Impact on Bitcoin as U.S debt limit deadline nears will be…

- The U.S. debt deadline could have positive implications for BTC.

- Bitcoin adoption increased while exchange inflow decreased.

In a recent interview, Arthur Hayes said that the U.S. debt ceiling deadline could be favorable for Bitcoin [BTC]. For the uninformed, the U.S. debt ceiling refers to the maximum amount of debt that the country may borrow.

How much are 1,10,100 BTCs worth today?

Possible yield amid rising arrears

When the debt ceiling reaches its limit, it could have significant economic and financial implications. Hayes, who was speaking on the “What Bitcoin Did” podcast hosted by Peter McCormack, noted that the 4.9% inflation rate, coupled with the deadline, could spell doom for the U.S. economy.

So, in consequence, residents of the country could start looking toward digital assets like Bitcoin for safety. However, the former BitMEX CEO opined that most people would still not buy Bitcoin despite the banking crisis. Instead, they would follow the “sinking ship” as the U.S. would try to print more money.

On 27 May, the Financial Times reported that the U.S. might not meet up with the 5 June deadline to pay its debt. According to the county’s treasury secretary, Janet Yellen, the government could run out of money. She also mentioned that printing more dollars might not solve the problem.

Earlier, on 1 June, Yellen had written to Congress for swift intervention. In the letter, addressed to House Speaker Kevin McCarthy, Yellen mentioned,

“Based on the most recent available data, we now estimate that Treasury will have insufficient resources to satisfy the government’s obligations if Congress has not raised or suspended the debt limit by June 5.”

However, Congress responded that it was working to make sure that it doesn’t default on the $31.4 trillion limit. Meanwhile, it appeared that new entrants were already adopting Bitcoin, based on Santiment’s data.

Growth in acquisition

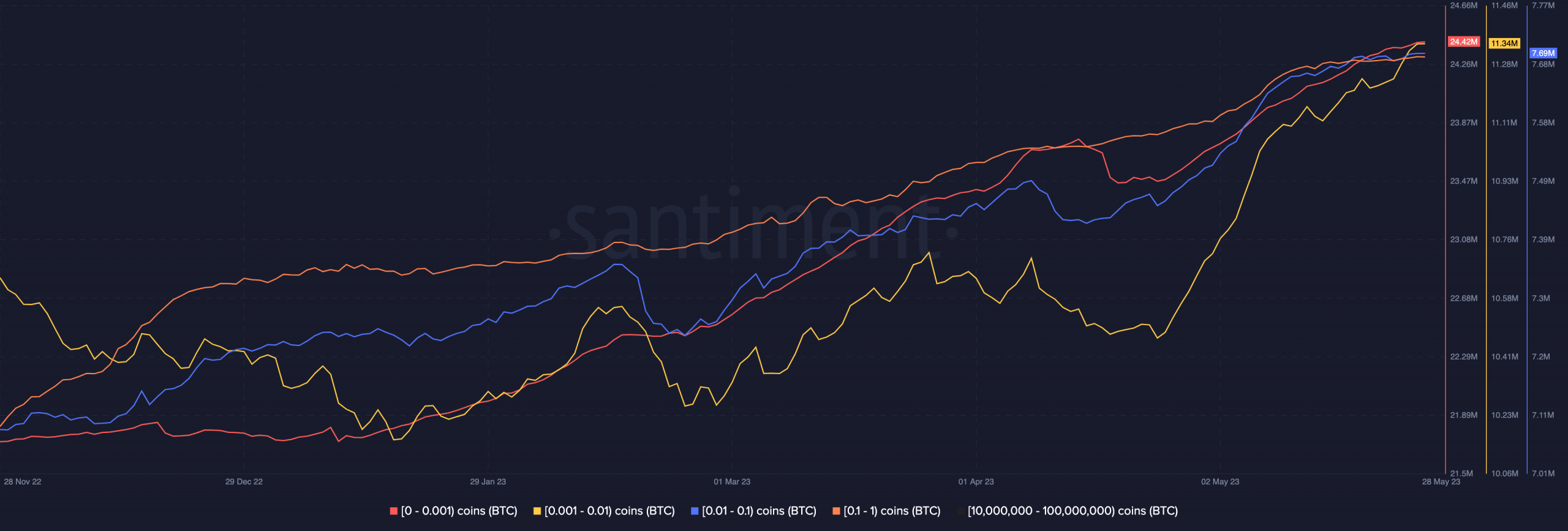

According to the on-chain analytic platform, the number of addresses holding between 0 to 1 coin have been increasing since April.

This supply distribution suggests increased activity within the retail cohort. In terms of circulation, Santiment showed that BTC had increased. As of this writing, the 30-day circulation was 1.17 million.

Is your portfolio green? Check the Bitcoin Profit Calculator

Circulation emphasizes the number of unique coins transacted within a specific period. Thus, the hike implies that the amount of BTC engaged in buying and selling had improved from the downturn a few weeks back.

Also, Bitcoin’s exchange inflow had decreased to 3105. The decline in this metric signifies fewer deposits into exchanges. Therefore, there could be a reduction in the motive to decrease holdings while resisting selling pressure.

![Bitcoin [BTC] circulation and exchange inflow](https://ambcrypto.com/wp-content/uploads/2023/05/Bitcoin-BTC-12.00.13-28-May-2023.png)