DAI-stressed MakerDAO struggles as users look toward other stablecoins

- MakerDAO has seen a decline in TVL, DAI’s supply, and annualized fee income in the last week.

- MKR shed 25% of its value during the same period.

While its DAI stablecoin regained its parity with the U.S. dollar last week, increased uncertainty as to whether a further de-pegging should be expected resulted in a decline in MakerDAO’s [MKR] total value locked (TVL) in the last seven days.

Is your portfolio green? Check out the Maker Profit Calculator

According to data from DefiLlama, the protocol’s TVL was $7.68 billion at press time, having decreased by 5% in the last week. The decline in MakerDAO’s value of assets was attributed to a drop in the number of collateralized loans on the protocol, as concerns grew over the viability of the DAI stablecoin.

The effects on DAI

This also culminated in a fall in DAI’s supply. Per data from Maker Burn, since 13 March, DAI’s supply fell by 13%. As of this writing, the stablecoin’s supply stood at 5.6 billion DAI tokens. When DAI supply drops, there are fewer DAI tokens in circulation, which could result from a decline in demand, as seen in the last week.

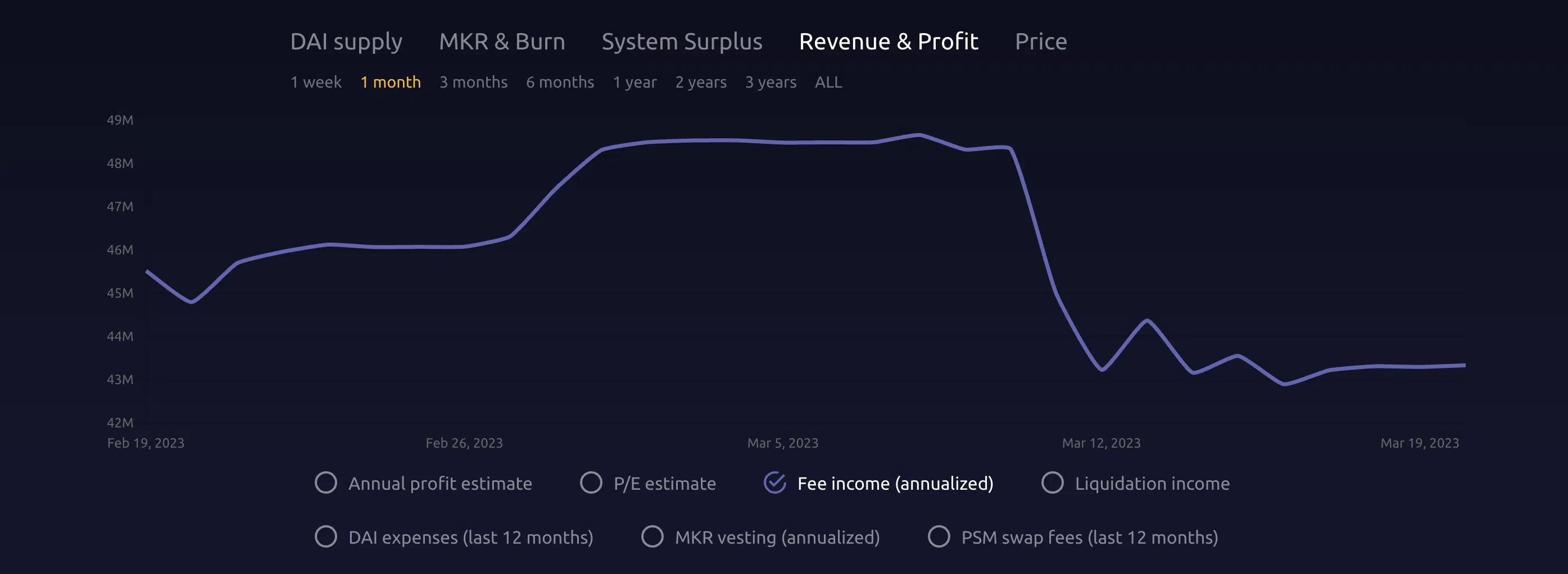

As DAI’s supply fell in the last week, MakerDAO’s annualized fee income also declined. Maker fees generate income when users open a Collateralized Debt Position (CDP) and generate DAI. The DAI is then paid in the form of the MKR token.

When users generate DAI by locking up collateral in a CDP, they are charged a stability fee, which is interest paid in DAI to the protocol. This stability fee is then converted into MKR and distributed to token holders as a form of fee income.

If the DAI supply declines, it means that fewer users are generating DAI by opening CDPs, which can cause a decrease in the stability fees collected by the MakerDAO protocol. This, in turn, can result in a decline in the amount of MKR tokens distributed as fee income.

According to Maker Burn, since the collapse of Silicon Valley Bank (SVIB), MakerDAO’s annualized fee income has dropped by 10%.

Read Maker’s [MKR] Price Prediction 2023-24

MKR is not spared from the massacre

Posting a double-digit decline of 25%, MKR was the crypto asset with the most losses in the last week, per data from CoinMarketCap. At press time, the altcoin exchanged hands at $693.42.

An assessment of MKR’s price on a daily chart revealed that buying momentum had declined significantly. Key momentum indicators were positioned below their respective neutral points. This suggested that MKR holders were more interested in selling off their holdings at press time.