A win for OP, but here’s why traders should remain cautious

- Optimism becomes LunarCrush’s coin of the day at a vital price point.

- OP curbs its downside after a resurgence of volume and is possibly headed for a pivot.

OP, the native token for Ethereum’s layer 2 network Optimism had a great start in January and at the start of February. After that, it has mostly been bearish but what goes down will eventually go up.

Is your portfolio green? Check out the Optimism Profit Calculator

OP, at press time, was flashing bullish signs but will the bulls pull off a significant win? Let’s first look at the latest regarding the token. LunarCrush selected OP as the coin of the day in the last 24 hours. While this may not mean much in the grand scheme of things, it underscores the growing interest in the token.

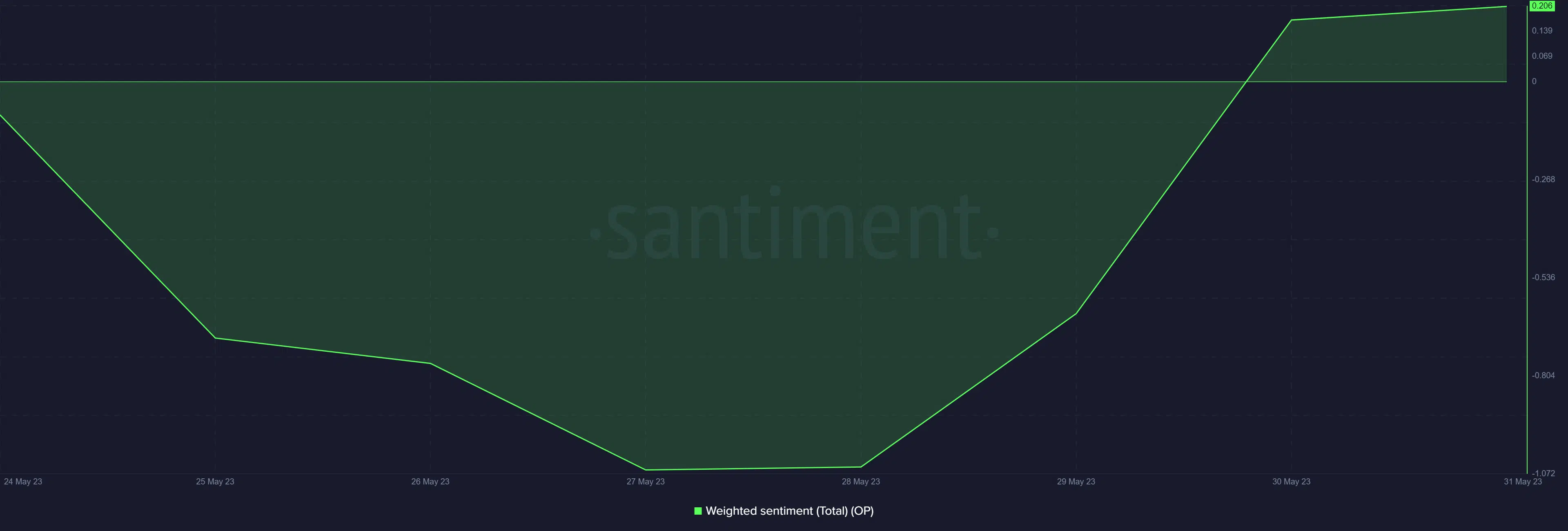

The LunarCrush observation may also indicate that investors were becoming more interested in OP. It also reflected the improving investor sentiment as seen in the weighted sentiment metric. OP’s weighted sentiment registered a healthy bounce back after bottoming out between 27 and 28 May.

But why are these observations important especially since we are in a new month? Well, that largely has to do with its current price position. The token maintained a bearish bias for the last four months during which it pushed into the oversold zone just once before in May.

OP bulls might be about to take over

OP, at the time of writing, was oversold on both the Relative Strength Index (RSI) and Money Flow Index (MFI). This was possibly one of the reasons why the token was attracting visibility and attention.

Its press time RSI position also underscored a bit of price-to-RSI divergence. In other words, the token was in a position that many would consider a potential buy zone.

While the current expectations were bullish, traders should also note that OP’s 50-day moving average was approaching its 200-day moving average. A bearish sign called a death cross forms when the 50-day MA crosses the 200-day MA from above.

A look at OP’s on-chain volume revealed that it has been growing towards the end of May, with its weekly peak in the last 24 hours. Its social dominance also registered its highest weekly peak in the last 24 hours, confirming that it was indeed receiving a lot of attention.

Judging by these findings, we can conclude that there was a prominent probability of a sizable bullish bounce. It bounced by as much as 26% the last time it dipped into oversold territory. While bullish expectations were high, a rally is not necessarily guaranteed hence traders should still exercise caution in case of extended downside.