The how and why of Litecoin outperforming Bitcoin

- Litecoin’s upcoming halving is just 23 days from now.

- LTC’s metrics and market indicators were bearish on the coin.

Litecoin [LTC] has outperformed Bitcoin [BTC] in terms of BitPay payments. This reflects how Litecoin’s adoption is rising. Whale activity around the coin also registered an uptick over the last month, which looked promising.

Read Litecoin’s [LTC] Price Prediction 2023-24

However, LTC’s price did not correspond to these updates, as its weekly and daily charts were painted red. Will the hype around halving and increased adoption be enough for the coin to increase its value in the coming days?

State of Litecoin ahead of halving

As per Litecoin Foundation’s tweet, LTC was ahead of BTC in terms of BitPay payments. While BTC had a percentage of 34.6%, LTC’s figure was 34.9%, which was impressive. This happened just a few weeks ahead of the upcoming LTC halving. To be precise, the halving is only 23 days away.

Since the halving is around the corner, it can help change market sentiment and cause an uptick in the coin’s price. However, this does not seem to be the case at press time as LTC’s price has declined. According to CoinMarketCap, LTC’s price plummeted by more than 3% and 16% in the last 24 hours and week, respectively.

At the time of writing, it was trading at $93.38 with a market capitalization of over $6.8 billion, making it the 11th largest crypto.

Litecoin’s hashrate also registered a decline, reflecting an outflow of miners. The same trend remained true for Litecoin’s miner revenues, which also went down.

Is an LTC trend reversal possible?

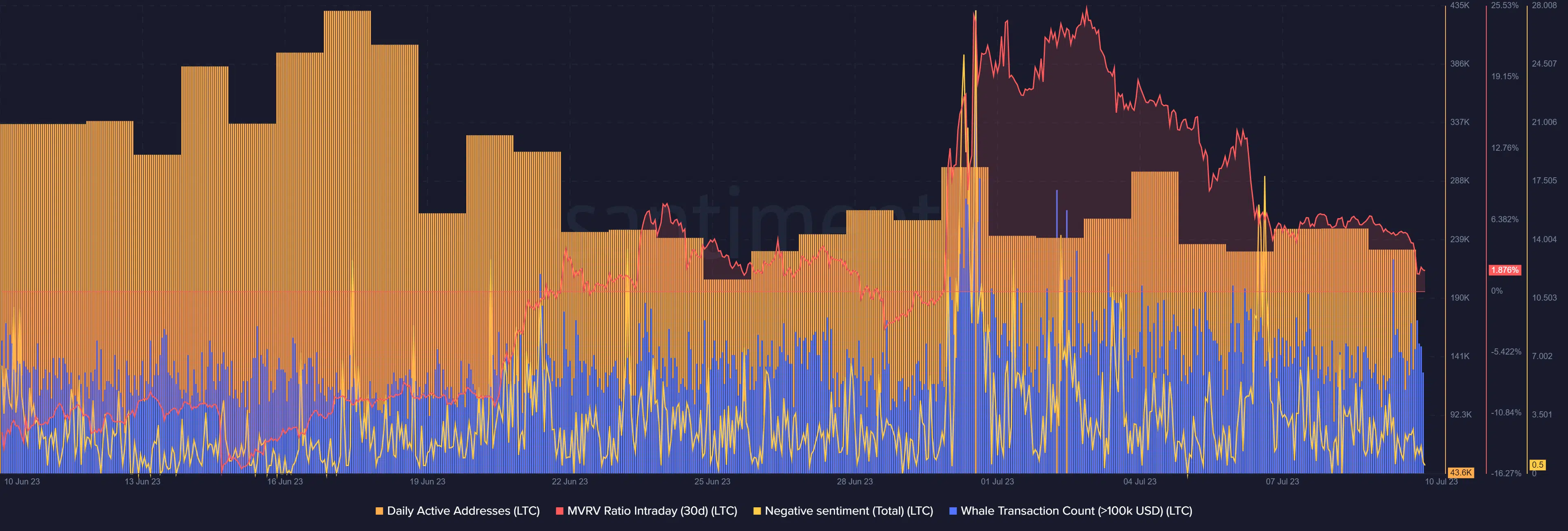

Despite the downtrend, whale activity around LTC remained pretty stable. However, apart from that, most metrics were bearish. For example, its daily active addresses declined over the last 30 days. After an increment, its MVRV Ratio also went down. On top of that, the coin’s negative sentiment spiked a few times over the last few days.

Realistic or not, here’s LTC market cap in BTC‘s terms

More bearish signs were revealed upon a check of its daily chart. Litecoin’s Relative Strength Index declined over the last few days, which is a development in the sellers’ favor. Its MACD displayed a bearish crossover, increasing the chances of a continued downtrend.

Nonetheless, the Exponential Moving Average Ribbon kept favoring the bears, which can bear fruit in the coming days.