Bitcoin: Expecting BTC to rally after FOMC’s latest update? Well…

- Bitcoin was up by 0.37% before the FOMC meeting results.

- The U.S. Federal Reserve held its federal funds interest rate at 5.25%, following an extended period of consecutive rate hikes.

The eyes of the market were on the Fed rate decision announcement from the Federal Open Market Committee (FOMC) meeting. The cryptocurrency market on the whole has experienced a turbulent few weeks. As such all eyes were fixed on the decision that would lead to price pump or dump.

Is your portfolio green? Check the Bitcoin Profit Calculator

Bitcoin [BTC] was seen to top the charts in social engagement ahead of the looming FOMC decision. A look at the 24-hour price action prior to the announcement revealed a price surge of 0.37%.

TOP COINS BY SOCIAL ENGAGEMENT

Wednesday, 14 June 2023, 10:01 UTC$btc $eth $sol $ada $dexthttps://t.co/Ye6Yvoh7kQ pic.twitter.com/lKif72QZST

— LunarCrush (@LunarCrush) June 14, 2023

In the aftermath of the FOMC meeting with no hike in interest rates, BTC didn’t stay in the green for long. The king of cryptocurrencies slipped to trading in the red and was exchanging hands 3.34% lower in the last hour of the time of writing.

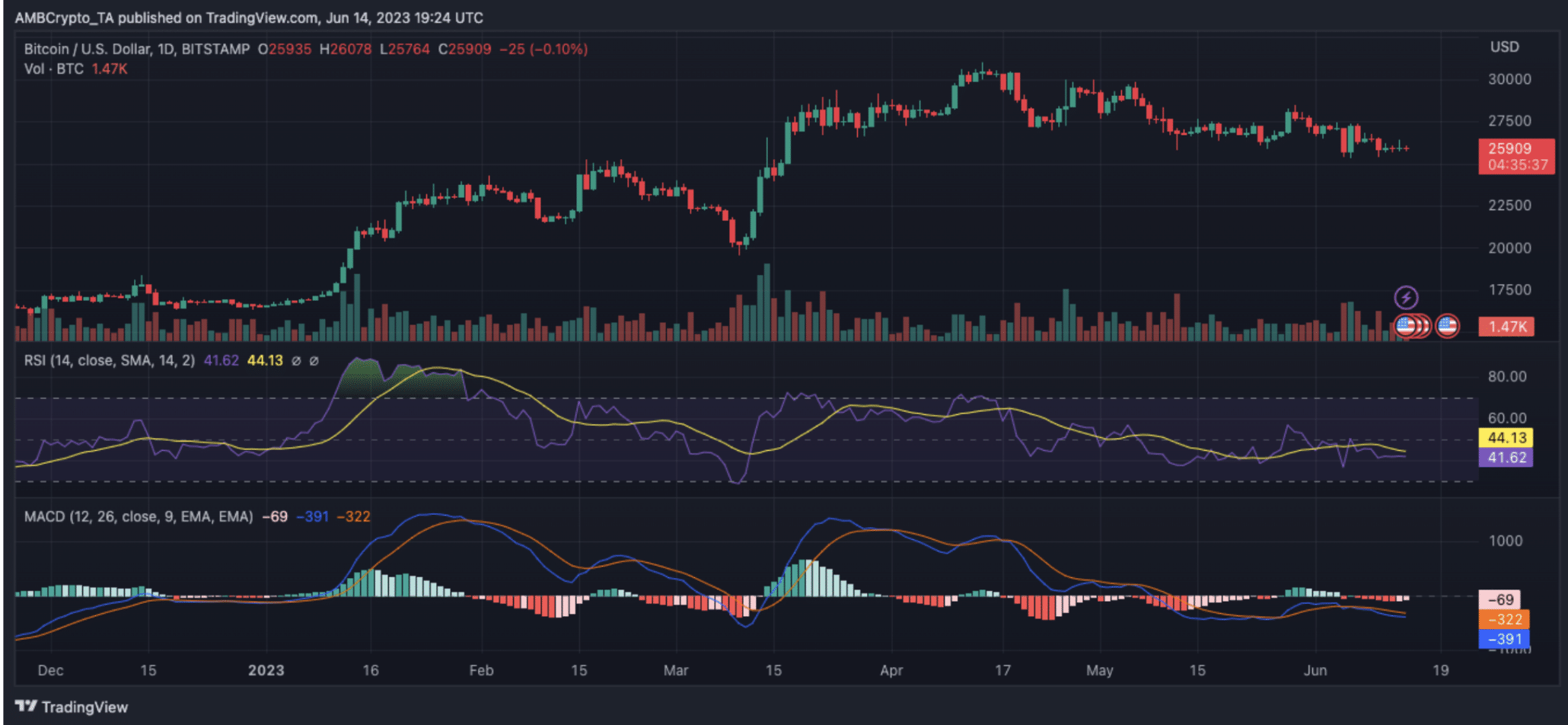

Bitcoin price reaction: Before meets after

Following the announcement, BTC didn’t exactly witness a significant price pump or dump. The cryptocurrency hovered between $25,800 and $26,000. It traded for $26,000 minutes before the Fed’s announcement, before falling to $25,756 moments afterward. BTC exchanged hands at $25,909 at press time according to TradingView.

The Relative Strength Index (RSI) oscillated below the neutral 50 level. This was a sign of limited buying pressure and pointed towards a slightly bearish momentum. However, it could also be taken as a sign that buyers and sellers were battling at a key area. Furthermore, a look at the Moving Average Convergence Divergence (MACD) highlighted a bearish stance for BTC.

At press time, the signal line (red) was above the MACD line (line), an indication of the ongoing bearish bias. Furthermore, the price move did nothing to recover the losses incurred last week. Recall that the SEC sued two of the crypto industry’s largest players (Binance and Coinbase) for securities law violations.

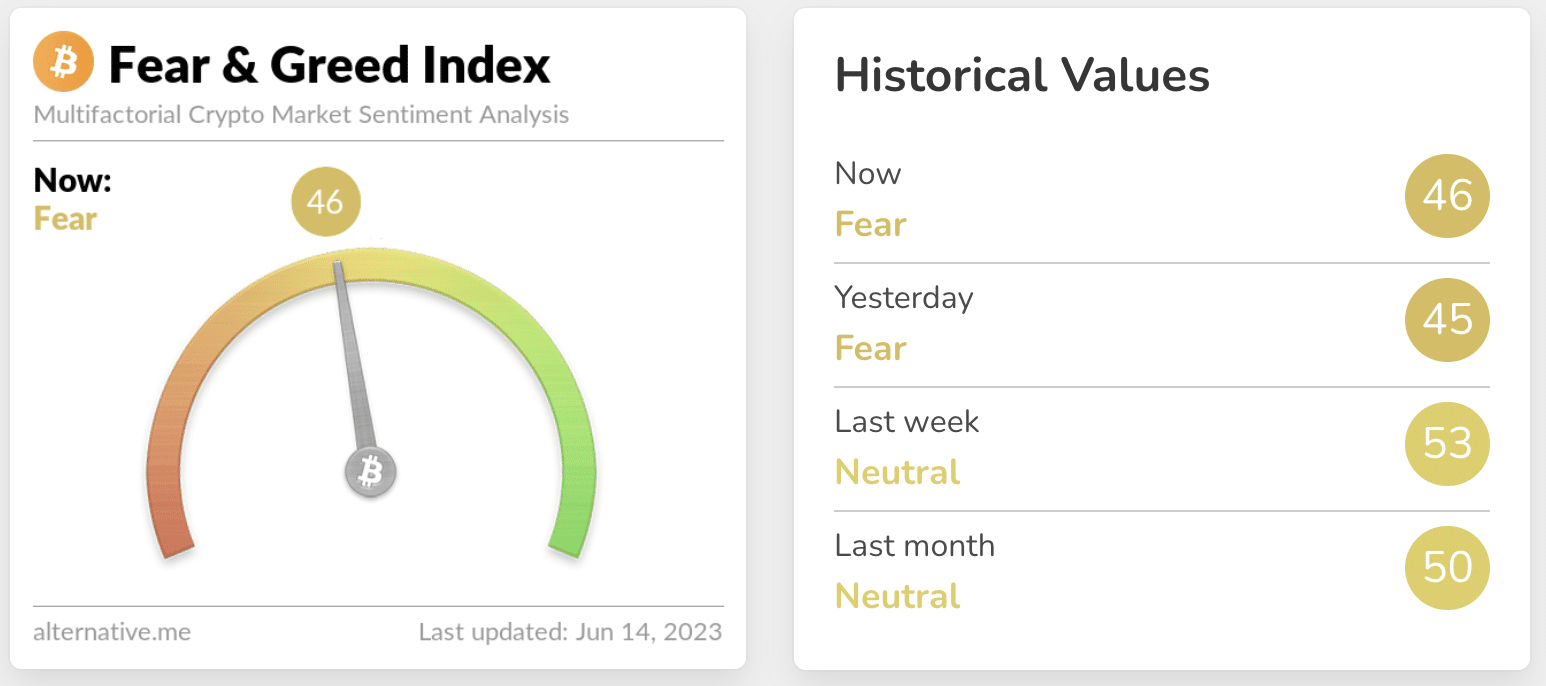

Furthermore, a look at the Bitcoin Fear and Greed Index didn’t exactly favor the sentiment around the cryptocurrency. As of 14 June, the BTC fear and greed index stood at 46, which indicated fear. This meant that investors witnessed some market skepticism at the time of writing.

Is your portfolio green? Check the Bitcoin Profit Calculator

Time to buy?

The news from the FOMC meeting was met with more questions than answers, as some attested to the ongoing price instability in the market. The lingering question remained: to buy or sell?

It annoys me to no end that Powell talks about how the Fed is responsible for price stability, but takes no responsibility for creating the instability. #Fed #FOMC

— Carol Roth (@caroljsroth) June 14, 2023

To which crypto educator, Budhil Vyas tweeted that the outcome of the FOMC meeting could be bullish and may favor market growth. However, the same may happen over a period of time and sudden movements may not be on the cards.

It should be a Positive as #FOMC didn’t raise it. NO HIKE

But due to market negative situation it might take some time to show a MOVE? https://t.co/mgTgVV1Wac— Budhil Vyas (@BudhilVyas) June 14, 2023