DeFi hack: Arcadia Finance hit by exploit on Optimism, Ethereum

- Exploiter attacked Arcade Finance on both the Ethereum and Optimism networks.

- Optimism network saw an uptick in activity; however, revenue continued to decline.

Arcadia Finance, a non-custodial protocol that supports on-chain cross-margin accounts, recently got exploited according to data from PeckShield. Arcadia Finance is a platform that allows its users to collateralize portfolios, access up to 10 times more capital, and interact with other protocols using their deposited collateral and borrowed funds. In this article, we’ll be looking into the attack and how it affected the Optimism network.

Is your portfolio green? Check out the Optimism Profit Calculator

Details of the attack

A community contributor from PeckShield, a reputable cybersecurity firm, recently identified an exploitation incident involving Arcadia Finance on both the Ethereum and Optimism networks, resulting in a loss of approximately $455,000.

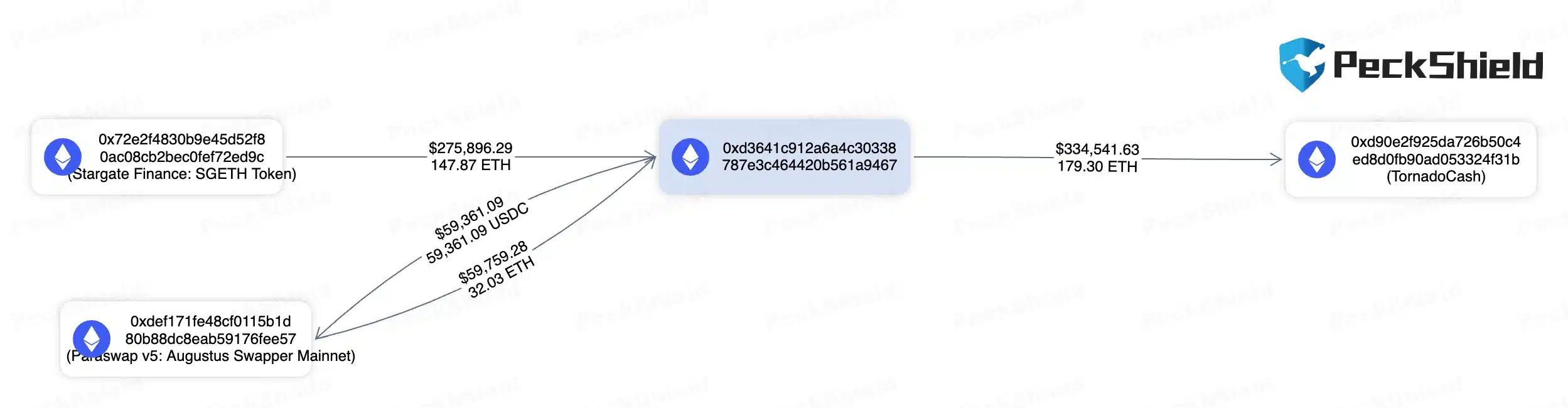

The exploiter acted quickly by transferring a total of approximately 179.3 ETH from the Optimism[OP] network. This amount was obtained through a combination of 148 ETH that was bridged from the Ethereum network and 59,000 USDC that was swapped.

The destination of these funds was Tornado Cash, which is a decentralized privacy solution for cryptocurrencies. By transferring the funds to Tornado Cash, the exploiter likely aimed to obfuscate the transaction history and make it more difficult to trace the origin of the funds.

#PeckShieldAlert Our community contributor has detected that @ArcadiaFi has been exploited on both #Ethereum and #Optimism for ~$455K

The exploiter on #Ethereum was frontrun by 0x5C75e94dD0Ab9c10BFd1B8073DafEF031D3c050dhttps://t.co/blGx5IEAkk

The exploiter on #optimism… pic.twitter.com/WDzF0XVcmL

— PeckShieldAlert (@PeckShieldAlert) July 10, 2023

The attacker used a process known as frontrunning to exploit the protocol. Frontrunning involves an individual executing a transaction ahead of others in a block. The frontrunner gains an advantage by prioritizing their transaction to exploit profitable opportunities. This practice allows them to potentially profit from price discrepancies or manipulate trades to their advantage.

Due to the uncertainty around Arcadia Finance, its TVL dropped significantly over the last few days according to data provided by Defi Llama.

How is Optimism doing?

Additionally, the exploitation of Arcade Finance may also impact the Optimism network negatively. As per token terminal’s data, the growth of daily active users on the Optimism network remained high and showed a growth of 3.9% over the last week. However, the revenue generated by the protocol declined significantly. In the last seven days, the revenue generated by Optimism fell by 52.6%,

This decline in revenue could impede Optimism’s growth in the long run.

Realistic or not, here’s OP’s market cap in BTC’s terms

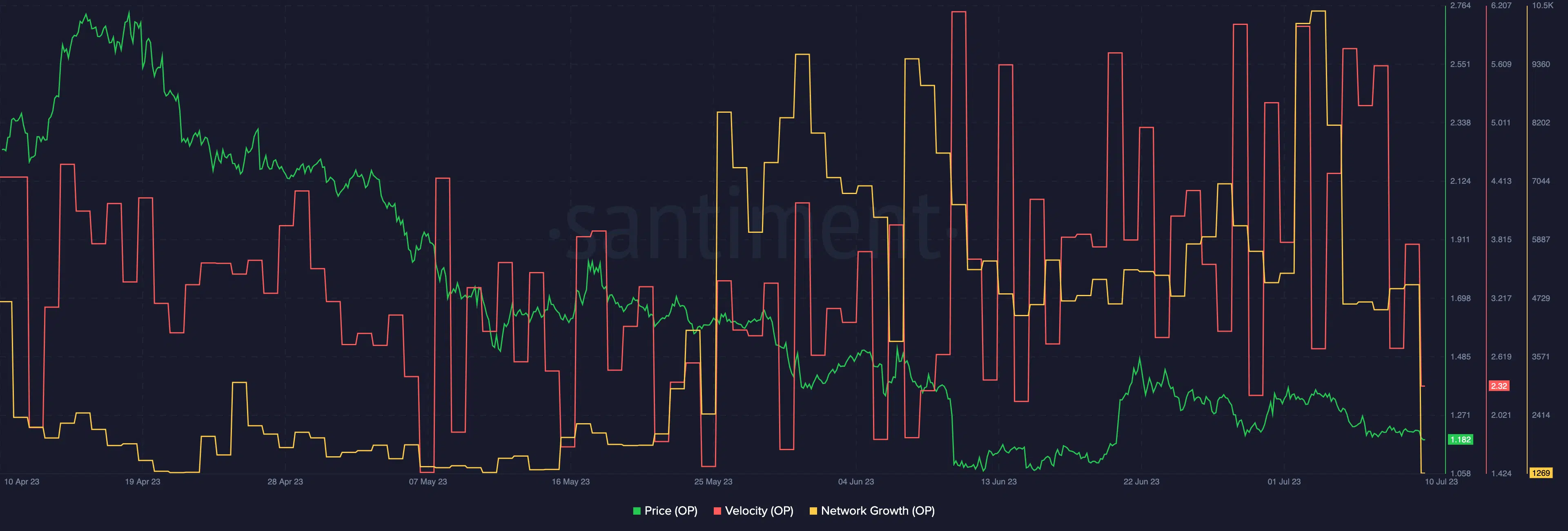

Coming to the OP token, the price of the token was $1.1215 at press time. The price declined significantly over the last month, along with its velocity. This indicated that the frequency with which OP was being traded had declined.