Tron rebounds in H1 2023; will the bull run continue in H2?

- In H1, Tron launched Stake 2.0, along with a few new features.

- TRX was up by 3.5% over the last week, and market indicators remained bullish.

The first half of 2023 saw Tron’s [TRX] network activity surge, alongside the release of new features such as Staking 2.0. Though the last quarter witnessed a price decline, the upcoming half might be different, as it started on a good note in terms of investors’ interest.

Is your portfolio green? Check out the Tron Profit Calculator

A look at Tron’s state in H1 2023

Tron’s 6 July tweet first mentioned updates related to the blockchain’s adoption. For instance, After Dominica accepted Tron as its national blockchain infrastructure. In March 2023, the blockchain forged yet another partnership with the country by leading the Dominica Digital Identity.

Apart from that, Sint Maarten’s United People’s Party planned to submit an initiative law in January to officially make Tron the country’s legal tender.

?#TRON 2023 Mid-Year Milestones

Halfway through 2023, #TRON continues to drive the sustainable growth of the #blockchain and #Web3 industry, thanks to a thriving ecosystem and open network.

Let’s review #TRON’s milestones.? pic.twitter.com/JAHcpiZyrr

— TRON DAO (@trondao) July 7, 2023

Tron also passed two proposals in the last month, named Proposals 82 and 83, which were followed by the launch of its new staking mechanism, Tron Stake 2.0. The launch of Stake 2.0 brought with it multiple new features that solved multiple challenges.

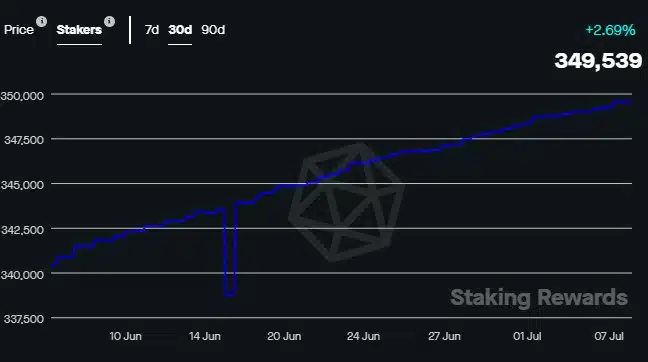

Considering the added capabilities and features that Stake 2.0 brought, it was likely that the number of more stakers would increase. However, the performance of Stake 2.0 was not up to par, as, after the launch, Tron’s staking metrics witnessed a decline.

Tron’s network stats soared

Consequently, Tron’s adoption got another boost, which was evident from its key network stats. For instance, the total number of wallets exceeded the 160 million mark a few days ago.

At the time of writing, TRONSCAN’s data revealed that the number was above 170 million, which was encouraging. A similar growth was also noted in terms of the blockchain’s total transactions, which at press time, had surpassed 6 billion.

Interestingly, though there were quite a few setbacks in Q2, the overall performance on the price front in H1 was promising. TRX started the year with a value of nearly $0.0545 and closed the half with an uptick as its value reached about $0.074.

A dive into Q3 2023

Speaking of staking, as per Staking Reward’s chart, Q3 started on a good note as the number of TRX stakers increased over the last week. At the time of writing, TRX had a staking ratio of 41.27% and a staking market capitalization of over $2.8 billion.

A similar upward trend was also seen in terms of the token’s price. According to CoinMarketCap, TRX was up by 3.5% in the last seven days. While writing, it was trading at $0.07793, with a market cap of more than $7 billion.

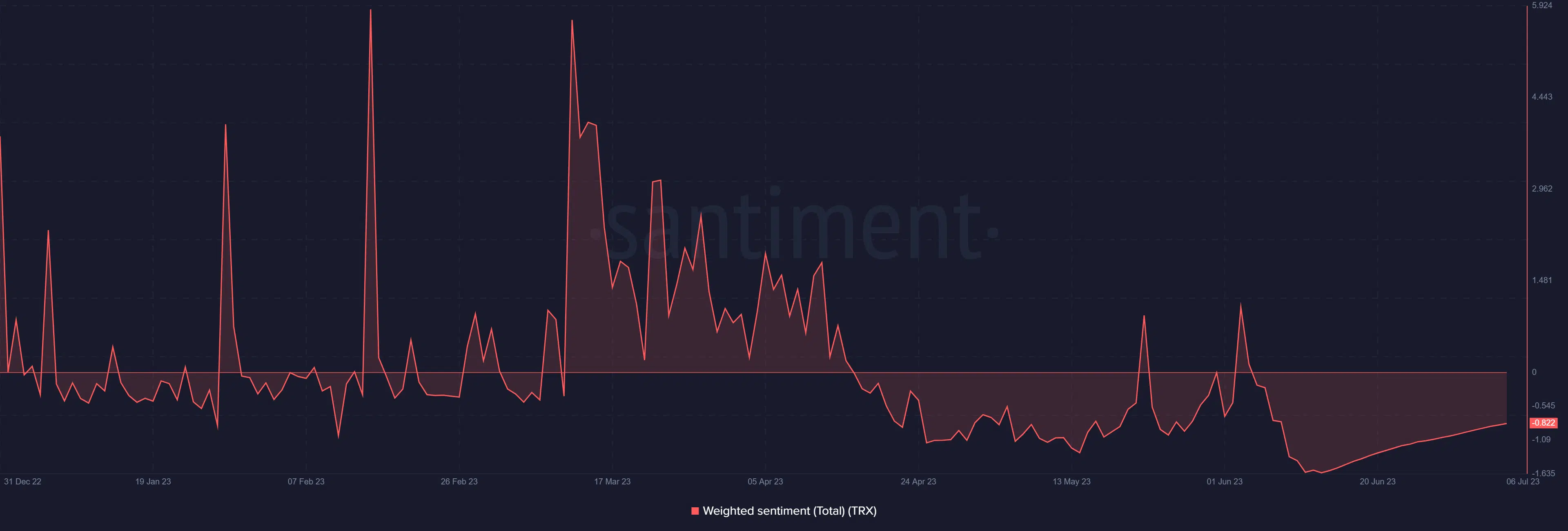

Additionally, the first few months of H1 witnessed a rise in positive sentiment. However, things changed later, as evident from its weighted sentiment. But the good news was that the graph again moved upward in Q3, reflecting investors’ confidence in the token.

This can be expected from Tron in Q3

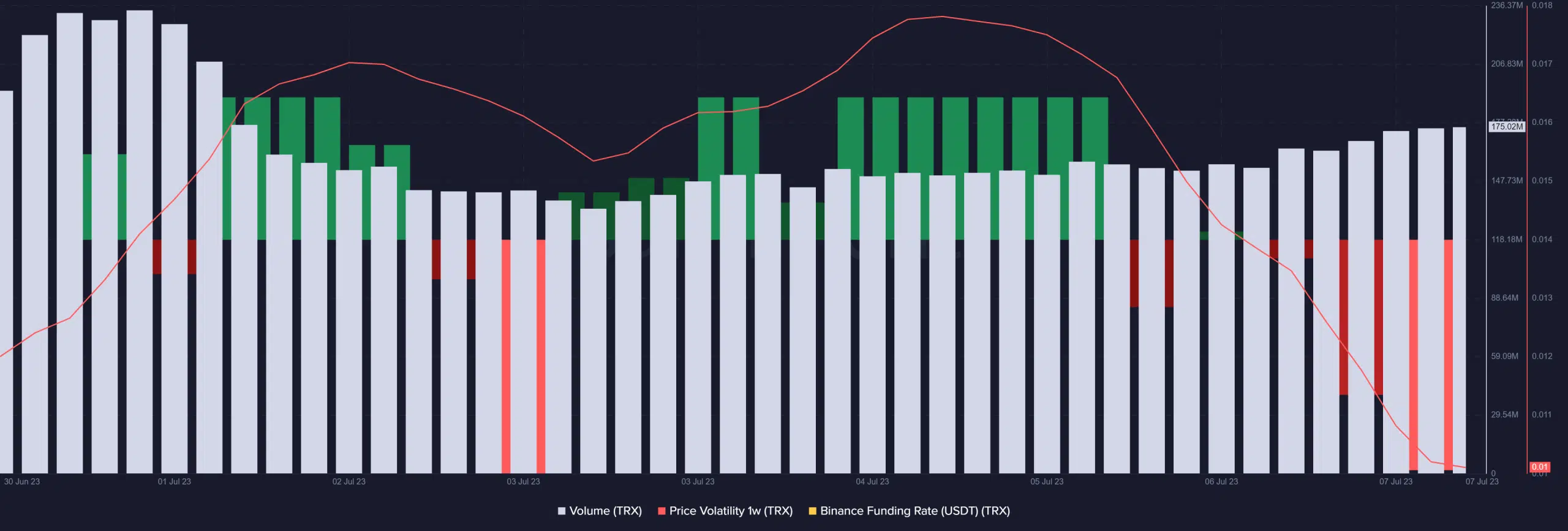

Though the token’s price action was positive, the same can’t be said for its on-chain metrics. For example, Tron’s trading volume declined slightly.

Its 1-week price volatility also plummeted, decreasing the chances of a continued uptrend and its demand in the derivatives market fell, as evident from its red Binance funding rate.

Read Tron’s [TRX] Price Prediction 2023-24

While the metrics looked bearish, most market indicators supported the bulls. The Exponential Moving Average (EMA) Ribbon displayed a bullish crossover, as the 20-day EMA flipped the 55-day EMA. The MACD’s finding also complemented that of the EMA Ribbon.

Tron’s Relative Strength Index (RSI) was also well above the neutral mark, suggesting that the token’s price could go up in the coming days. However, TRX’s Chaikin Money Flow (CMF) looked troublesome as it registered a slight decline.