Are XRP sellers back in the game?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Price rejection at bearish OB halved week-long gains.

- Market sentiment inclined to sellers with 52.2% shorts advantage over longs.

Ripple [XRP] has been on a steady uptrend, since 16 June. From 16 June to 22 June, XRP bulls rallied from the $0.4600 price zone and steadily drove prices higher to reach a mini-high at $0.5277.

Read Ripple’s [XRP] Price Prediction 2023-24

This move amounted to gains of 15.5% within a week but almost half of the gains were erased within a 12-hour period on 22 June. A swift price rejection at the bearish order block ($0.5200 – $0.5400) saw prices sink under the $0.4940 resistance level.

Bearish order block halts bullish rally

The Volume Profile Visible Range (VPVR) tool showed the Point of Control (red) at $0.4620. This marked it as the point where the most volume of trading occurred in the visible range, which extended back to late March.

The Value Area High was at $0.5456 (confluence with key resistance) and the Value Area Low was at $0.4172 (confluence with key support). This marked levels for traders to keep an eye out for price movements which could determine XRP’s long-term trend.

With the POC serving as a base for the previous bullish rally, a break below it could signal a shift in momentum from bullish to bearish. However, bulls could yet rally again from that level, especially with the overall bullish sentiment still prevalent in the market.

In the meantime, the Relative Strength Index (RSI) remained under the neutral 50, hinting at insufficient demand for a sustained rally. The Chaikin Money Flow (CMF) dipped under the zero mark on 23 June. It climbed briefly to +0.09 before slumping to +0.02. Overall it showed decreasing capital flows into XRP.

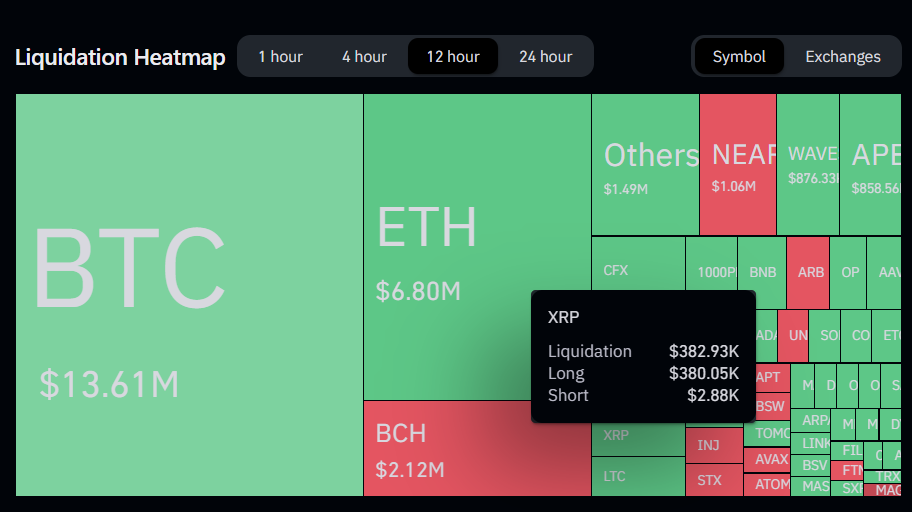

Sellers backed in the futures market

The long/short ratio data from Coinglass highlighted the bearish advantage, as shorts held a 52.2% edge on the 12-hour timeframe. This suggested a possible lack of bullish conviction with speculators more inclined to short XRP at the current price.

Realistic or not, here’s XRP’s market cap in BTC terms

Similarly, liquidation data showed longs were caught out. Out of the $382.93k liquidated in the 12 hours before press time, $380.05k worth of positions were long. This indicated current market sentiment was firmly in favor of the sellers.

Source: Coinglass