Can Bitcoin benefit from the meme craze? Data suggests…

- Bitcoin network observes growth as interest in memecoins increases.

- Miner revenues begin to decline.

The crypto market has been flooded with memecoins such as PEPE recently. Users have been flocking to memecoins and the interest in them peaked again. An unlikely recipient of the hype was Bitcoin.

Read Bitcoin’s Price Prediction 2023-2024

Bitcoin joins the party

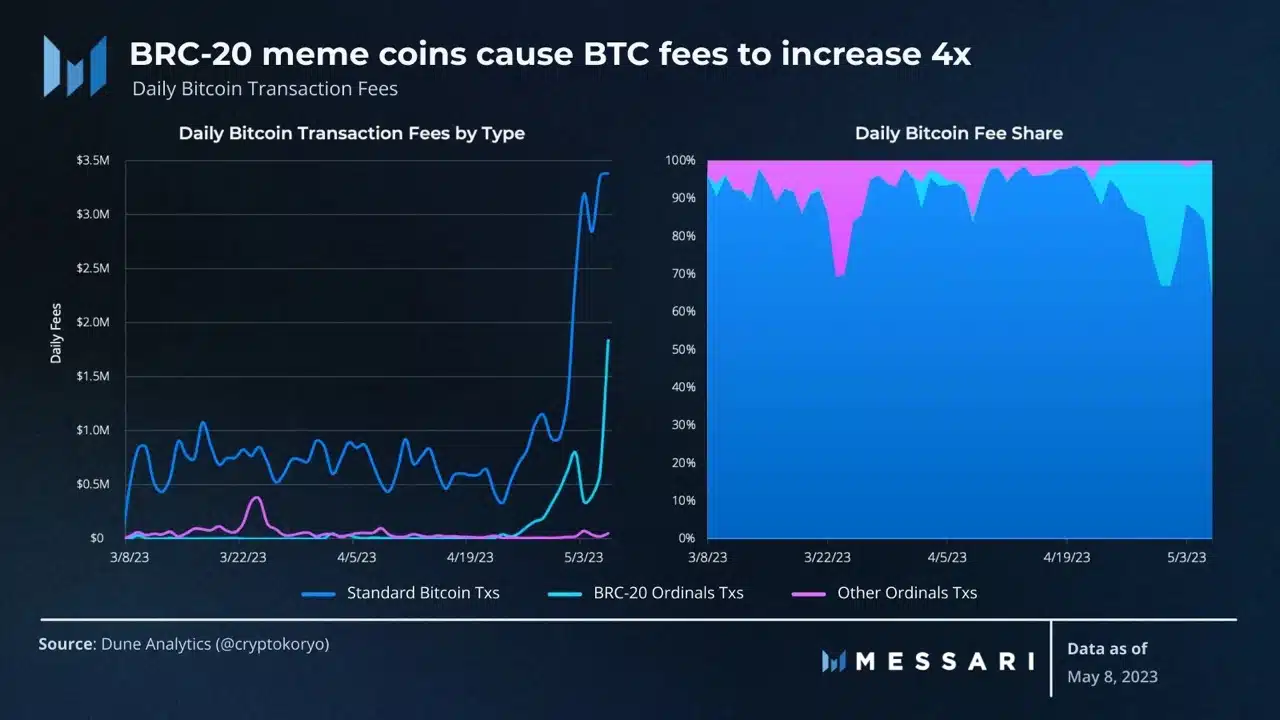

According to data provided by Messari, memecoins weren’t gaining traction on Ethereum scaling solutions, but have been making their mark on the Bitcoin network.

These memecoins were able to spread to the network due to the novel BRC-20 standard built on the Ordinals protocol.

The rising interest in memecoins impacted the daily transaction fees that were being generated on the network. The data indicated that BRC-20 Ordinal transactions generated more than $1.5 million in daily fees.

Even though general transactions still make up a majority of the fees generated on the network, a large share of it was now generated by BRC-20 transactions.

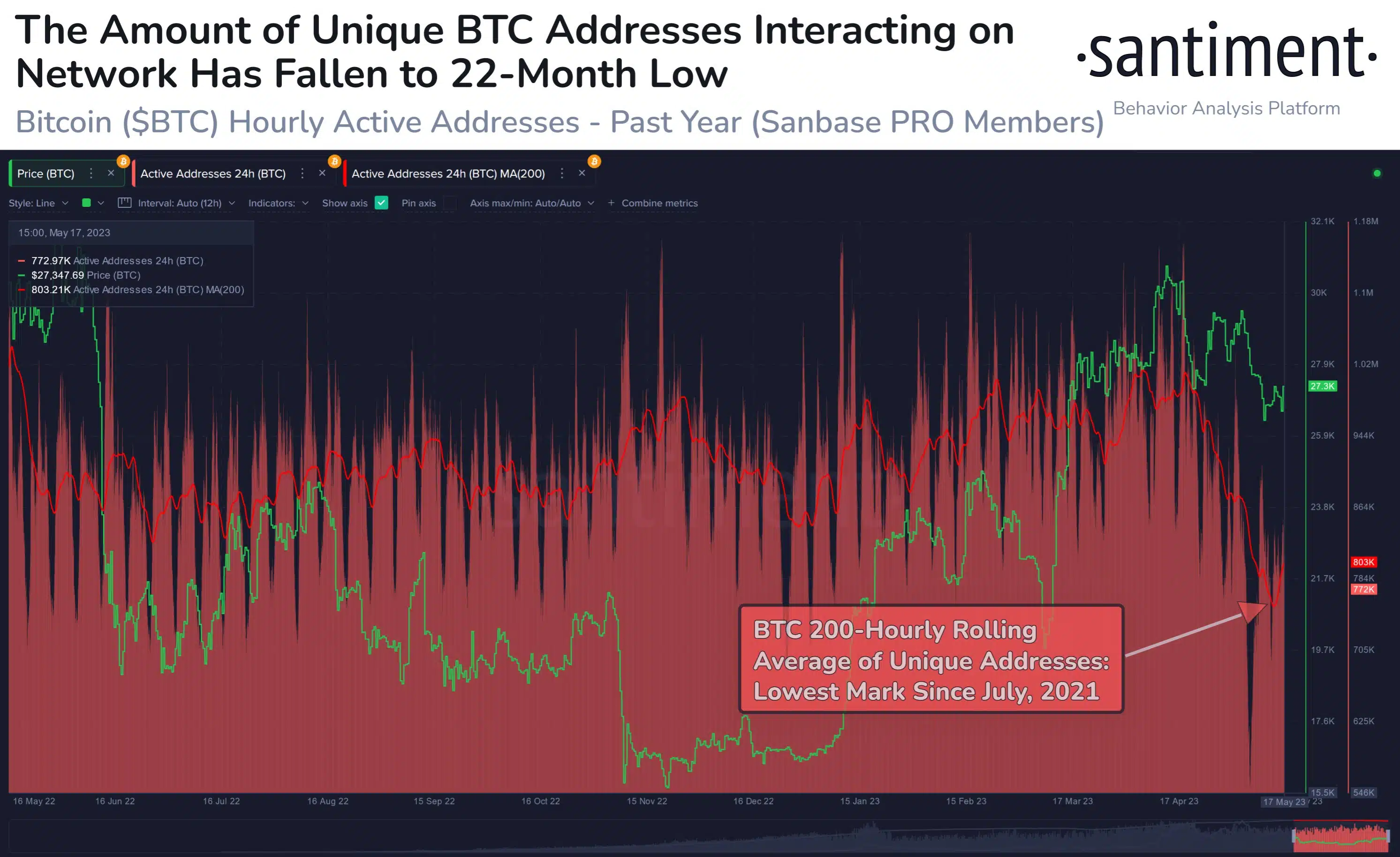

However, the amount of standard Bitcoin transactions has started to decline.

In May, there was a significant decrease in Bitcoin’s activity, coinciding with a market-wide price correction.

This decline in activity was noteworthy as it marked the first time since July 2021 that the number of daily unique Bitcoin addresses fell below 800,000.

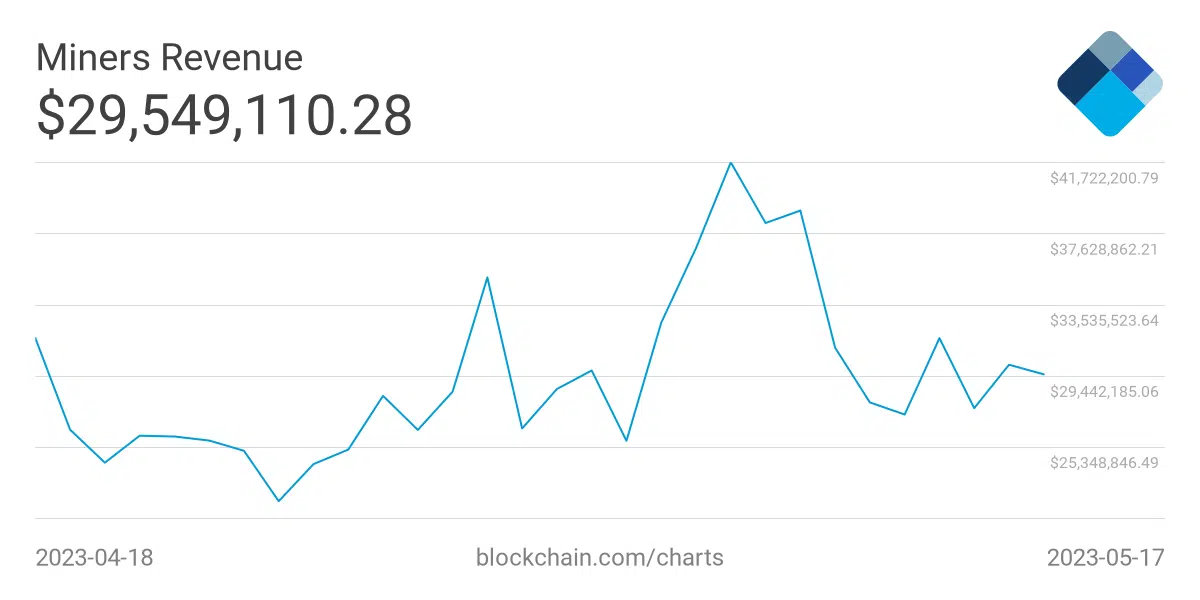

Impact on miners

The falling transactions on the Bitcoin network could impact the state of Bitcoin miners and their earning capacity. At press time, the daily revenue being generated by miners dropped from $41.72 million to $29.44 million in the last few days.

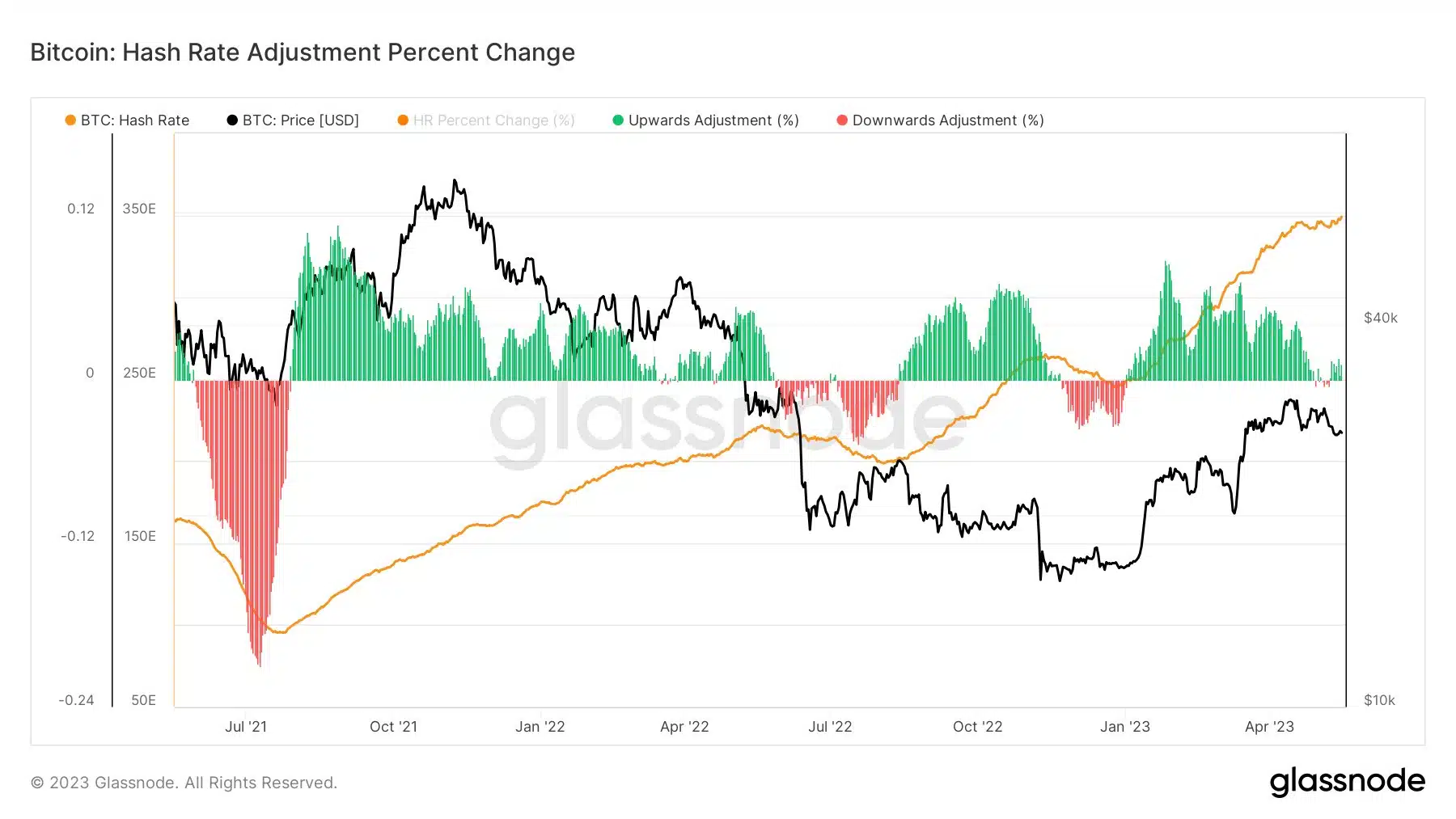

Additionally, there was a recent upward trend in hash rate, which reached a historic high of 350 tera-hashes per second, based on a 30-day moving average.

Is your portfolio green? Check out the Bitcoin Profit Calculator

A high hash rate enhances the overall security and stability of the network by making it more resistant to potential attacks.

However, a high hash rate increases competition among miners. Thus, making it more challenging for individual miners to earn rewards due to the higher computational power required.