Maker: Can short-term bullishness push MKR towards $1500?

- MKR has a bearish swing market structure and a bullish substructure.

- Due to the short-term bullishness, a move to $1,500 appeared likely.

Maker DAO [MKR] has gained 6.7% over the past week. This figure would have been closer to 20%, but the swift losses of Bitcoin [BTC] on Saturday took MKR token prices down 11%.

The Maker DAO token could likely resume its upward trajectory in the coming days.

Buying pressure signals bullish intent

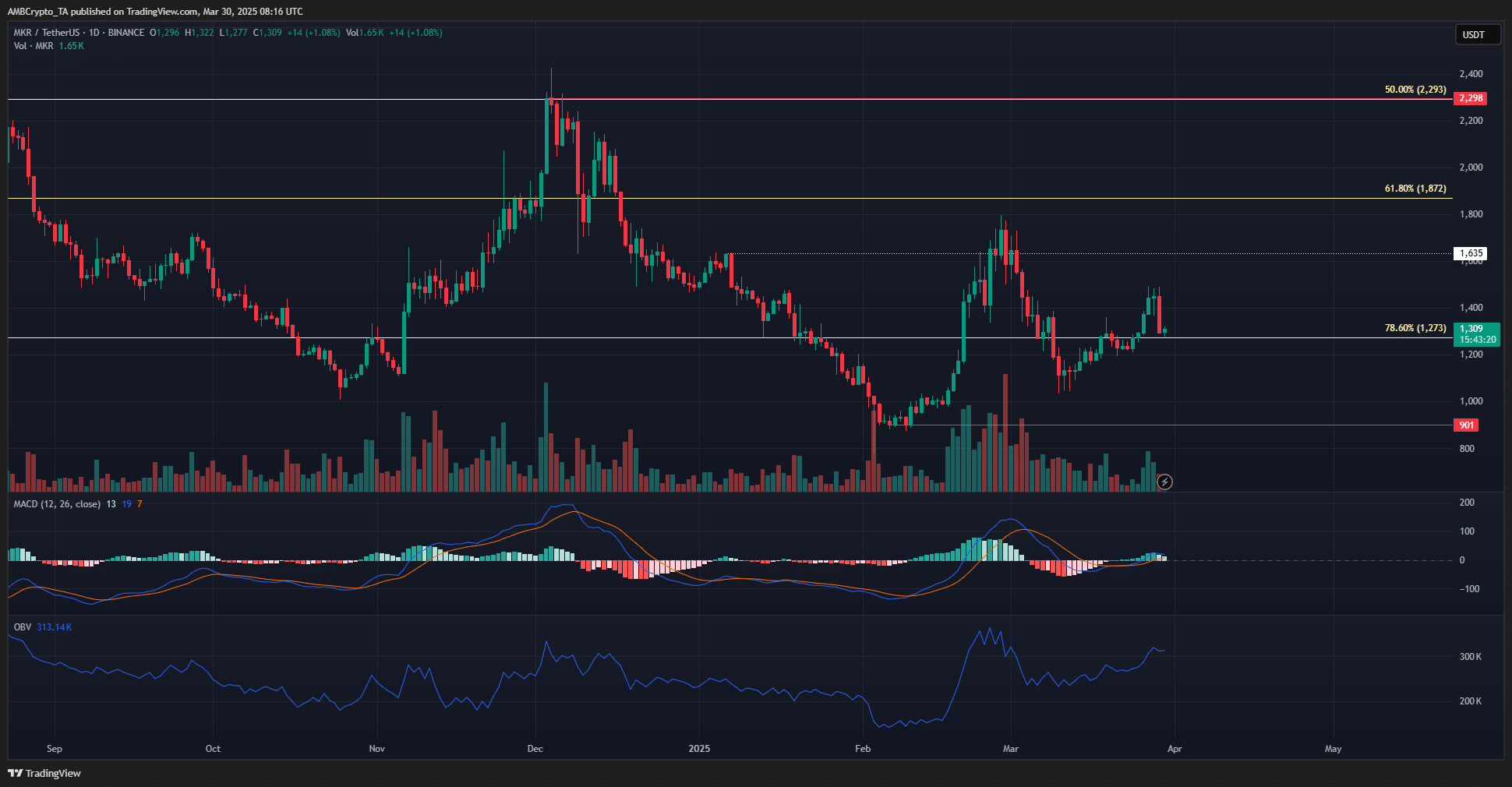

The 1-day chart showed that MKR has a bearish swing structure and a bullish substructure, both of which are studied using swing highs and lows.

The swing structure refers to the longer-term structure, which is likely to dictate the trend in the coming months. The substructure was bullish after the late February rally beyond $1,635.

This bullish substructure was still in play but would be broken if the price fell below $1,115. Therefore, investors have reason to be cautiously optimistic. The OBV also agreed with this finding.

It showed steady buying pressure over the past month. The retracement to $1,115 in early March did not suppress the bulls too much.

There has been renewed buying pressure in the past three weeks as Maker DAO prices bounced from $1,115 to $1,309.

The MACD also climbed above the zero line, but was barely above the level. As such, it did now show overwhelmingly bullish momentum on the daily chart.

The Fibonacci levels also helped the analysis. With the price able to climb back above the 78.6% level at $1,273, it was a clue that a recovery was possible.

Yet, due to the bearish swing structure, bulls should be prepared to take profits and cut losses quickly, if the buying pressure begins to slacken.

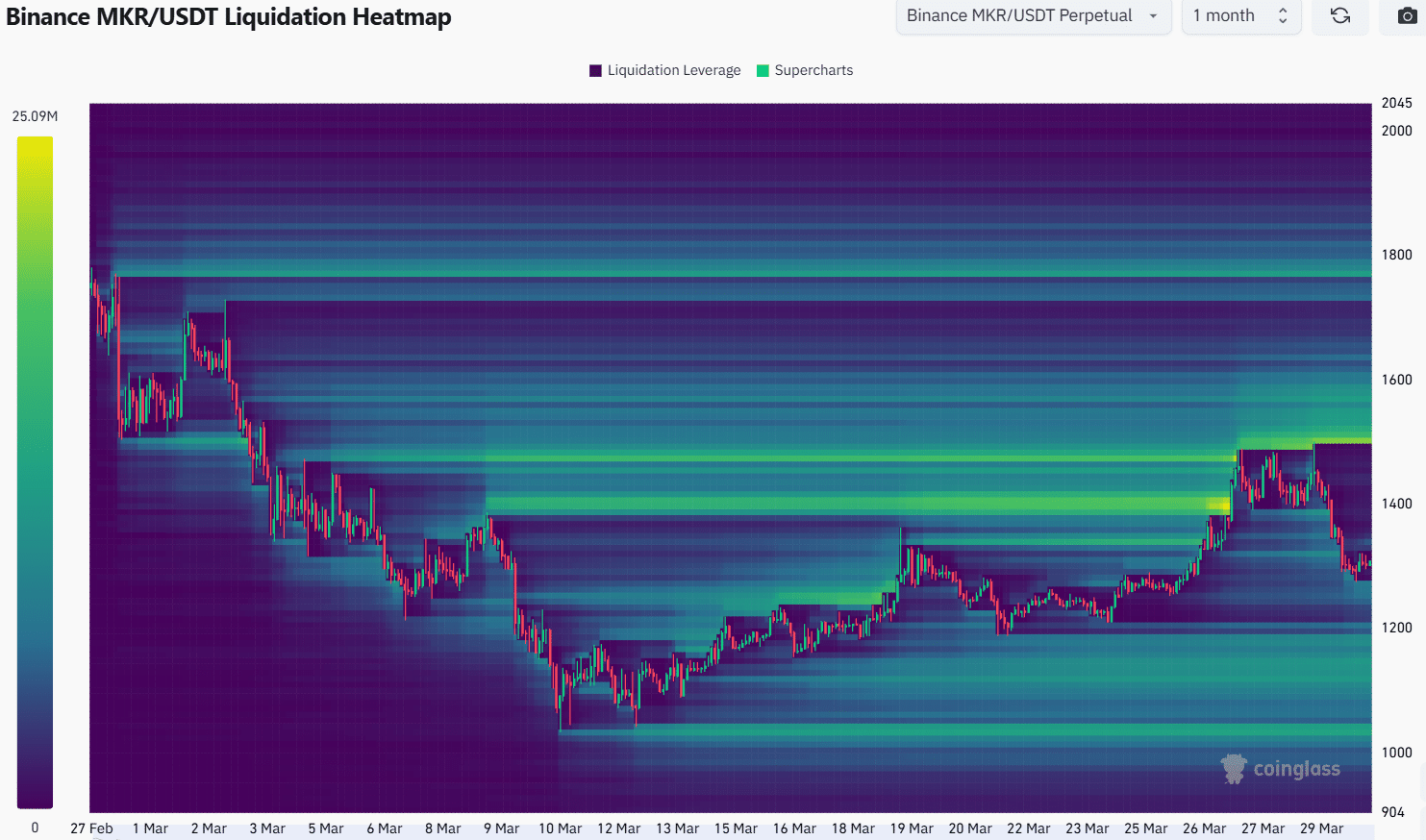

Source: Coinglass

The liquidation heatmap showed that the $1,500 level was the next target, as it was a strong magnetic zone. The $1,160-$1,180 was also a region which could attract the prices lower.

Apart from the losses on Saturday, MKR has maintained a bullish trend over the past few days. This short-term bullishness could take over and drive the price to $1,500 once more.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion