As MATIC inflicts a breakout, can it sustain the momentum

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

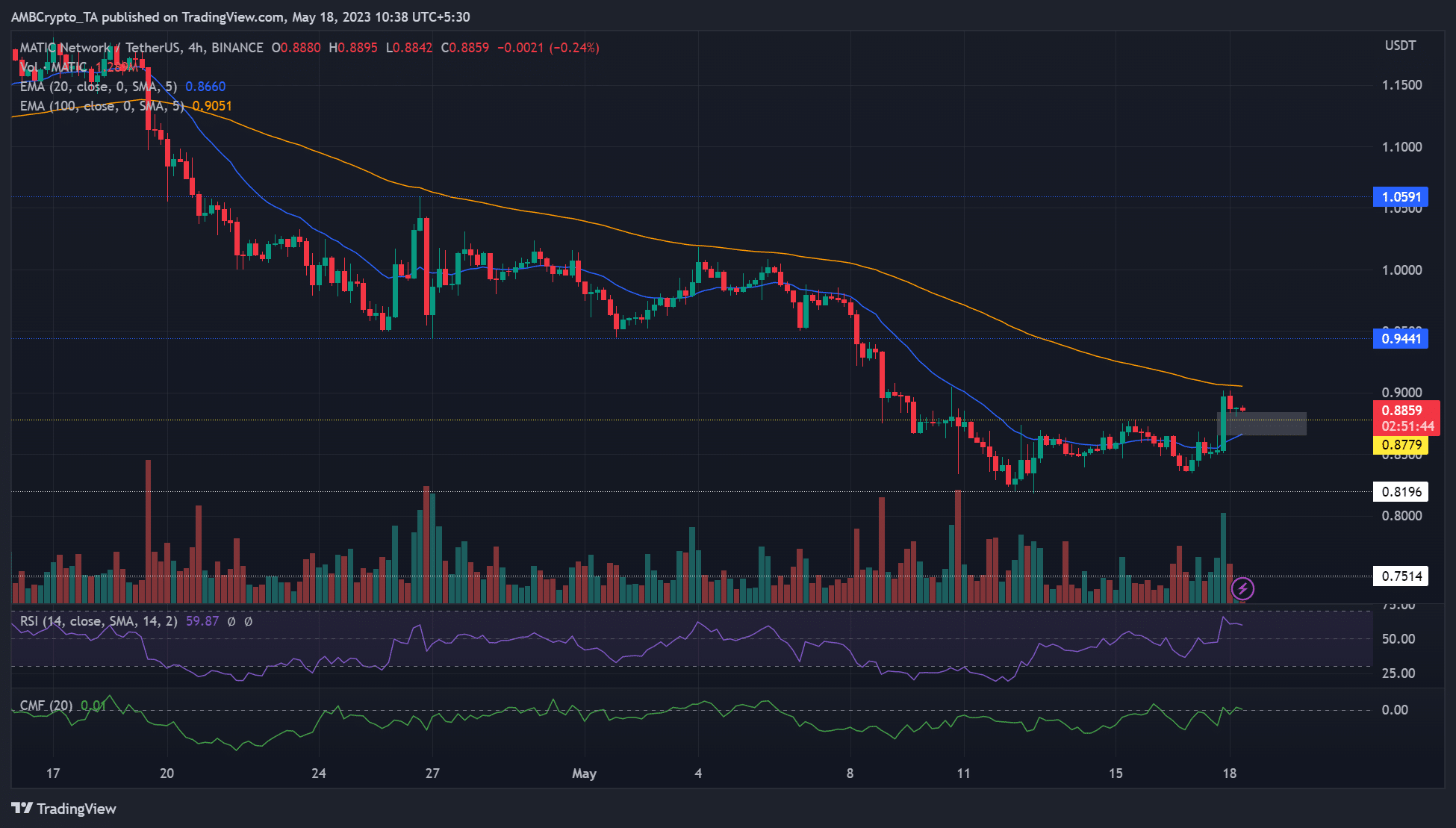

- MATIC close above the short-term range highs of $0.8779.

- The rally faced rejection at 100-EMA ($0.9051) at press time.

Following the optimistic tone surrounding the U.S. debt ceiling talks, Bitcoin [BTC] improved slightly and reclaimed the $27k zone on 17 May. Similarly, Polygon [MATIC] edged higher, inflicting a breakout from its short-term range formation.

Is your portfolio green? Check MATIC Profit Calculator

MATIC’s move left a fair value gap (FVG) that aligns with the 50-EMA of $0.8660. Will this zone act as strong support for bulls, or will bears crack it?

Can bulls smash the 100-EMA hurdle?

Since 9 May, MATIC has been stuck within a short-term range of $0.8196 – $0.8779. It broke above the range on 17 May, but it remains to be seen if the breakout isn’t a “fakeout.”

Price action moved above the short-term trend, 20-EMA of $0.8660 (blue line), giving near-term bulls the upper hand on 17 May. However, the rally stalled near the 100-EMA of $0.9051 (yellow line) at press time.

The 100-EMA has been a key dynamic resistance level during the second half of April and May. Besides, the impulse move and subsequent breakout on 17 May left an FVG within the $0.8651 – $0.8838 zone (white).

Ergo, the price could retreat to this FVG zone before continuing with the uptrend.

As such, it could be an entry point for a move-up targeting the March lows and key Q1 support level of $0.9441. But near-term bulls must clear the 100-EMA hurdle to gain more leverage.

A close below the FVG zone and 20-EMA could drag MATIC to retest range lows at $0.8196.

Meanwhile, the RSI retreated slightly but was still within the upper ranges, indicating that buying pressure eased somewhat. CMF increased but hovered near the zero mark, highlighting the wavering of capital inflows.

A neutral position in the futures market, but…

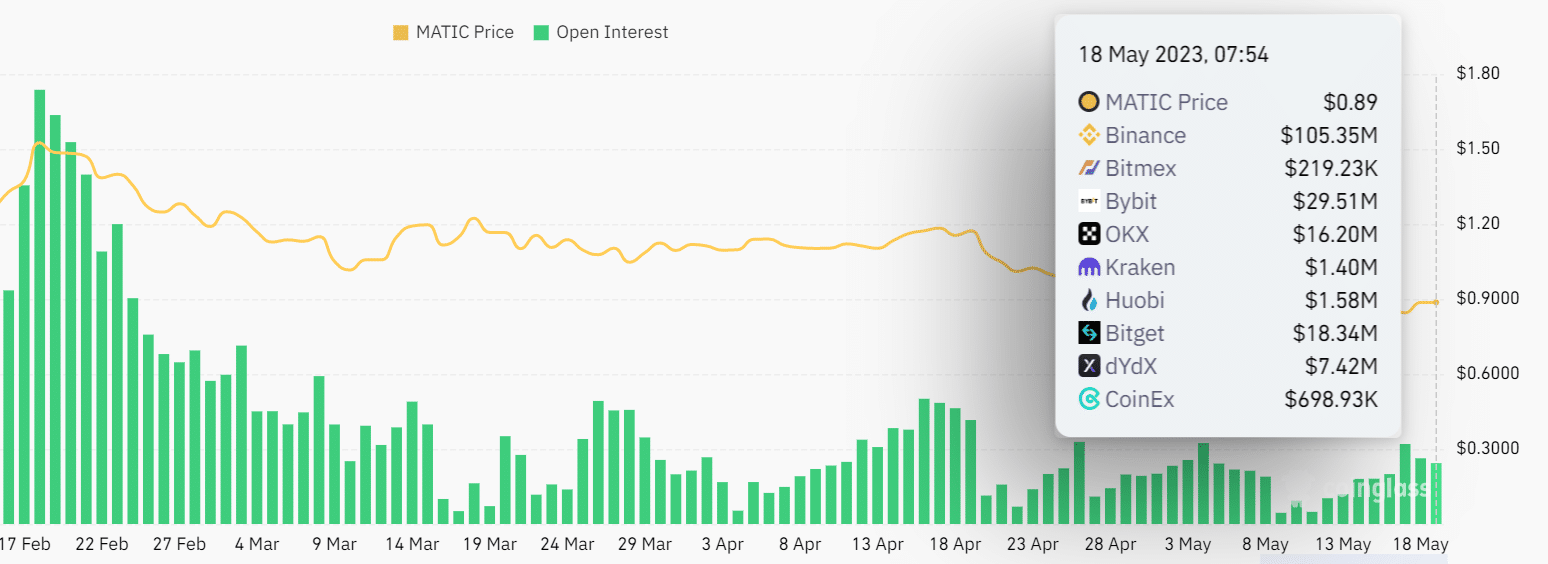

According to Coinglass, MATIC’s open interest rate dropped drastically at the end of February and has fluctuated since then. This indicated that demand for MATIC wavered in the derivates market.

How much are 1,10,100 MATICs worth today?

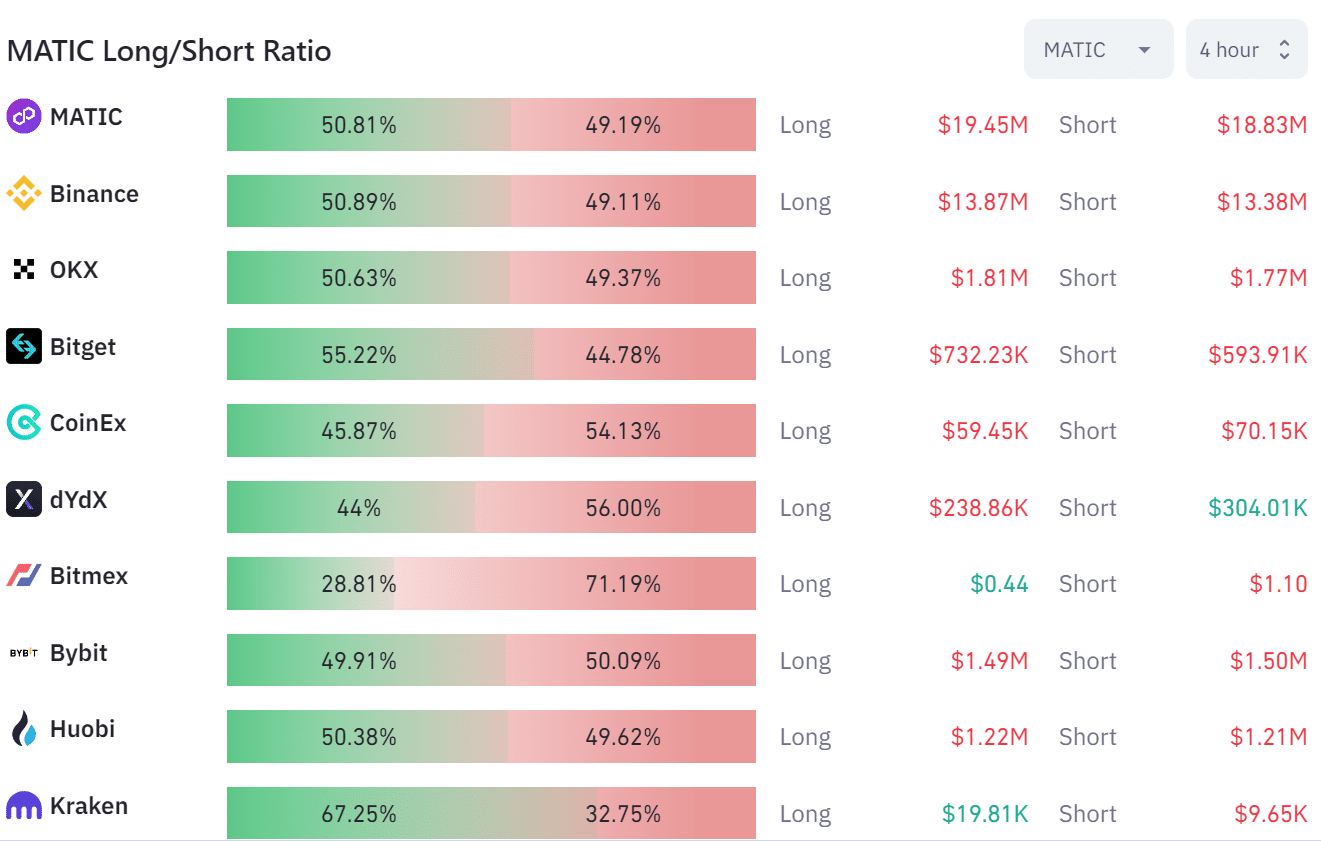

On the other hand, the exchange long/short ratio indicates that longs dominate at 50.81% against shorts (49.19%) in the 4-hour timeframe.

The narrow-spread paints a neutral position in the futures market. Traders should track BTC’s price action for optimized trade set-ups.