As DeFi wars intensify, MakerDAO loses its place to Aave

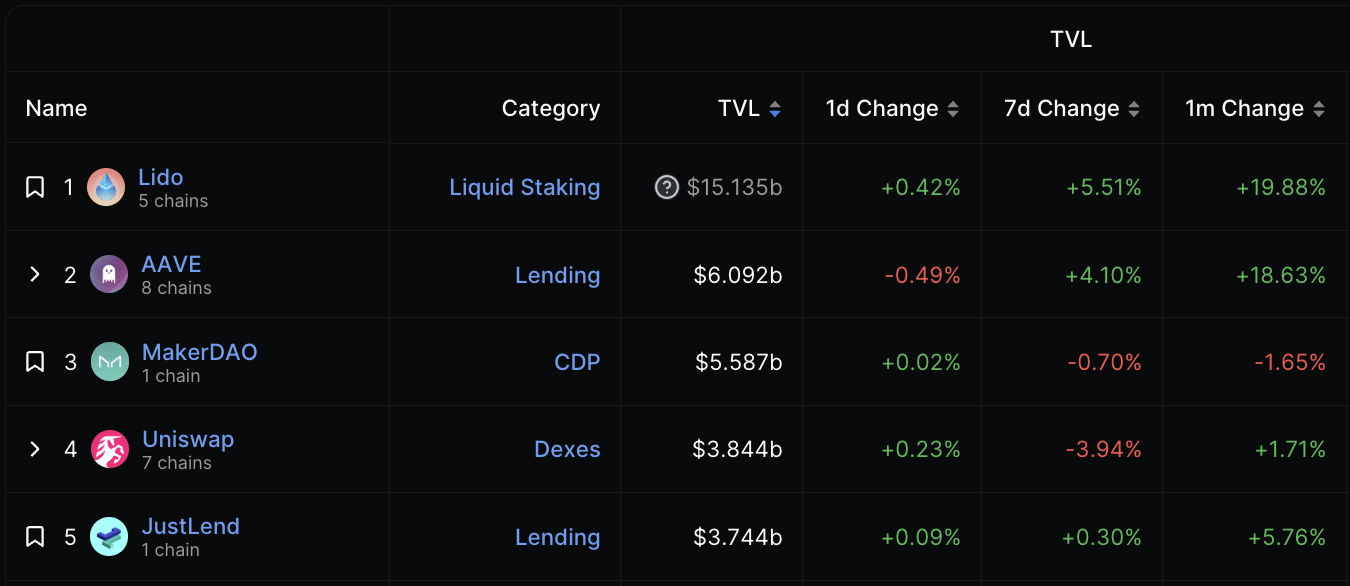

- Maker has been displaced as the second-largest DeFi protocol in terms of TVL.

- The protocol’s revenue has gone up in the last month due to significant changes made to its portfolio.

Lending protocol MakerDAO [MKR] has been replaced by Aave [AAVE] as the second-largest decentralized finance (DeFi) protocol in terms of total value locked (TVL) after Lido Finance [LDO], data from DefiLlama showed.

Is your portfolio green? Check out the MakerDAO Profit Calculator

The persistent fall in Maker’s TVL in the past few months was exacerbated by the collapse of Silicon Valley Bank (SVB), the depeg of USDC and its DAI stablecoin, and the consequential fall in DAI supply rates.

At press time, Maker’s TVL was $5.58 billion, falling by 15% since 10 March when SVB collapsed, and the USDC and DAI stablecoins lost their parity with the U.S. dollar.

Some forecasts a looming end; one person strives for a bright future

Pseudonymous DeFi analyst Nah_Gmy in a series of tweets published on 15 July, found that “the last two US-based VCs have capitulated.” According to the Twitter user, Paradigm, a research-driven technology investment firm, “unloaded their bags 4 months ago, and a16z is in the process of liquidating right now.”

This comes a few years after VC firms Polychain and Dragonfly divested from all their MKR holdings, exiting the project. The persistent exit of giant VC firms from Maker offers a gloomy overview of what many see in its future.

2/ The last two US-based VCs have capitulated.

Paradigm unloaded their bags 4 months ago, and a16z is in the process of liquidating right now. Interestingly, they're even using the same desk to execute. Total disbelief.

Polychain and Dragonfly offloaded all their $MKR years ago pic.twitter.com/DdsHs6gxzd

— Nay (@nay_gmy) July 15, 2023

However, Maker’s co-founder Rune Christensen has intensified MKR’s accumulation in the last month. Nah_Gmy noted that Christensen “might be the only founder in crypto who’s ever purchased their own token.” According to the analyst, this shows his commitment to ensuring that Maker stays afloat.

Since November 2022, Christensen has sold a total of 13.57 million LDO for approximately $26.14 million. The average selling price of these LDO tokens was $1.92. With the proceeds from these sales, he has repurchased 32,637 MKR tokens. This amounted to $23.95 million, at an average price of $734.

Rune Christensen, co-founder of MakerDAO, has sold a total of 13.57 million LDO ($26.14M) since 2022/11 to repurchase MKR, with an average selling price of $1.92; cumulatively bought 32,637 MKR ($23.95M), with an average price $734. The two Rune addresses currently hold a… https://t.co/Nsb8K9gJug

— Wu Blockchain (@WuBlockchain) July 17, 2023

The two addresses associated with the co-founder currently hold a combined total of 123,893 MKR tokens, valued at approximately $122 million. This represents 12.6% of the total circulating supply of MKR tokens.

Realistic or not, here’s MakerDAO’s market cap in BTC’s terms

State of Maker

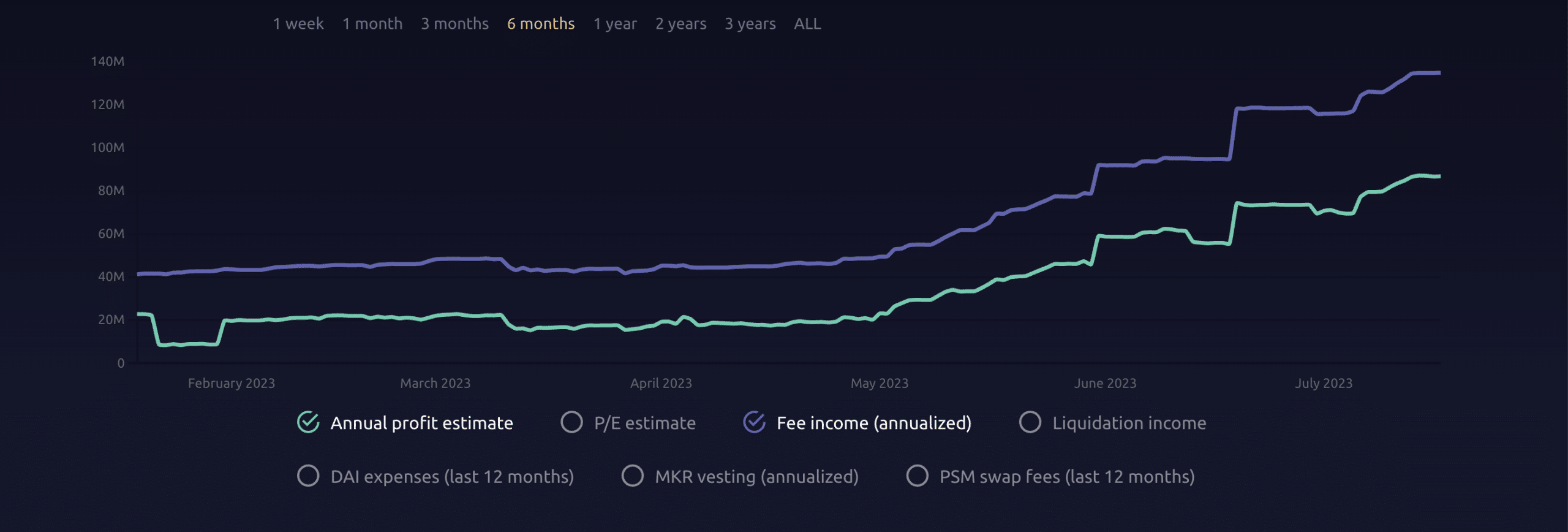

Following USDC’s depeg in March, Maker began efforts to diversify its backing assets and reduce its dependence on the stablecoin. The protocol reduced USDC’s contribution to DAI collateral from 50% to under 9% and made real-world assets (RWA) a substantial portion of its portfolio.

The inclusion of RWA helps secure DAI as collateral and contributes to the overall revenue generation for MakerDAO, which has happened in the last month. According to data from Maker Burn, Maker’s revenue has since been on an uptrend.

Further, in June, Maker increased its Dai Savings Rate (DSR) to 3.49% from 1%. It offered additional incentives for investors to hold and lend DAI instead of other stablecoins such as USDC and USDT. As a result of this, in the last month, the DSR recorded inflows of $170 million. This represented over 100% growth, according to data from Dune Analytics.

![Solana's [SOL] high fee generation figures are misleading - Here's why!](https://ambcrypto.com/wp-content/uploads/2025/05/B6ACB721-6173-4255-91A4-FEE8D9DE21D1-400x240.webp)