Bitcoin in Peter Schiff’s books: Valid views or skeptic critic?

- Schiff mentioned that Bitcoin’s rally might put a stop to the uptick enjoyed by other assets outside the crypto market.

- Long-term holders displayed high confidence in BTC as Schiff’s favorite lagged behind.

Peter Schiff, a well-known economist and financial commentator, has repeatedly made his stance on Bitcoin [BTC] clear through public statements and numerous tweets. While some view his thoughts as valid critiques backed by sound economic reasoning, others perceive them as skeptical and dismissive of the cryptocurrency market at large.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

In another round of employing his Bitcoin hammer, Schiff opined that the recent surge above $30,000 means the king coin was late to the party, already enjoyed by other speculative assets. Referring to the entire crypto assets as “low quality”, Schiff pointed out,

“Now that Bitcoin has finally joined the party, perhaps it’s a sign that the party will soon end. Usually, rallies end when the lowest quality stuff finally participates.”

Before the latest rally, Schiff had also mentioned that Bitcoin lacked long-term demand. He had also highlighted that investors involved with the $594 billion market cap coin were gambling.

Schiff’s gold can’t match BTC, still…

Never ashamed to call gold the best store of value, the global strategist at Euro Pacific Asset Management’s criticism of BTC started as early as 2013.

And despite several incidents that seem to have proven his opinion wrong, Schiff has never backed down on his viewpoint. In fact, he once called Bitcoin’s “digital gold” reference a hoax that would never materialize to anything relevant.

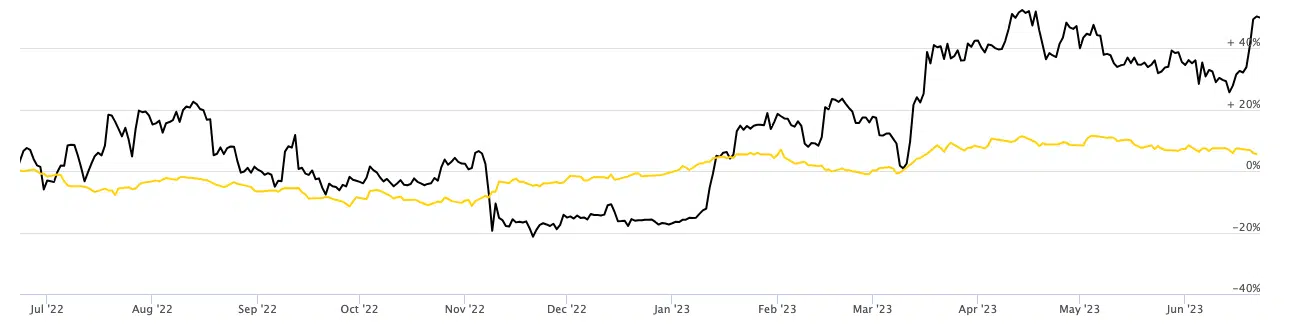

However, Schiff’s constant criticism has not yielded the results the man would have desired. On a Year-To-Date (YTD) basis, BTC’s performance was an 84.57% hike.

Gold, on the other hand, could only boast of a 6.26% hike within the same period, according to data from Longtermtrends.

But in this same year, both Bitcoin and Gold have had a strong correlation. This happened around March when several traditional institutions were plagued with challenges. During this period, Schiff boasted that gold should be the go-to safe haven.

During this period, CoinShares’ Head of Research, James Butterfill, explained that both assets seemed like a less risky investment. This was his conclusion when he compared Bitcoin to other assets, like the S&P 500. Yahoo Finance reported Butterfill’s opinion where he said,

“As Bitcoin begins to behave more like a safe haven asset and less like a risky one, there are some fundamental similarities between Bitcoin and gold that are notable.”

Calls maxis “marketing frauds”

In exploring Shiff’s underlying arguments and understanding of the crypto landscape, let’s take it back to 2021.

At that time, Schiff engaged in a heated debate with SkyBridgeCapital CEO and Bitcoin maximalist Anthony Scaramucci.

The debate, which was hosted on the Intelligence Squared YouTube channel had Scaramucci mention that Bitcoin’s scarcity and portable feature would ensure that it transcends gold in the long term.

“Bitcoin is being adopted quite rapidly and the result of this means that the price is going to go a lot higher.”

On his part, Schiff argued that Bitcoin and gold have absolutely nothing in common. He also added that,

“Part of the marketing fraud is to try and portray Bitcoin as gold— gold 2.0, digital gold. It’s just a string of numbers without any sustainable value.”

Long-term holders care less about these rants

However, things took a surprising turn recently when Schiff tweeted about a certain collaboration with inscriptions on Bitcoin Ordinals.

For context, Bitcoin Ordinals are protocols that allow digital assets to be inscribed on satoshis — the smallest Bitcoin unit. While these assets are similar to NFTs, they are stored in a separate data structure on the Bitcoin blockchain.

In response to Schiff’s tweet, crypto investor Anthony Pompliano welcomed the gold advocate to the Bitcoin family. However, the critic was quick to rebuke the gesture. In addition, he noted that he was still steadfast in his condemnation of the coin.

By and large, Peter Schiff’s constant opinions have sometimes drawn some prospective investors away from accumulating BTC. But it seemed that price alone has not been the only factor that has helped win the heart of the Bitcoin faithful.

According to Glassnode, Bitcoin’s reserve risk — a long-term cycle indicator, was at a low point. Typically, the metric compares the motive to sell at the prevailing market price against long-term holders’ resistance to liquidate, even in unfavorable market conditions.

Is your portfolio green? Check the Bitcoin Profit Calculator

When the metric rises significantly, it implies that holders’ conviction to keep possession of the coin is low. But the low value means that long-term holders’ confidence in BTC was extremely high.

In conclusion, Peter Schiff’s views on Bitcoin can be characterized mostly as skepticism or his resolve not to pander to his long string of wrong calls.

While he has often expressed concerns about its volatility and price fluctuations, his points about whether it’s a long-term store of wealth might not stop soon.