Circle’s risk-averse moves and adjusted reserves could do this for USDC

- Circle makes risk-averse moves regarding its treasury. Despite high collateralization, overall sentiment remains negative.

- USDC’s dominance in the DeFi market begins to slow down, and market cap declines.

Circle has been in the news recently due to the collapse of the Silicon Valley Bank(SVB). After its collapse and the impact it had on USDC’s market cap and peg, the governance at Circle has become increasingly risk-averse.

This was showcased by the comments made by Jeremy Allaire, CEO of Circle, in a recent interview. Reportedly, he disclosed that Circle does not hold U.S. Treasuries maturing beyond early June. According to Circle’s March Audit report, $28.8 billion of Circle’s overall reserves were held up in U.S Treasury bonds.

So why was this decision made?

Playing it safe

According to Jeremy, Circle doesn’t want to carry exposure to a potential breach of the ability of the U.S. government to pay its debts.

After being severely impacted by the fall of SVB, Circle has been extremely cautious in terms of the allocation of its funds. At press time, Circle had $30.2 billion in its reserves, and $4.8 billion was at banks. Compared to the amount in circulation, Circle has managed to collateralize USDC.

USDC also exhibited a negative net issuance. This indicated that the amount of USDC that is being burned (or taken out of circulation) exceeds the amount that is being minted (or created). Essentially, there is more USDC being redeemed or withdrawn than there is being issued, leading to a decrease in the overall supply.

Despite these factors, the overall sentiment around USDC remained negative. Over the last few weeks, the weighted sentiment around USDC became increasingly negative. This indicated that the crypto community had started to amp up the negative comments around USDC.

Coupled with that, the stablecoin also witnessed a declining interest in the DeFi sector. According to Dune Analytics’ data, the overall DEX Swap Volume fell significantly from over $15 billion to $1.19 billion.

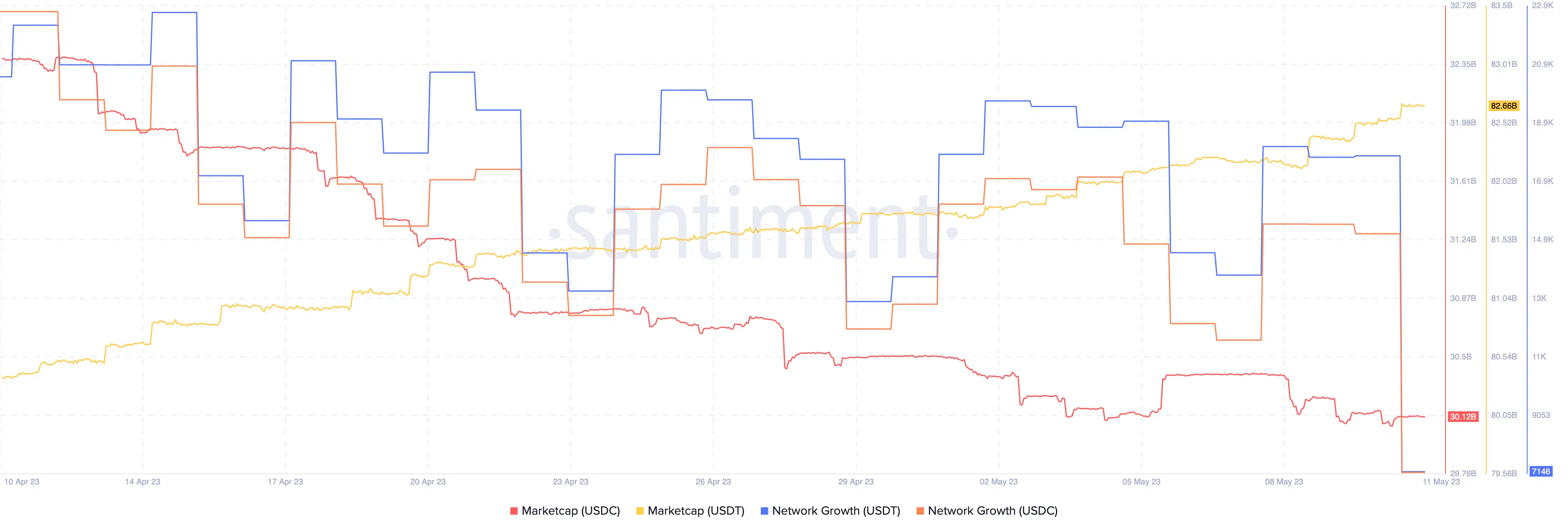

In terms of market cap, USDC was still lagging behind as USDT continued to take up a large part of the market share. However, both the stablecoins witnessed a decline in terms of network growth suggesting that new addresses were beginning to lose interest in both the stablecoins.