Polkadot announces new proposal; will DOT see a change of fate

- Polkadot proposes to increase validators, aiming to boost network activity and address revenue decline.

- Despite challenges on the social front, Polkadot’s real yield index remains strong, attracting increased stakers.

Polkadot‘s continuous development efforts have led to high activity within its network. Recent governance proposals shed light on what developers may be working on in the future, and could potentially improve the state of DOT.

New proposals on the way…

Polkadot’s proposal to increase the active set of validators on its network is one of the notable developments. The objective of this proposal is to gradually add five new validators in each era, over a span of 20 eras.

Additionally, there will be a one-time increase of three validators, bringing the total to 400 by the end of the 20 eras. This increase is believed to be a carefully considered measure that would not compromise the security of the chain.

It would also allow for natural leveling as the set of validators expands. Core developers have also agreed on similar increases in value, indicating a collective effort to enhance the network’s governance structure.

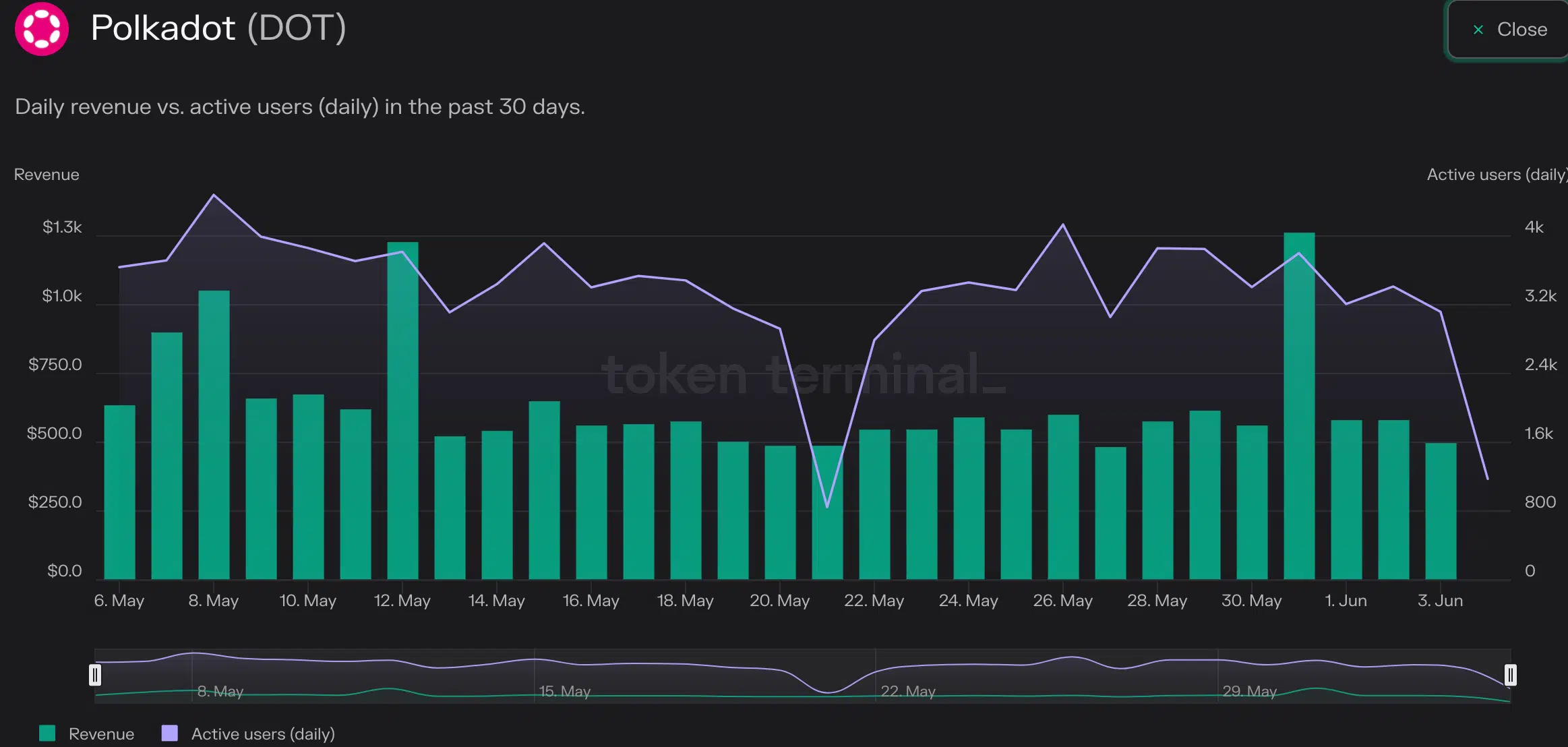

These improvements on the Polkadot network could help address Polkadot’s declining activity and revenue. According to Token Terminal’s data, the activity on Polkadot declined by 22.7% over the last month.

Additionally, the revenue generated by Polkadot during this period also experienced a decline. By implementing governance measures aimed at increasing the active set of validators, Polkadot intends to reinvigorate the network and potentially reverse these downward trends.

On the other hand, despite the decline in overall activity and revenue, Polkadot performed well in terms of the real yield index, as reported by Polkadot Insider. The real yield index is a measure of the actual return that investors or participants can earn from owning and engaging with a blockchain network, after adjusting for inflation.

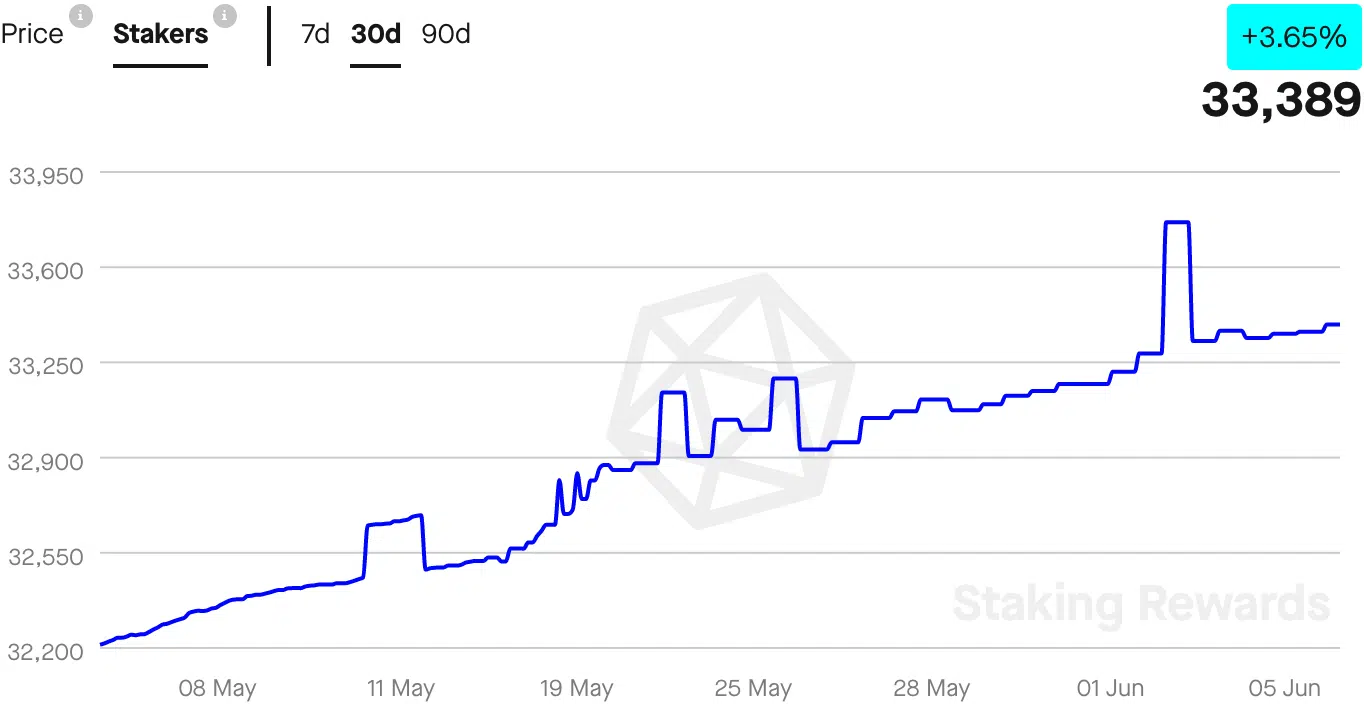

This positive aspect may have contributed to the increased interest from stakers on the Polkadot network. Staking Rewards data indicated that the number of stakers witnessed a growth of 3.65% over the last month. This increase in stakers demonstrated continued confidence in Polkadot’s potential and the desire to actively participate in the network.

This is where things could get tricky…

However, on the social front, Polkadot encountered some difficulties. According to LunarCrush’s data, the number of mentions and engagements for Polkadot fell by 59% and 36% respectively. This decline in social activity and engagement may be indicative of a waning interest or a shift in focus toward other blockchain projects.

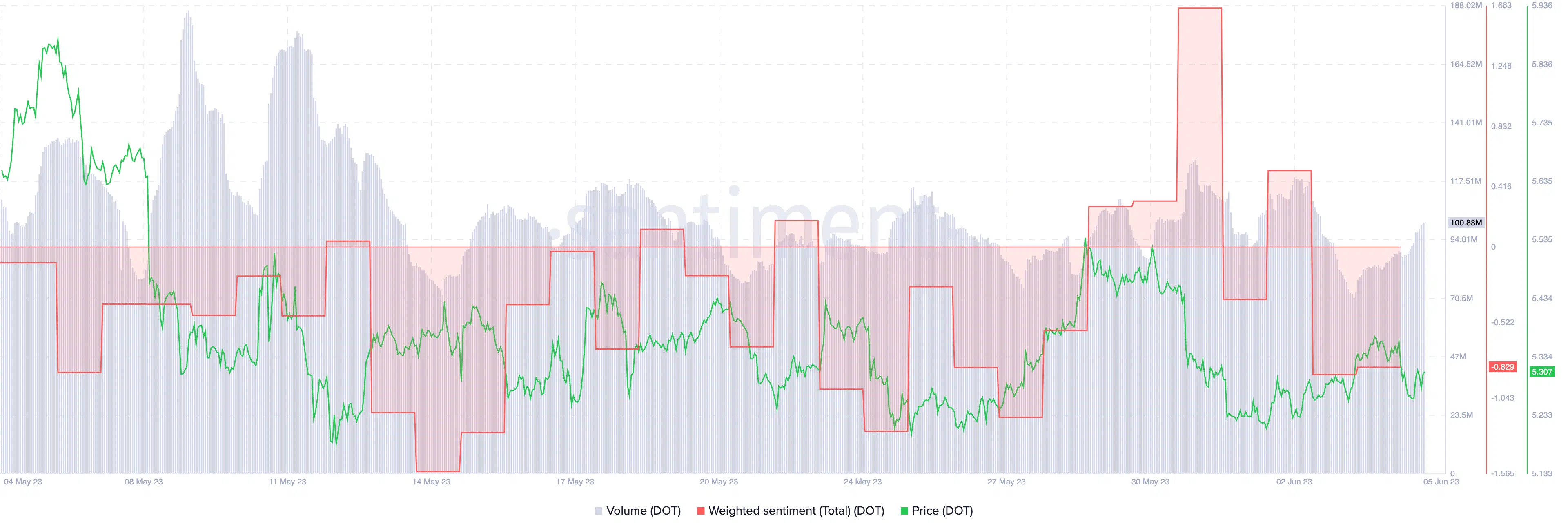

The weighted sentiment around Polkadot also experienced a drop in the last few days. This suggested that there were more people expressing negative opinions about DOT than positive ones.

In addition to these challenges, the price and volume of DOT also witnessed a drop during this period. The decrease in price and trading volume indicated a decreased demand for DOT tokens in the market.