MATIC’s recovery elusive amidst regulatory uncertainty

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

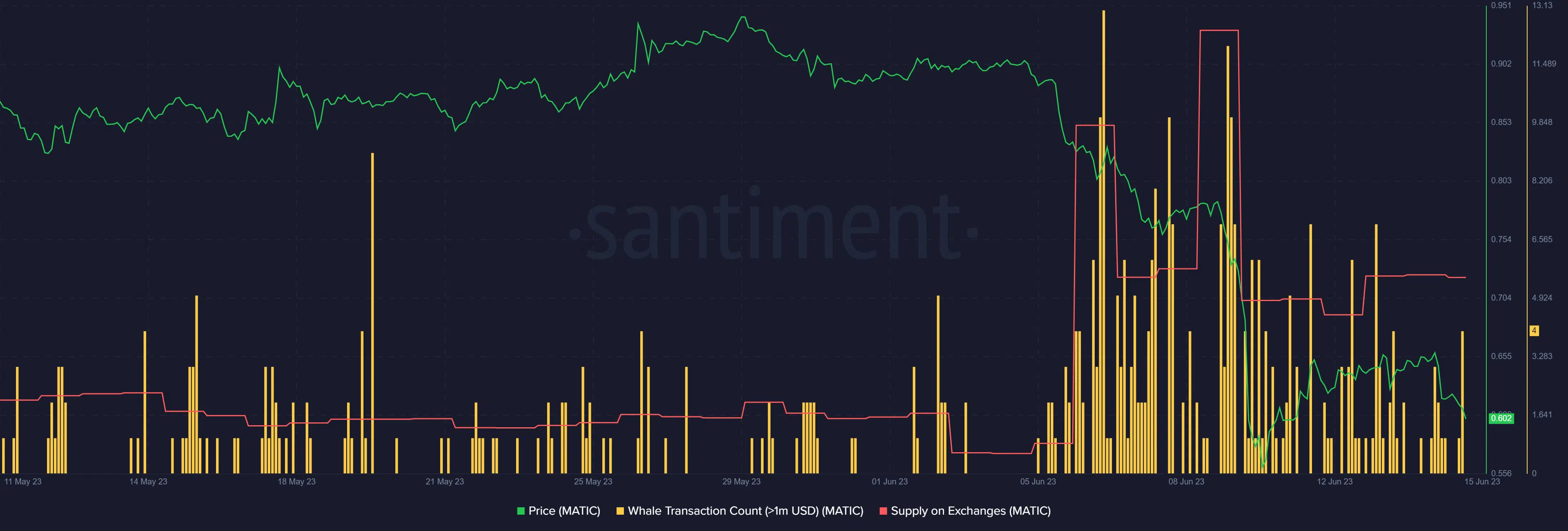

- MATIC has lost over 30% of its value since 5 June.

- MATIC saw significant whale interest, but a strong recovery wasn’t observed.

Uncertainty still looms for Polygon [MATIC] after its classification as a security by the US SEC in early June. In addition, Bitcoin’s [BTC] drop to $24k after the Fed decision could further complicate MATIC’s price chart performance.

Read Polygon’s [MATIC] Price Prediction 2023-24

At press time, MATIC’s drop eased below its descending channel’s mid-range of $0.6530. But the mid-range has become a key roadblock for bulls. It has shed over 30% of its value since 5 June, dropping from $0.90 to $0.60.

Prices to drop further?

MATIC’s drop eased at the bullish order block (OB) of $0.3160 – $0.5010 (cyan), formed on the weekly chart on 13 June 2022. Notably, an overhead resistance level at $0.6984 is above the mid-range.

The decline in CMF and RSI reiterates increased selling pressure and capital outflows from MATIC’s market.

So, MATIC could face a price rejection at the mid-range level of $0.6530 and retest the bullish OB of $0.3160 – $0.5010. A breach of this key support zone could expose MATIC to more aggressive selling and potentially push MATIC to $0.1800.

But if the bullish OB doesn’t crack despite the uncertainty, MATIC could see a rebound from this level. The immediate target for such a likely rebound will be the $0.6984 resistance. But bulls must clear the mid-range roadblock before advancing.

MATIC’s supply on exchanges spiked

The US regulatory pressure unnerved some whales, as seen by the spike in >$1 million whale transactions (yellow) in the past few days. However, despite whale interest, there wasn’t a strong upswing at the time of writing.

How much are 1,10,100 MATICs worth today?

Besides, the supply on exchanges, which tracks short-term selling pressure, saw rapid movements in the same period. It hiked sharply, declined, and spiked again only to ease at press time. It shows that MATIC’s selling pressure looms due to regulatory uncertainty.