How GMX improves Arbitrum’s prospects for success

- GMX’s volume on Arbitrum surged by 162.4% in a month.

- Despite a decline in overall activity, Arbitrum’s revenue continued to rise.

Decentralized exchanges (DEXes) are witnessing a surge in interest as trust in centralized exchanges dwindles. In particular, GMX, one of the most popular DEXes on the Arbitrum[ARB] protocol, experienced a remarkable 162.4% increase in volume over the past month.

Is your portfolio green? Check out the Arbitrum Profit Calculator

The growing interest in perpetual DEXes holds the potential to benefit both GMX and the Arbitrum ecosystem in the long run.

GMX assists Arbitrum

Recent data highlighted the substantial uptick in volume on GMX, which has seen an impressive surge of 162.4% over the past month. As a prominent DEX on the Arbitrum protocol, GMX’s performance indicates a growing appetite for decentralized trading options among users.

Perpetual DEXs have seen significant volume over the last month.@muxprotocol appears to be the outlier, trading at a $46M TVL with $69M in volume (0.65x TVL to volume)

Compare that to other Perp DEXs:

– $GNS 0.86x

– $GMX 2.81x

– $SNX 1.40X pic.twitter.com/HJGccOZHsp— Emperor Osmo? (@Flowslikeosmo) June 22, 2023

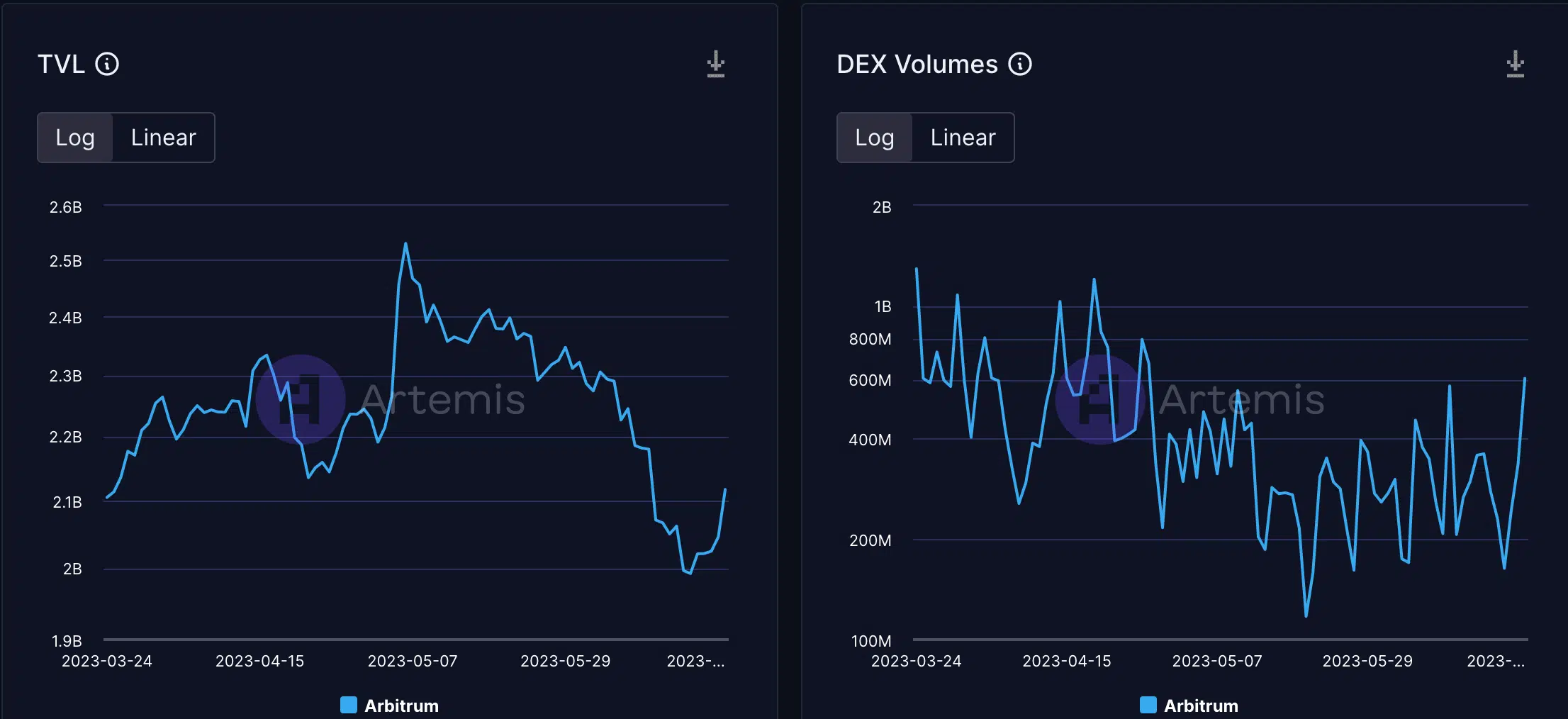

Arbitrum’s overall DEX volumes have also witnessed a significant boost, climbing from $163 million to $607 million in the last few days, according to Artemis data. This surge in trading activity has contributed to the growth of Total Value Locked (TVL) on Arbitrum, reaching $2.12 billion from $2 billion within the same period.

While overall activity on the Arbitrum protocol experienced a 5% decline over the past week, the revenue generated by the platform continued to rise. Revenue rose by 14.4% during the same period.

This positive revenue trend suggests that despite a temporary decline in user activity, the platform’s monetization potential remained intact.

The upcoming implementation of Ethereum’s EIP 4844, introducing danksharding and “blobs” to the network, is expected to further augment revenue generation on Arbitrum. By reducing transaction costs on Layer 2 networks, the EIP 4844 will likely attract a larger user base to protocols like Arbitrum. This can lead to increased fees for the platform.

State of ARB

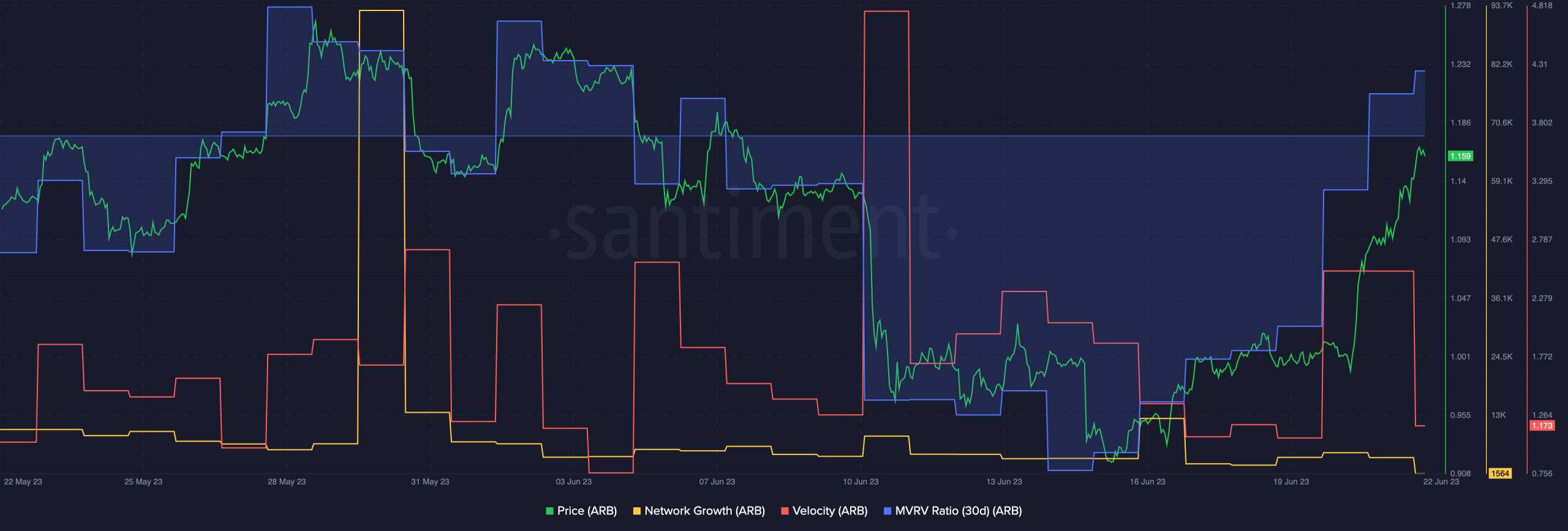

At the time of writing, the ARB token was trading at $1.16, displaying notable price growth in recent days. However, network growth of ARB declined, indicating a relatively lower level of interest from new addresses.

Realistic or not, here’s ARB’s market cap in BTC’s terms

Additionally, a decrease in the velocity of ARB transactions suggested a reduction in overall activity.

As ARB’s price grew, the MVRV ratio rose as well, indicating profitable positions for many addresses. If this trend continues, selling pressure could rise among these addresses, impacting AR negatively in the future.