Uniswap contributors open up discussion on deploying V3 iteration on Base

- A proposal has been submitted to discuss a potential deployment of Uniswap V3 on Base.

- UNI has seen increased accumulation in the last seven days.

Discussions have been initiated by three prominent contributors to Uniswap to explore the possibility of deploying the V3 iteration of the decentralized exchange (DEX) on Coinbase’s Layer 2 blockchain Base upon its mainnet launch.

The proposal published on Uniswap’s governance forum on 17 March was put forward by she256, Michigan Blockchain, and GFX Labs.

According to the proposal’s proponents, Base’s integration with the Coinbase ecosystem presents an opportunity to introduce new users to Uniswap while providing a seamless user experience and developer platform that surpasses Ethereum’s capabilities.

Realistic or not, here’s UNI’s market cap in BTC terms

They added that successfully deploying Uniswap V3 on Coinbase’s Base would establish Uniswap as the leading DEX for the Layer 2 (L2) blockchain network.

Uniswap leads, and others follow

Deployed across six chains, namely Ethereum, Arbitrum, Polygon, Optimism, BNB Chain, and Celo, Uniswap’s total value locked (TVL) across all these networks was $4.08 billion. Of its three deployments, Uniswap V3’s $2.9 billion TVL represented 71% of the DEX’s entire TVL.

Per data from DefiLlama, Uniswap’s TVL has grown consistently since the year began. The DEX’s TVL has increased by 24% in the past four and a half months.

The spike in Uniswap’s TVL is attributable to a surge in the number of active users on the platform. Earlier in May, it reached a new record for the number of active users on its platform, surpassing 30 million.

Moreover, per data from Token Terminal, in the last 30 days alone, the daily active user count on the DEX has gone up by 53%.

With increased meme coin trading in the last month, Uniswap has seen an influx of traders on its platform trying to take advantage of the meme coin craze.

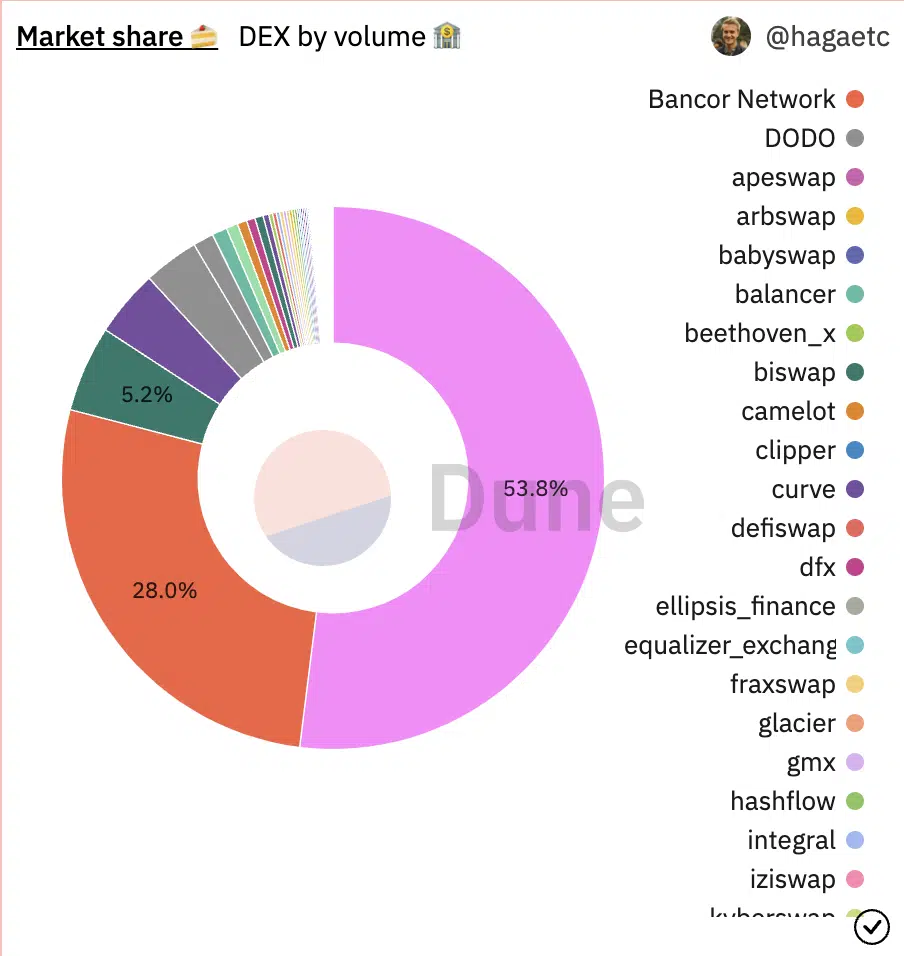

Per data from Dune Analytics, with a trading volume of $8.40 billion in the last seven days, Uniswap was responsible for 54% of all trades conducted across DEXes in the market.

UNI has seen traction in the last week

Trading at an 88% decline from its all-time high of $44.97, which it clinched two years ago, UNI has seen increased activity in the last week. Changing hands at $5.37 at press time, data from CoinMarketCap revealed a 5% price increase during that period.

Read Uniswap’s [UNI] Price Prediction 2023-24

On a daily chart, UNI accumulation outweighed distribution. The alt’s Relative Strength Index (RSI) and Money Flow Index (MFI) rested above their respective neutral lines at 50.28 and 63.09.

Indicating increased liquidity inflow into the UNI market, the Chaikin Money Flow re-entered positive territory on 10 May. At press time, this was pegged at 0.13.