LSTs overshadow traditional ETH use; will ETH remain unaffected?

- LSTs have taken over Ethereum as collateral on DeFi platforms.

- Liquid staking accounted for around 28% of the staking market share.

With the launch of Ethereum [ETH] staking, stakers have created more utility for their LSTs as it is gradually replacing ETH as collateral. According to recent reports, Liquid Staking Tokens (LSTs) are reshaping the Ethereum DeFi landscape. Thus, overshadowing traditional ETH usage as a preferred collateral choice.

Read Ethereum’s [ETH] Price Prediction 2023-24

Integrating ETH with the Proof of Stake (PoS) network unleashed a new dimension of Decentralized Finance within the Ethereum ecosystem. In a recent development highlighted by Messari, Liquid Staking Tokens (LSTs) are steadily gaining ground as the preferred form of collateral for DeFi applications.

This is gradually overshadowing the traditional use of ETH.

Ethereum DeFi space sees growth of LST collateral

Messari recently reported a notable trend where LSTs had gained traction as a favored form of collateral in Ethereum’s DeFi ecosystem. This shift was particularly evident in the lending sector. Furthermore, LSTs were seen replacing ETH as the primary choice for collateral.

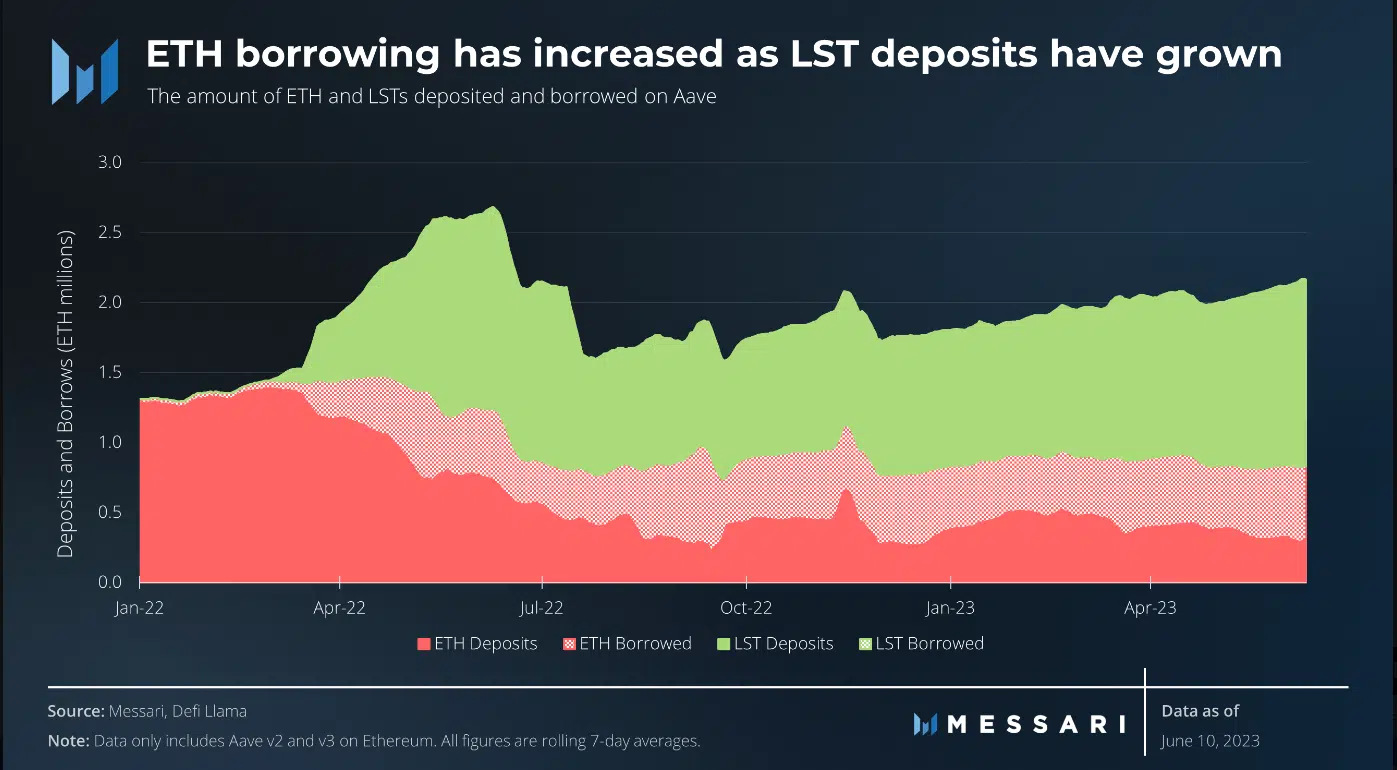

Data from Aave’s staking and borrowing activities revealed a significant surge in LST usage. This led to LSTs surpassing ETH to become the largest collateral asset, as depicted in Messari’s chart.

Additionally, ever since the implementation of the Merge, LSTs experienced a remarkable surge in popularity. They accounted for around 20% of Total Value Locked (TVL) across various liquid staking protocols.

The term “LST” derives from its inherent liquidity, allowing users to stake their assets while navigating the DeFi landscape and earning additional yields.

Staking and borrowing on Aave

DefiLlama’s data provided insights into the borrowing and staking activities on Aave, shedding light on the substantial volume of transactions. A deep dive into Aave V2 revealed that the staking volume exceeded $187 million while borrowing reached over $1.7 billion.

Furthermore, in the borrowing landscape of Aave V3, the borrowing volume surpassed $960 million. When comparing these statistics with the earlier Messari data, it becomes evident that LSTs emerged as the primary collateral on the Aave platform. This was in comparison to Ethereum.

Ethereum staking landscape

Based on data provided by Hildobby on Dune Analytics, the current figures indicated that over 25.3 million ETH was deposited. The current deposit accounted for approximately 21.10% of the total ETH supply.

Liquid staking commanded a significant share of the market, representing over 28%. Additionally, the data revealed a continuous influx of new stakes, with over 1000 ETH staked as of this writing.

Is your portfolio green? Check out the Ethereum Profit Calculator

Furthermore, on a daily timeframe, ETH displayed positive trends. As of this writing, it was trading around $1,900, showcasing a minor increase of less than 1% in value on top of the 5% surge witnessed on 21 June.

Furthermore, the price chart also indicated that ETH had surpassed its short Moving Average (yellow line). This previously served as a resistance level. Additionally, the Relative Strength Index (RSI) showed that ETH was experiencing a strong bull trend.