Arbitrum’s declining metrics point towards…

- Arbitrum’s daily active users and number of transactions plummeted over the last month.

- ARB’s price increased marginally as sentiment around the token improved.

Arbitrum Insider, a popular Twitter account that posts updates related to the Arbitrum [ARB] ecosystem, revealed that the network’s total gas fees soared in the last 24 hours. However, a look at other on-chain metrics told a different story.

Read Arbitrum’s [ARB] Price Prediction 2023-24

Arbitrum’s health check

As per the 18 June tweet, top projects contributed to Arbitrum’s surge, such as Stargate, Circle, Layer Zero, and more.

? Gas fees on @arbitrum blasting off! ?

With soaring total gas fees in the past 24 hours, it's clear that notable projects are witnessing massive adoption and usage. ?

Join the revolution and harness the power of Arbitrum for yourself! ?#Arbitrum $ARB pic.twitter.com/YOFtlZKO5D

— Arbitrum Insider (?,?) (@arbinsider) June 18, 2023

Though a high total gas fee means increased usage, the scenario was different in this case. Arbitrum’s daily fees have been declining for the last 30 days, as per Token Terminal. This caused the network’s revenue to plummet as well over the last month.

If that was not enough, Artemis’ data gave even more cause for concern. As per the charts, ARB’s daily active addresses were declining. The number of daily transactions followed a similar trend.

These metrics suggested that Arbitrum’s adoption and usage deteriorated over the past 30 days.

ARB investors not content

ARB’s performance has also been sluggish, as evident from its price chart. According to CoinMarketCap, ARB’s price has only increased by nearly 1% in the last seven days.

At the time of writing, ARB was trading at $0.9964 with a market capitalization of over $1.2 billion, making it the 36th largest crypto.

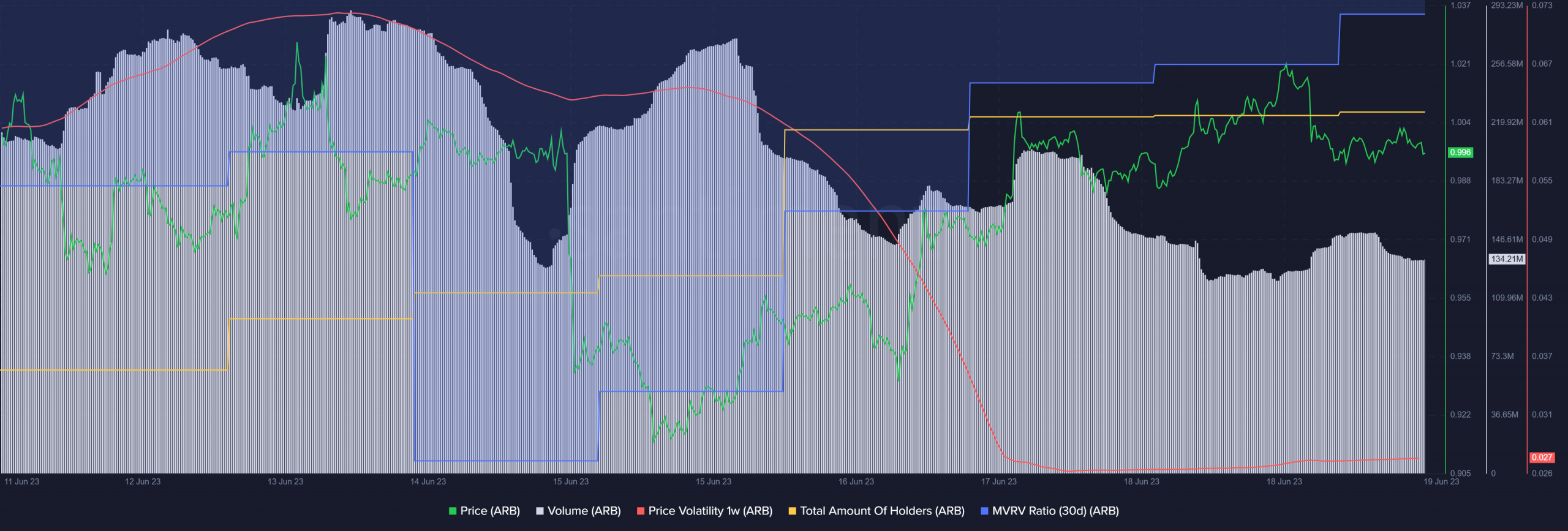

A look at ARB’s on-chain metrics gave an understanding of what went wrong. For instance, ARB’s volume declined, which indicated a lower willingness of investors to trade the token. ARB’s 1-week price volatility also plummeted.

However, it was interesting to note that despite the less volatile week, the total number of ARB holders rose, as did the MVRV ratio, which was encouraging.

How much are 1,10,100 ARBs worth today

Market sentiment around Arbitrum changed

Investors’ confidence in ARB seemed to have increased last week, as evident from Santiment’s chart. ARB’s weighted sentiment improved drastically in the last seven days, which was optimistic.

However, its social volume plummeted sharply, reflecting that the token was not making much of an impact at press time.