Will Curve’s new stablecoin prove as its mettle in the days to come

- crvUSD gets deployed on Curve protocols UI. TVL on Curve begins to decrease.

- CRV’s price falls, however, holders continue to show faith in the token.

As the DeFi space continues to get more competitive with protocols, such as Uniswap and SushiSwap dominating the sector, protocols such as Curve are having a hard time competing.

Realistic or not, here’s CRV’s market cap in BTC’s terms

However, Curve recently announced that they will be launching a new stablecoin on their protocol known as crvUSD, which could help the protocol compete in the space.

Curve enters a new playing field

On 4 May, the smart contracts for these stablecoins were deployed on the protocol. However, the stablecoin pools’ integration into the Curve Finance protocol occurred on 18 May.

These pools are regular pools, not metapools, which means they don’t combine multiple stablecoins. The purpose of having separate pools is to distribute trust across various stablecoins, specifically for the PegKeeper contracts.

For context, PegKeeper contracts refer to smart contracts designed to maintain the stability of a stablecoin’s value, keeping it pegged or closely aligned with a specific reference asset, typically a fiat currency like the US dollar. These contracts monitor and manage the supply and demand dynamics of the stablecoin, making adjustments as necessary to ensure its price remains stable

Stablecoin pools with crvUSD are now visible in UI.

The are not metapools but plain pools in order to split trust between multiple stablecoins for PegKeeper contracts pic.twitter.com/TPJOv60rR3

— Curve Finance (@CurveFinance) May 17, 2023

In the $crvUSD system, the holder’s collateral is converted to $crvUSD if its value declines, and repurchased if its value increases. This ensures a gradual and continuous process without abrupt liquidations.

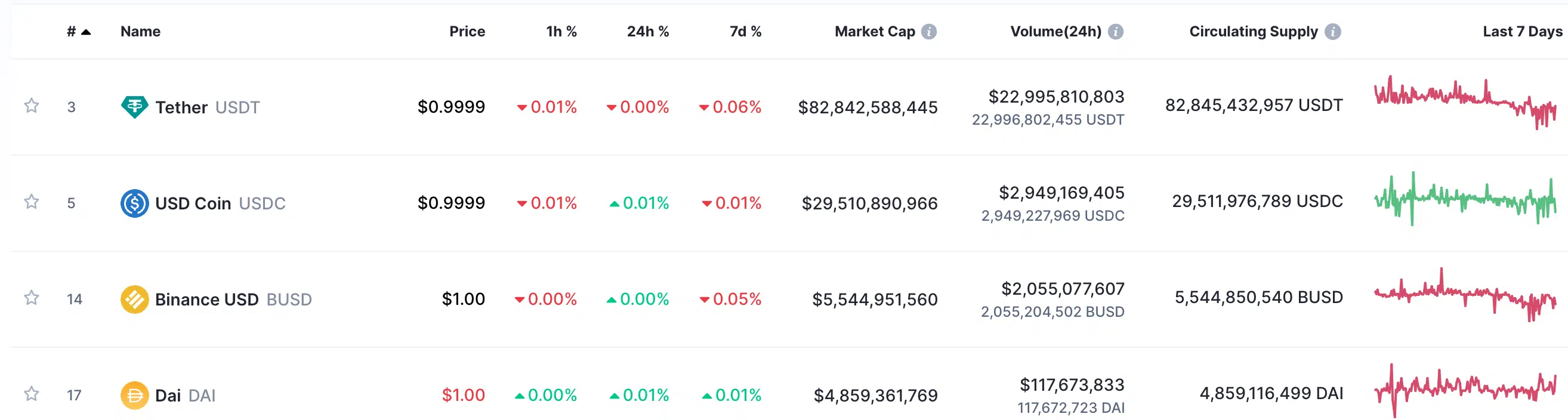

Despite the benefits of the crvUSD, the stablecoin will have a difficult time making its mark. The market is crowded and extremely competitive at press time. Stablecoins such as USDT, USDC, and DAI have captured a large part of the marketshare with USDT leading the way.

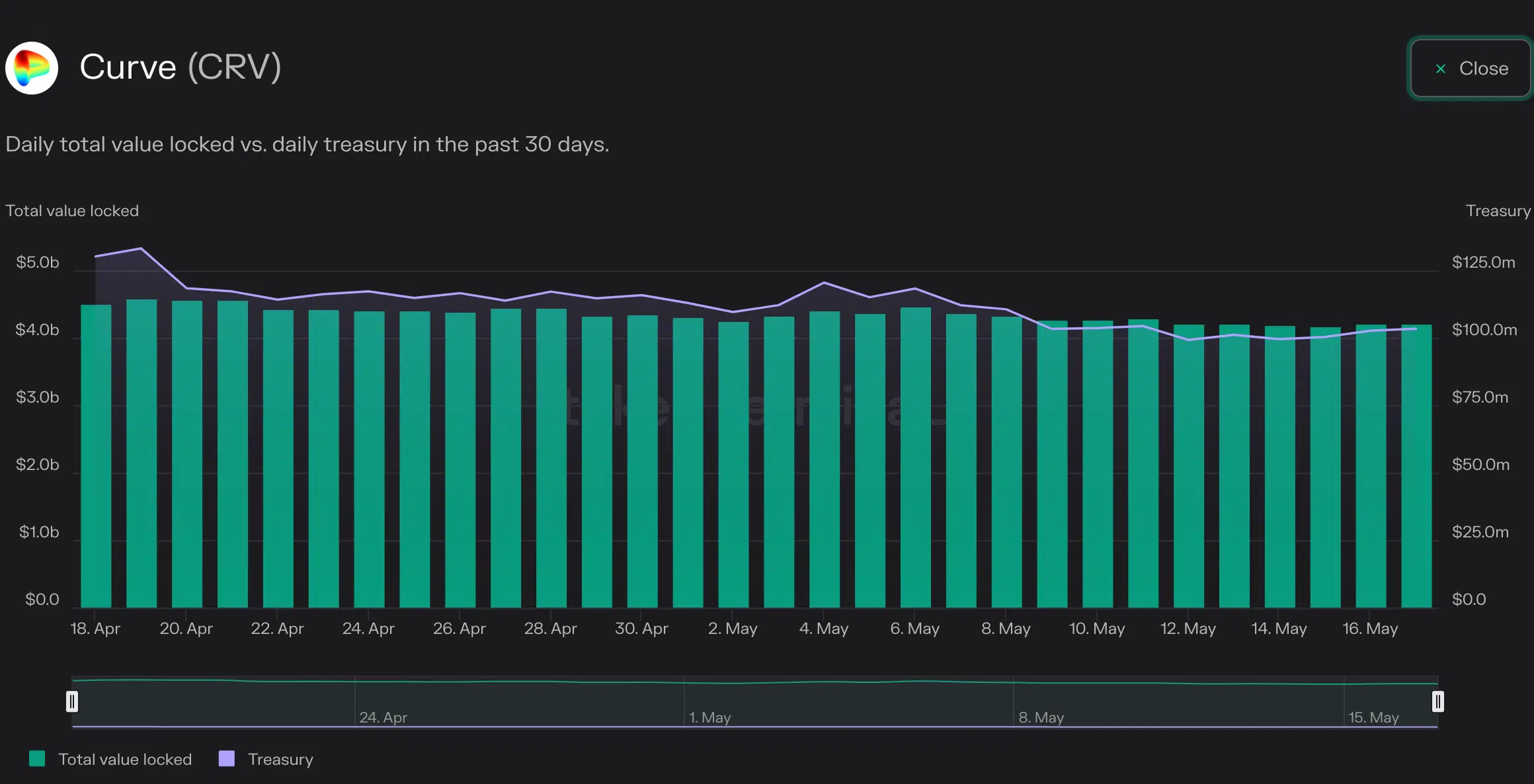

Even though crvUSD may have a tough time breaking into the stablecoin market, the introduction of crvUSD could aid the protocol in other areas such as TVL and treasury holdings.

At press time, the total value locked on the protocol was $4.2 billion. It had declined by 6.3% over the last month.

As a consequence of Curve’s poor performance, the overall earnings generated by the protocol also declined by 20.6% over the last month according to the token terminal’s data.

State of CRV

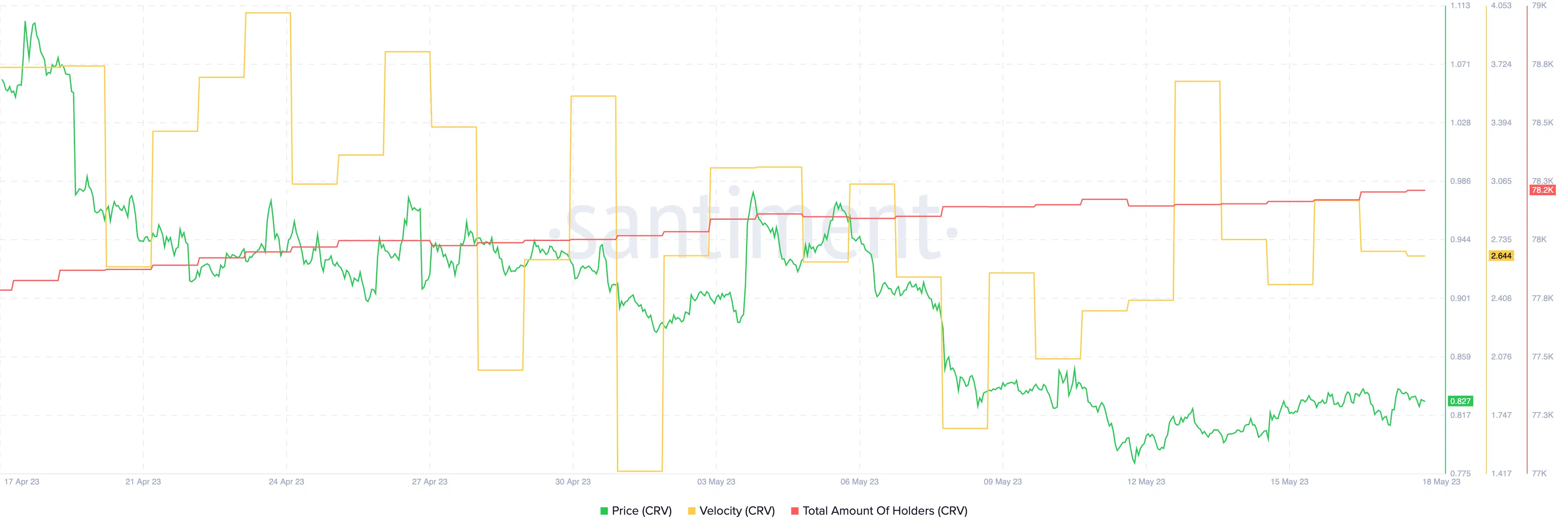

Coming to the CRV token, the number of holders of the token remained the same over the last month. Despite this, the price of CRV fell during this period.

Read Curve’s Price Prediction 2023-2024

Only time will tell whether the introduction of crvUSD will have a positive impact on CRV going forward.