Cardano breaks out past range highs, should bulls prepare for a rally

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- The market structure of ADA was bullish over the past week.

- Bitcoin could derail a bullish scenario for Cardano in case of rejection near the $28k resistance.

Despite the weakness of Bitcoin in the markets over the past week, Cardano buyers have been steady. They were able to force a market structure break last Saturday and their efforts saw ADA break out of the short-term range highs.

Read Cardano’s [ADA] Price Prediction 2023-24

At the time of writing, the bulls have built a strong zone of demand around the $0.37 area after the efforts of the past ten days. Bitcoin was stuck beneath the $27.8k resistance but an upward move for BTC would likely be closely followed by ADA as well.

The range highs were beaten, what next for ADA?

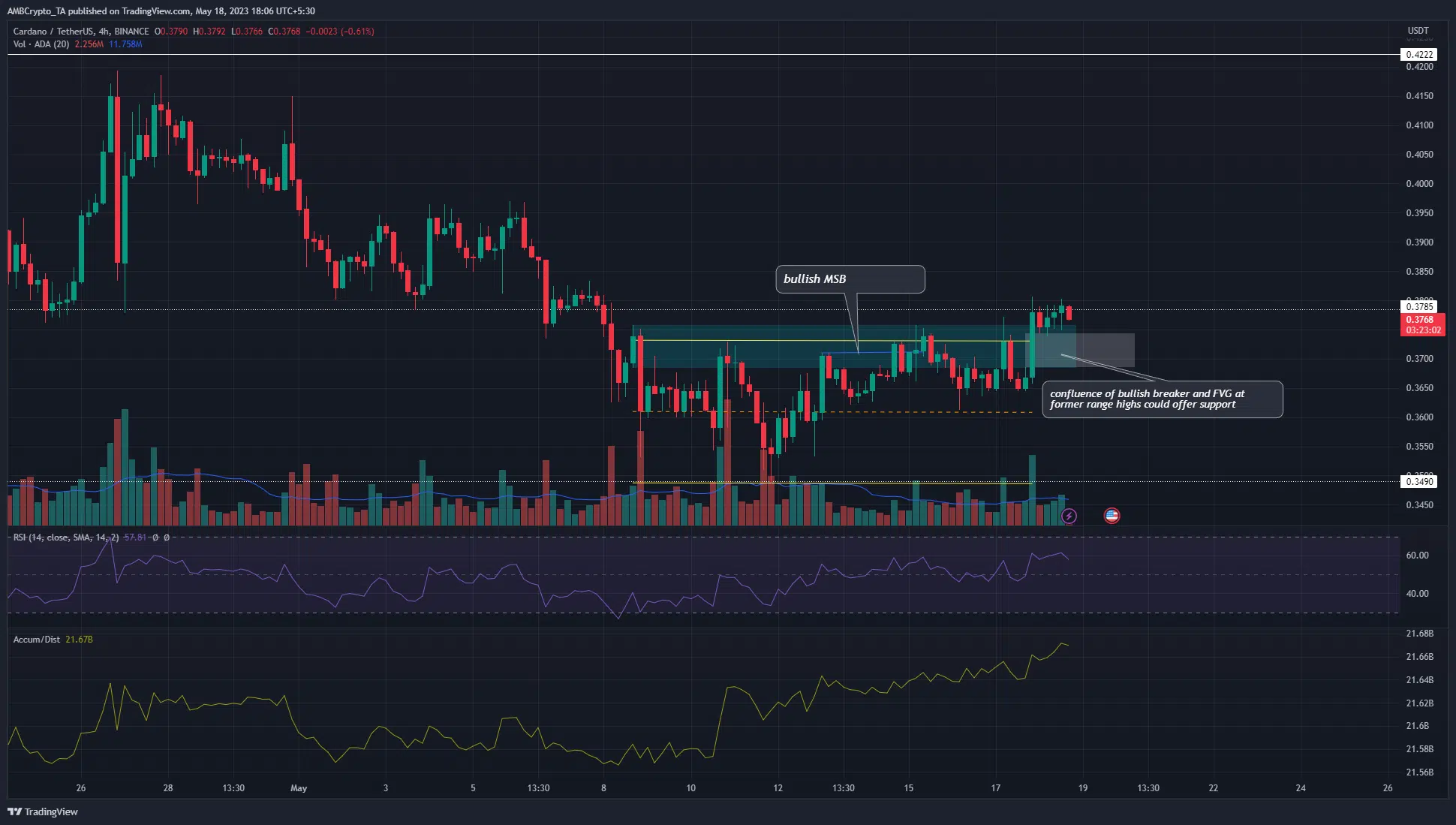

The 4-hour chart showed the RSI was above neutral 50 since 12 May. This showed upward momentum over the past week, and the reading of 57 at press time suggested the momentum remained bullish.

The A/D indicator was also in a strong uptrend since 10 May, showing consistent demand. This fueled the ADA bulls’ defense of the mid-range mark at $0.36. The range (yellow) extended from $0.349 to $0.393.

Realistic or not, here’s ADA’s market cap in BTC terms

On Wednesday, ADA saw a sharp move above the range highs and an H4 trading session close at $0.378. In doing so the price left an imbalance (white) on the charts.

Moreover, this region was atop the former bearish order block at the $0.37 level. This OB, now a bullish breaker, would also serve as a demand zone. Hence, traders can anticipate a retest of this region and a positive reaction from the price.

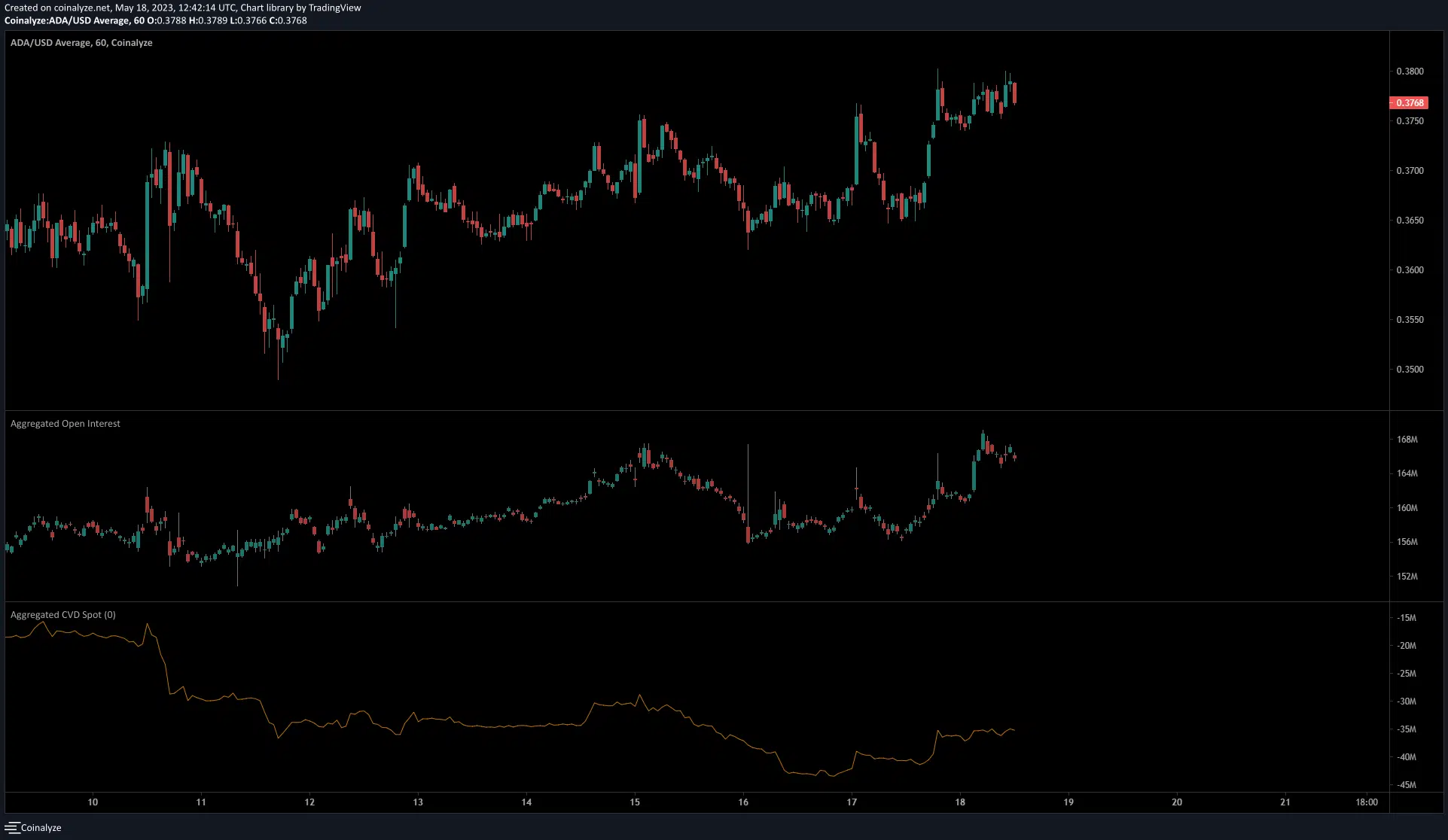

Source: Coinalyze

The Coinalyze data showed that demand was not as strong as the A/D indicator showed. The spot CVD was in a slow decline from 10 May to 16 May, but has stabilized and noted some gains since 17 May. This showed that the recent move past $0.373 was backed by demand but ADA was not in an accumulation phase over the past week.

The Open Interest showed discouraged longs on 15 and 16 May and signaled bearish sentiment at that time. Since then, both the OI and the price have rallied, suggesting ADA’s bullish sentiment was growing stronger.