Is Aave in the clear following the Curve hack?

- Aave was no longer at risk due to liquidation at the time of writing.

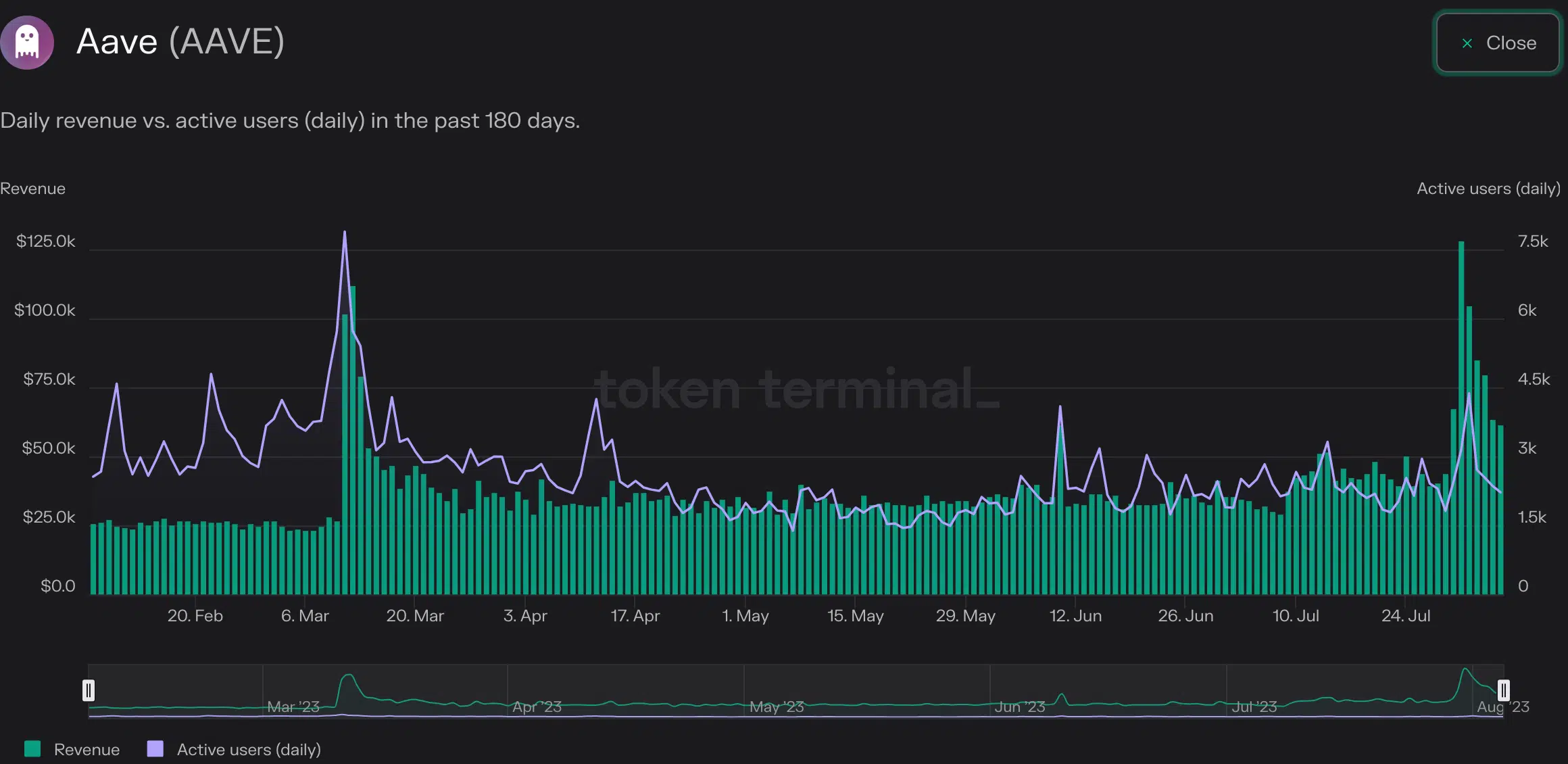

- Revenue on the protocol continued to rise as AAVE’s prices recovered.

The recent security breach on Curve had far-reaching consequences for both the cryptocurrency sector and the DeFi market. Among the protocols susceptible to adverse effects from this breach was Aave[AAVE]. This vulnerability stemmed from the fact that the founder of Curve held a substantial $60 million loan on Aave v2, primarily backed by CRV. If this loan were to face liquidation, the increased selling pressure could trigger potential contagion, further impacting the market and the protocol.

Is your portfolio green? Check out the Aave Profit Calculator

Aave in the clear

Yet, current data revealed that the CRV collateralized position stood at 29 million in debt at the present moment, with a high utilization rate of 2.21. For context, a high utilization rate indicates that a substantial portion of the available resources or assets is actively being utilized or borrowed, nearing a state of nearly full capacity.

Even in the unlikely event of liquidation, the 29 million debt would not pose a substantial risk. Moreover, any potential impact could be effectively managed through the safety module and treasury, providing a reassuring layer of control and mitigation.

List of degens that bought $42M of $CRV and bailed out defi ? https://t.co/KqHNNimjoK pic.twitter.com/REWl5dVvQh

— FreddieRaynolds (@FreddieRaynolds) August 6, 2023

The mitigation of the risk to Aave and the state of DeFi, in general, was only possible due to contributions from various large investors. Whales such as Justin Sun and DCFGod aided in protecting both Curve and the Aave protocol.

Realistic or not, here’s Aave’s market cap in BTC’s terms

Doing better than Aaverage

Despite these factors, activity on Aave continued to decline. Token terminal’s data highlighted that over the last month, the number of daily active users on Aave fell by 7.5%. However, the revenue generated by Aave remained consistent. It grew by 45.3% during the same period despite the setbacks and FUD faced by the protocol.

Along with the protocol’s revenue, the price of the token also witnessed some growth. Over the last week, AAVE’s price has appreciated from $62 to $65.77. The recent surge in AAVE’s price could be attributed to the rising number of holders of the AAVE token.