What XRP’s decoupling means for you

- XRP’s daily chart revealed that the bears were taking over the bulls.

- However, sentiment around the token has improved over the last week.

After last week’s bull rally, multiple altcoins have still been registering marginal growth. However, the case with Ripple [XRP] seemed different.

Read Ripple’s [XRP] Price Prediction 2023-24

XRP is behaving differently

While most altcoins were registering marginal growth, Santiment’s tweet revealed that XRP was witnessing more transactions in loss than profit. As per the tweet, if history is to be believed, this looked slightly bullish.

This is because coins moving at a greater ratio at a loss compared to a profit have a higher likelihood of rising in value.

XRP’s price has also declined slightly, by 0.7%, over the last 24 hours, as per CoinMarketCap. At the time of writing, it was trading at $0.4814 with a market capitalization of more than $25 billion, making it the sixth-largest crypto.

But is a trend reversal awaiting?

Investors must wait

A look at XRP’s daily chart suggested that the token’s bull rally might get delayed, as most market indicators were bearish. For instance, the MACD displayed a bearish edge in the market.

The token’s Money Flow Index (MFI) moved southward. As per the Exponential Moving Average (EMA) Ribbon, the gap between the 20-day and 55-day EMA was also reducing, yet another bearish signal.

Nonetheless, XRP’s Chaikin Money Flow (CMF) was bullish as it registered an uptick.

This is what metrics suggest

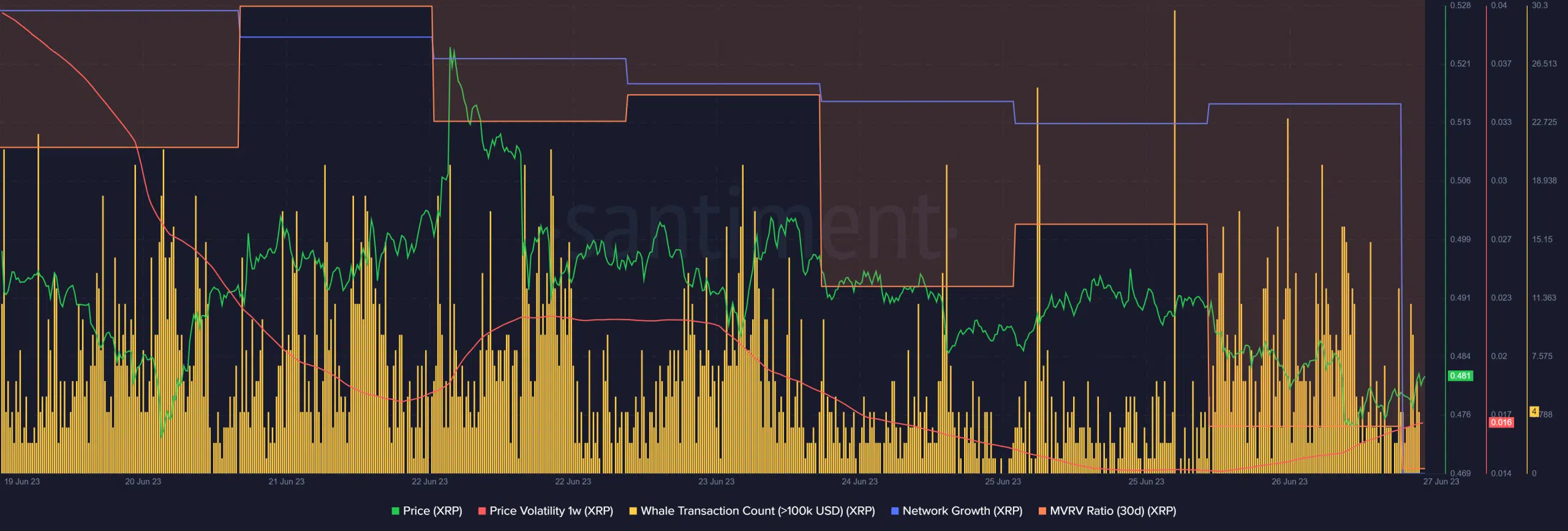

The metrics also told a similar story. Whale activity increased while the token’s price was declining, suggesting that the big shots might be selling their assets. Ripple’s network growth also declined marginally.

Additionally, XRP’s 1-week price volatility sank, decreasing the chances of a sudden uptrend. However, XRP’s MVRV Ratio was down substantially, which could be a possible market bottom indicator.

Is your portfolio green? Check the XRP Profit Calculator

Confidence in XRP is high

XRP’s social volume has remained relatively stable over the last seven days. The metric revealed that the token remained a topic of discussion in the crypto space.

Confidence in the token also increased substantially last week, as evident from the rise in its weighted sentiment.