Polygon zkEVM’s growth unhindered: What it means for MATIC

- Polygon zkEVM’s TVL was on the rise, as were its daily active addresses.

- MATIC was under selling pressure, and market indicators supported the bears.

Polygon’s [MATIC] zkEVM adoption has been on the rise for quite a few weeks now. The rollup’s unique addresses skyrocketed and were about to cross the 100,000 mark. At press time, the figure stood at 93,000.

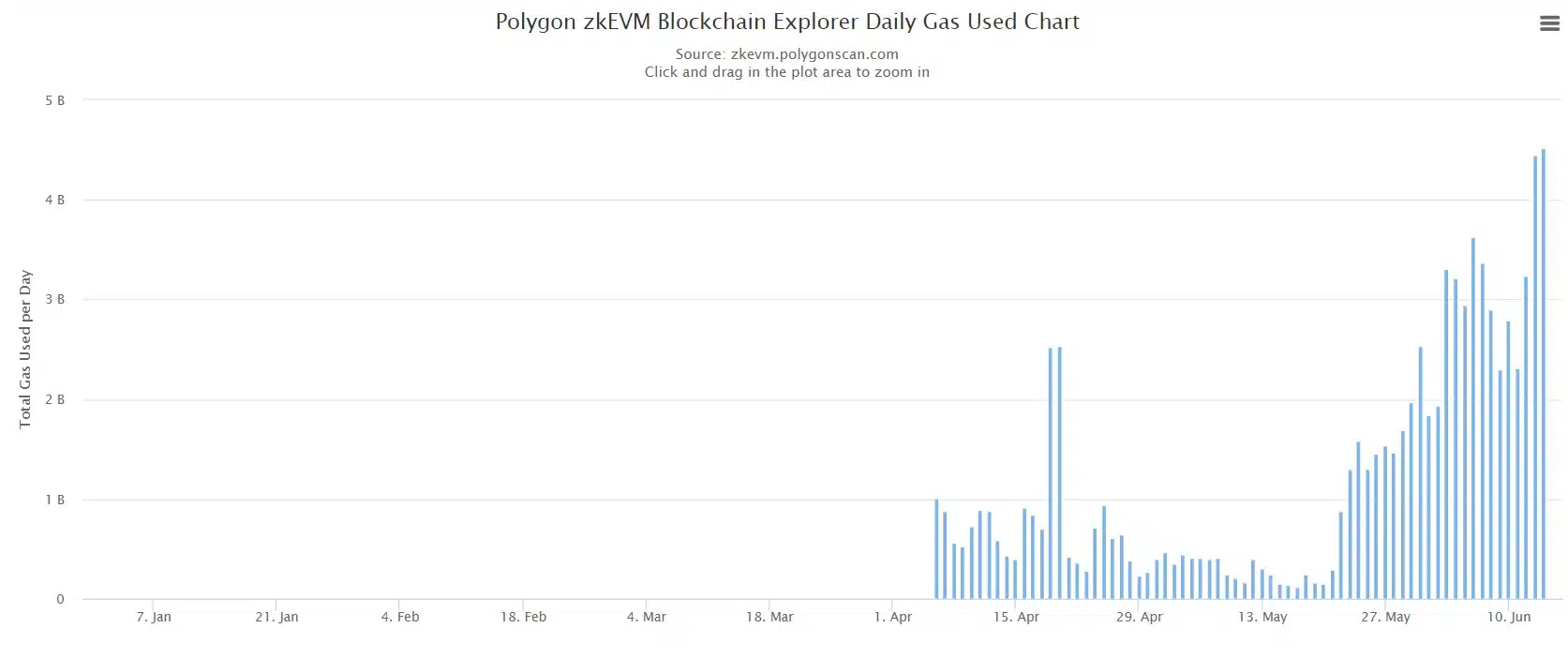

Not only did the rollup’s unique addresses register an uptick, but its daily gas use also reached an all-time high on 4 June. A hike in the metric clearly revealed increased adoption, which looked encouraging for zkEVM’s future.

A similar trend of increase was also noted on other metrics. For instance, daily transactions on zkEVM also went up over the last several weeks, as did its daily active addresses. The rollups’ overall value has also increased of late, as evident from the rise in its TVL.

Interestingly, zkEVM announced its integration with several platforms, which has increased its capabilities and offerings substantially. The latest one brings the integration of Polygon zkEVM with Magpie.

With this new addition, users can harness the power of Polygon’s zkEVM with Magpie, the first aggregator on the network, and unlock a new level of scalability, privacy, and security.

? Harness the power of Polygon’s zkEVM with Magpie, the first aggregator on the network!

Prepare to unlock a new level of scalability, privacy, and security.

Together, we can build a new nesting ground! #zkEVM #Magpie #DeFi @0xPolygonDeFi pic.twitter.com/I1sc1jJJ2a

— Magpie Protocol (@magpieprotocol) June 1, 2023

MATIC’s performance has been disappointing

While zkEVM’s ecosystem continued to flourish, MATIC’s performance favored the sellers. According to CoinMarketCap, MATIC’s price declined by 4% in the last seven days. At the time of writing, it was trading at $0.8884, with a market capitalization of over $8.2 billion.

The blockchain’s on-chain metrics revealed that the declining price trend can continue for a long time.

As per CryptoQuant, MATIC’s exchange reserve was increasing, suggesting that it was under immense selling pressure. Active addresses and the number of transactions also declined, which were both negative signals.

Polygon’s social volume declined over the last week, reflecting a decrease in the token’s social volume. Not only that, but MATIC’s weighted sentiment also sank sharply. A decline in the metric suggested that negative sentiment around MATIC dominated the market.

How much are 1,10,100 MATICs worth today?

Bears to command the market?

The Exponential Moving Average (EMA) Ribbon was bearish, as the 20-day EMA was below the 55-day EMA. MATIC’s MACD displayed the possibility of a bearish crossover soon.

Besides, Polygon’s Relative Strength Index (RSI) also registered a downtick, increasing the chances of a continued downtrend.