most active addresses in April. As per the tweet, BNB had nearly 11 million active users, while SOL and ETH had 5.1 million and 4.9 million, respectively.

Which chains had the most on-chain active addresses in April & how did they compare to March?

BNB Chain: 10.9M (-11%)

Solana: 5.1M (-12%)

Ethereum: 4.9M (-7.9%)

Polygon: 4.2M (+6%)

Arbitrum: 2.4M (+7.8%)And what were these addresses doing?

Let's take a look on-chain… pic.twitter.com/mjrBPgbmif

— Nansen ? (@nansen_ai) May 3, 2023

Is your portfolio green? Check the BNB Profit Calculator

Over the last 30 days, the blockchain’s fees and revenue have also remained pretty stable. Interestingly, BNB’s GameFi ecosystem made a considerable contribution to this performance last month.

BNB GameFi’s role can’t be ignored

Meanwhile, BNB recently posted a tweet that pointed out an interesting event. The tweet mentioned that 20 gaming dApps on BNB Chain account for 9.17% of the average daily transactions on BNB Chain.

Did you know 20 gaming dApps on BNB Chain account for 9.17% of the average daily transactions on BNB Chain? ??

Find out more with 10 interesting facts on the state of gaming dApps on BNB Chain. https://t.co/rrEkKtLupO

— BNB Chain (@BNBCHAIN) May 4, 2023

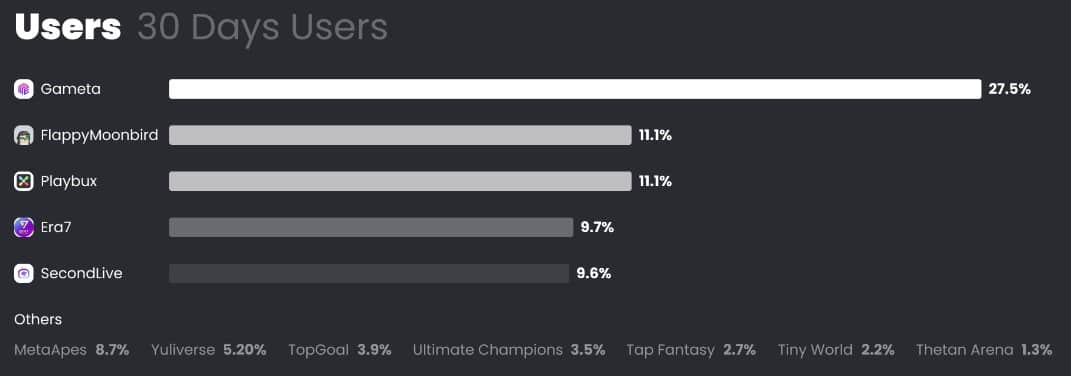

Furthermore, the gaming dApps also contributed to BNB’s increasing active addresses. Gameta recorded the highest number of users among all gaming dApps, with 123570 MAUs (Monthly Active Users), representing 27.5% of the total gaming users in this list.

Coming back to transactions, SecondLive recorded the highest number of transactions for any gaming dApp on BNB Chain in the last 30 days.

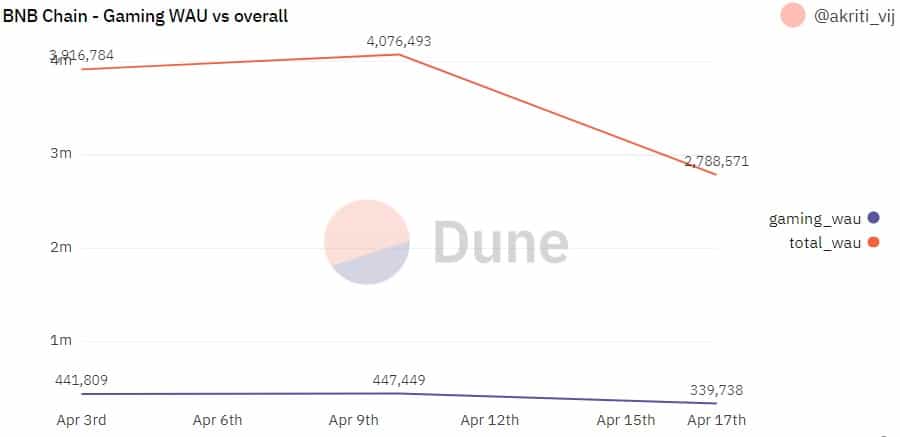

However, though these data sets suggested growth, Dune’s chart told a different story. BNB’s weekly average users in gaming saw a slight decline of late.

Well, new dApps such as Gaimin, PlayZap, Mystic Treasures, and Ultimate Champions got listed on BNB Chain in the recent past. So things might change in the future.

Taking into account the increasing popularity of web3 gaming, the possibility of a boom in BNB’s GameFi space can’t be ignored.

A similar trend was noted this month

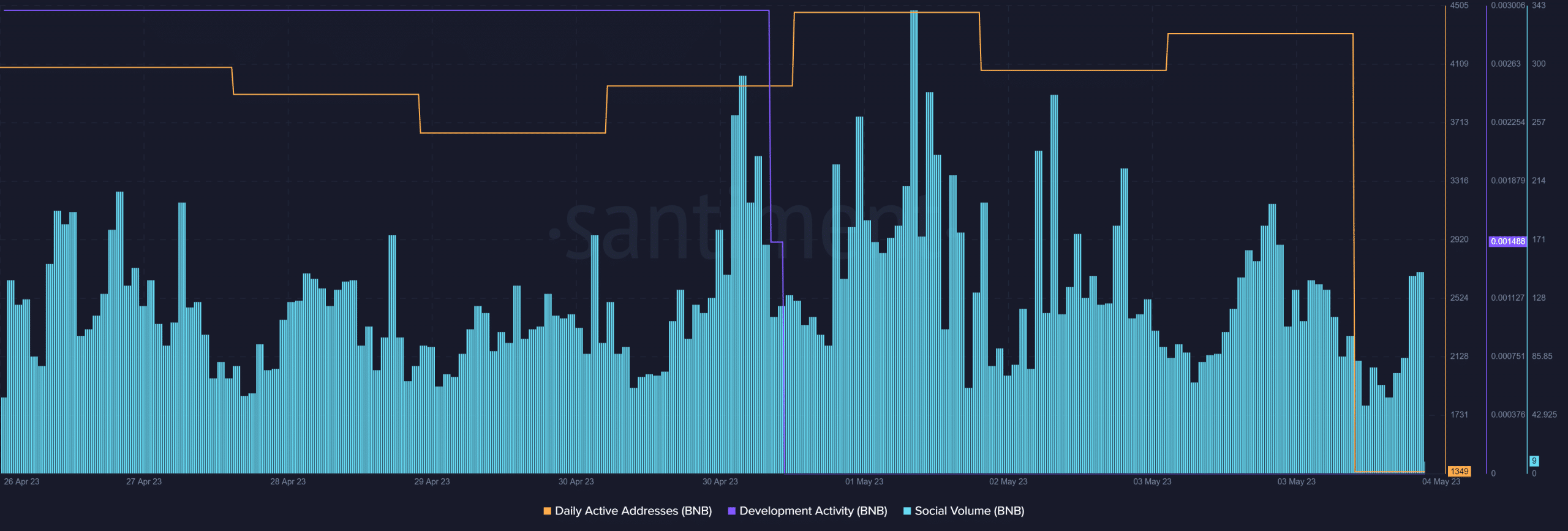

BNB’s April month’s achievement seemed to have continued in May as well. Santiment’s data revealed that its daily active addresses were considerably high, which was a positive signal.

The token also remained popular in the crypto space, as evident from its social volume. However, BNB’s development activity declined last week, which by and large was a negative sign.

BNB’s price took a sideways path

While BNB Chain went ahead of ETH and other competitors in terms of active users, investors were not very happy with the token’s price action.

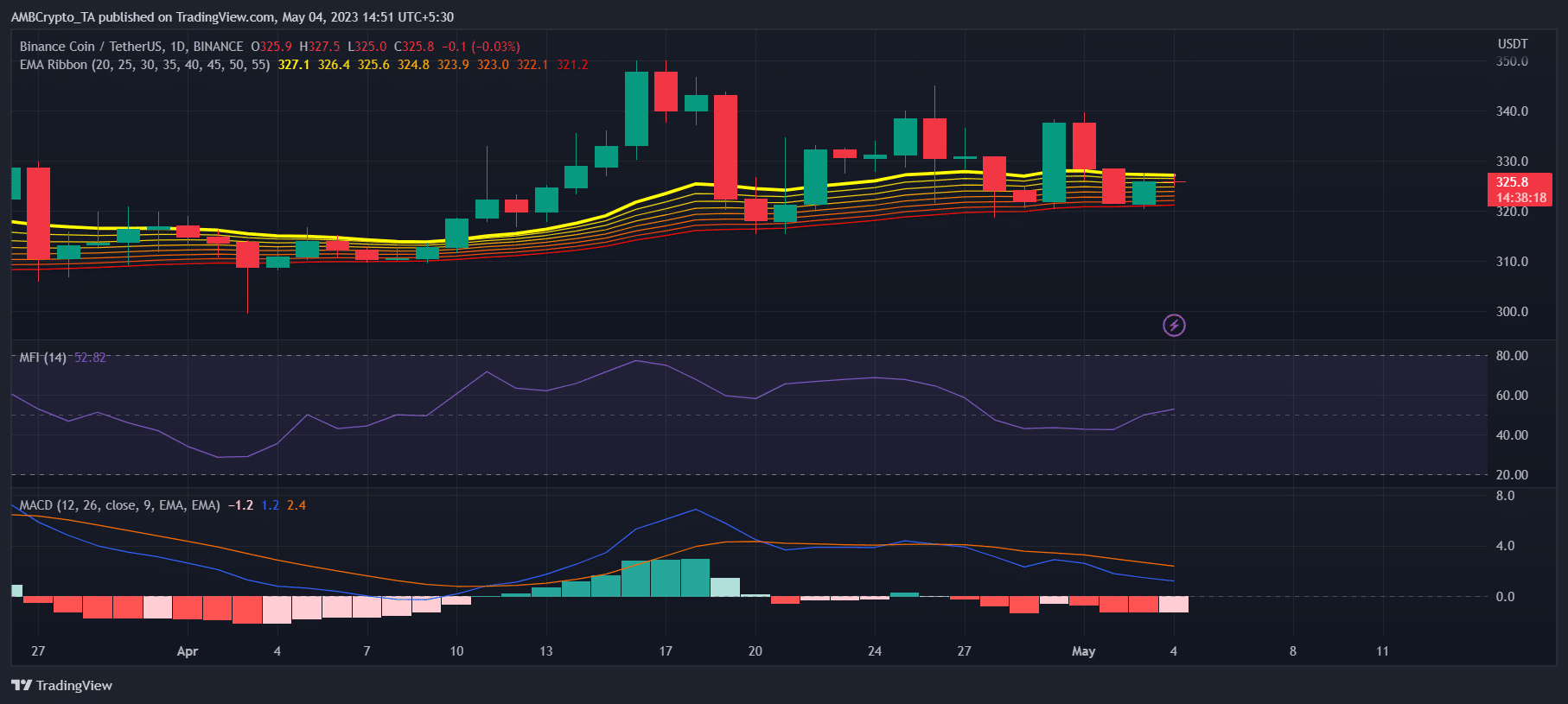

According to CoinMarketCap, BNB’s price did not move much over the last few days. At press time, it was trading at $326.18 with a market capitalization of over $50 billion.

Read BNB’s Price Prediction 2023-24

Nonetheless, investors might want to wait before making a decision on BNB.

The Money Flow Index (MFI) indicator, at press time, registered an uptick and was headed above the neutral mark.

The Exponential Moving Average (EMA) Ribbon suggested that the bulls were leading the market as the 20-day EMA was above the 55-day EMA. Lastly, BNB’s MACD was concerning as it displayed a bearish crossover.